Germany’s tax advisory market is undergoing a quiet revolution — not just due to digital transformation or global compliance challenges, but also because an unexpected player has entered the scene: private equity.

Once considered off-limits, tax firms are now catching the attention of financial investors. Despite strict legal restrictions on ownership by non-professionals, investors are finding creative ways to gain a foothold. Through complex structures, holding companies, or silent partnerships with limited voting rights, private equity is unlocking access to a traditionally conservative market.

What does this mean for the profession?

The trend is dividing opinions. Some see it as a chance for modernization, professionalization, and scale. Others fear a creeping loss of independence and a shift toward commercialization that may undermine core values of the profession.

TAXDOO: A Partnership Model Without Compromise

In this evolving landscape, TAXDOO offers a future-proof alternative. Rather than seeking equity or control, we empower tax firms with cutting-edge technology that streamlines and scales compliance processes — especially in the fast-moving world of e-commerce — while preserving full independence.

Our philosophy is simple: partnership without ownership. With TAXDOO, firms remain in control while gaining access to automation solutions for VAT, accounting, and cross-border compliance that reduce manual work and increase efficiency.

Bottom line

Private equity’s growing interest in tax firms is not a passing trend — it’s a sign of deeper change. To stay ahead, firms should take a proactive approach and choose partners who support their growth without compromising their autonomy.

➡ Learn more in the original article by Manager Magazin (in German): Read here

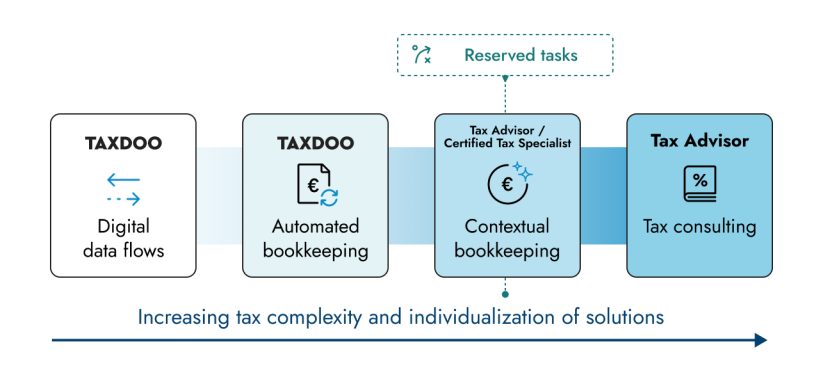

A model is currently being developed in e-commerce that is intended to serve as a blueprint for a key question: How can technology and tax consulting efficiently complement and empower each other in the AI age?

The key question is: How can the symbiosis of individual tax advice, reserved tasks and efficient automation be achieved – thought through from start to finish and for the greatest benefit of the client?

Mantra for years: Accounting will disappear!

Every tax expert has probably heard this truism regularly for over a decade. Little to nothing has happened so far.

Why?

Because “disappearance” was and still is simply too short-sighted. Technology never serves an end in itself, and problems generally never disappear—not even if we ignore them.

At its core, it is always about the question: Where and how can technology be used for a clearly defined goal and benefit?

I am speaking here for my industry – e-commerce – and from the experience of working with over 800 tax firms: this goal and the associated benefits have never been clearly defined. We’re now addressing this.

Accounting: a collection of different activities and processes

If you don’t understand a problem in depth and in its components, you will rarely find a solution to it.

Let’s break down what is generally understood as accounting in e-commerce.

1. Digital data flows: the foundation

Automation begins with interfaces to marketplaces, shops, and payment providers. These ensure clean data flows and form the basis for a key question and the central principle of the GoBD: Is the accounting complete?

2. Automated accounting: currently the greatest automation potential

Standard cases, document reconciliation, technical reconciliations: This is repetitive and algorithm-based work with low perceived value – yet enormous amounts of data. This is precisely where the greatest potential for automation lies. But it’s also precisely where the greatest potential for errors currently lies in practice – with implications for the two following steps.

3. Contextual Accounting: Experts & Machines

Where automation reaches its technical limits and tax context is required, a hybrid approach combining tech and tax, or experts and machines, emerges: with high demands on both. In accounting, we then regularly discuss the clarification of individual issues and the associated tax assessment.

4. Tax advice: proactive, data-based and a premium product

No more accounting – but closely linked to it. At the end of the process is the actual consulting: closing, tax return, strategy. This involves considerable effort, but also the greatest (perceived) benefit for the client – provided the path and the fundamentals are right.

accountDigital + Taxdoo: a platform for automated accounting and enabler for proactive and data-based tax advice

Tax firms today face the challenge of efficiently managing e-commerce mandates – despite growing data volumes and a shortage of skilled workers. The solution: a clear division of labor between machine-based, scalable accounting and contextual tax expertise.

Strategic acquisition for a new infrastructure

In April 2025, Taxdoo acquired 100% of the shares in accountDigital – with a clear goal: to create a platform for tax firms on which both data collection and automated accounting are scaled and standardized using AI.

One product – two tasks: Automation & relief

Tax offices receive automated accounting from us (see step 2 above) as a finished product directly in DATEV. We reliably handle the mechanical booking processes so that you can concentrate on what is the core of their work: contextual accounting (including, where applicable, reserved tasks) and tax advice.

Scaling meets practice: Hundreds of mandates already integrated

The Taxdoo + accountDigital platform already automatically processes the data of hundreds of e-commerce clients. This provides a proven, productive accounting infrastructure that can be seamlessly integrated into the firm’s and DATEV processes.

New clarity: What AI can do – and what only tax experts can do

Our platform enables a clear separation between machine-based and contextual tasks. Transactions and payments are processed and decrypted daily to provide a transparent and timely picture of business transactions.

This database forms the basis for proactive, data-driven tax advice from tax firms.

Resource focus: Skilled workers make the difference

Especially in times of limited capacity, one thing is particularly important: the targeted deployment of specialists in tax offices. Our platform ensures that staff are deployed precisely where they create added value – in tax classification and client consulting.

accountDigital + Taxdoo: the vision and the people behind the platform

For us, the acquisition of accountDigital is far more than a traditional merger. It represents a clear commitment to automation at the highest level and to close collaboration with the law firm community.

With accountDigital we are strengthened by 30 experienced accounting professionals who efficiently onboard clients and continuously review the results of our AI-based processes.

Tax advisor Stefan Gostomzik plays a central role in this. Since the merger, he has focused entirely on the further development of our technology – and is a direct, equal point of contact for tax advisors and all Taxdoo teams.

Product managers with skin in the game

Stefan is a tax advisor who has experienced every challenge one might encounter in e-commerce accounting for years. He is now responsible for our product development in the accounting area and is able to focus on it 24/7. And I can assure you, 24/7 is not a commonplace term.

Stefan’s central wish, which he had previously only addressed to the accountDigital team, is now directed at all tax firms out there: “I’m only satisfied when someone ruins my weekend because they showed me a transaction that our technology can’t yet (correctly) map.“

This founder DNA, to personally vouch for the product at any time and anywhere, was the decisive reason why we chose accountDigital. This Always-Day-1-Spirit we will protect like our greatest treasure, because that is what it is.

But there is also a partnership-based error culture, which for us is the core to create broad acceptance for the platform solution in the market.

What does this mean?

We develop the product together with the users = tax offices.

What’s next? Pilot phase with the first tax offices starting in September

Over 200 tax and e-commerce experts met at the Taxdoo Innovation Summit 2025 in Hamburg to discuss with thought leaders such as Philipp “Pip” Klöckner (Doppelgänger Podcast) and tax consultant Stefan Groß (“Taxpunk”): How is AI changing our work – now and in the coming years?

Taxdoo CEO Dr. Christian Königsheim presented the platform to the general public for the first time. Tax firms were then given the opportunity to register for a pilot phase.

You also want to take part in the pilot phase?

Then register now and actively help us shape the future!

This pilot phase will start in September and we will publicly report on it. Doing this, we want to create trust through transparency from day one.

Because the most important thing that lies before us now cannot be solved with technology.

With optimism and enthusiasm: Transformation begins in the head and ends in the heart

Luisa Stalla, who also participated in the Taxdoo Innovation Summit 2025 as Transformation Manager of the German Tax Consultants Association (DStV), summed it up in a personal conversation: “Every successful transformation begins in the head and must end in the heart.“

That is what we are concerned about and what we are currently working on with absolute focus!

Accounting and VAT compliance – two topics that, for many internationally active online merchants, mean just one thing: Effort. Complexity. Uncertainty. But that’s about to change now. Thanks to a unique partnership between two industry leaders: TAXDOO has acquired accountDigital, a company specialized in e-commerce and known for its AI-powered accounting software – ushering in a new era of automation and transparency.

What does this mean for online merchants?

And what opportunities arise for tax advisors?

In an in-depth interview, the founders of both companies share exclusive insights into their vision – and explain why this merger is more than a technical integration. It’s a strategic milestone.

The Perfect Match: TAXDOO & accountDigital

When Dr. Roger Gothmann and Dr. Christian Königsheim founded TAXDOO nine years ago, automated VAT compliance in international e-commerce was seen as highly complex, even impossible. Tax advisors warned against it. But TAXDOO proved the opposite. “We went straight to the source – Amazon, Shopify. We extracted the transaction data directly, evaluated it automatically for tax purposes, and reported it abroad,” explains Gothmann.

The goal: to simplify VAT compliance for online merchants so they can focus on their core business. Today, TAXDOO serves clients ranging from global players like L’Oréal to small Amazon sellers.

Enter accountDigital. Originating from the digital tax firm stb-digital, the company quickly evolved into a specialist in e-commerce accounting. “The complexity for an e-commerce merchant lies in their outgoing invoices. They operate like a global enterprise. And that needs to be reflected properly,” explains Stefan Gostomzik, founder and CEO of stb-digital. To tackle this, accountDigital developed its own platform – focused on automation, transparency, and AI-powered efficiency.

What began as a simple collaboration through a shared YouTube video quickly evolved into a forward-looking partnership. The motivation: Both companies work with similar data sources and build their own software – but at different stages of the process chain. TAXDOO automates international VAT processes. accountDigital digitizes accounting from the ground up.

Together, they form an end-to-end solution previously unseen in the market. “We’re passionate about VAT,” adds Gothmann. “And the accountDigital team is obsessed with accounting. When those two obsessions meet – something big happens.”

Why Now? The Perfect Moment for a Merger

“TAXDOO is simply the market leader,” says Gostomzik. “But we realized – we’re doing the same things. We’re both fetching data, building interfaces, developing software.” The logical next step: collaboration over duplication.

Christian Königsheim highlights the strategic benefits: “We can now not only automate VAT-related data processing, but also take over our customers’ entire pre-accounting workflows. That significantly relieves the burden on tax advisors.”

For Nadine Jobst, Co-founder and Managing Director of accountDigital, the merger is a breakthrough: “We’ve never been able to advise beyond German tax law. Now, together with TAXDOO, we can provide international support – directly, efficiently, and without detours.”

What Changes for Online Merchants?

In short: everything – and yet nothing. Existing customers of both companies can continue using their familiar systems for now. Behind the scenes, however, a unified platform is taking shape. For online merchants, that means: a central platform for accounting and VAT – transparent, automated, and scalable.

“We believe that for e-commerce merchants, accounting and VAT compliance will eventually feel like they just take care of themselves,” says Gothmann. “Our vision is that merchants don’t have to deal with these topics at all.”

Gostomzik adds: “Merchants won’t have to worry about anything. Everything is handled from a single source. And that’s a huge advantage.”

What Does This Mean for Tax Advisors and Accountants?

Contrary to some fears, tax advisors are not going away – quite the opposite. “Tax advisors will always be needed,” Gothmann emphasizes. “But not for typing up receipts. We’re providing the data foundation that allows them to finally focus on real advisory work.” He adds: “No more data silos, no more isolated accounting or VAT systems – everything runs on a single platform.”

AI plays a central role. “Our AIs handle repetitive tasks like document processing,” says Gostomzik. “That means tax professionals can finally do what they’re meant to do – advise.”

The Vision: A System That Grows with You

The vision is clear: a unified platform that automates both accounting and VAT compliance, all built on a shared data foundation. A solution that supports both small merchants and large enterprises as they scale internationally – without data breaks or manual work.

Both TAXDOO and accountDigital already serve thousands of clients today. And both companies share the same goal: to meet merchants where they are and offer a platform that scales with their growth. “Scalability in e-commerce is huge,” says Nadine Jobst. “A good product can take off overnight – and now the infrastructure can grow right along with it.”

A Market Redefined

“There is no comparable solution on the market today,” says Christian Königsheim confidently. “There are software tools, and there are specialized tax firms – but no one combines both on one platform with this depth and breadth.”

Nadine Jobst adds: “This is a symbiosis the market hasn’t seen. The combination of accounting and VAT expertise in one platform – that’s unique.”

TAXDOO has acquired 100% of accountDigital. Around 30 employees will stay on board and work closely with TAXDOO teams in core areas like development, product, sales, and marketing. Familiar remote-first structures, technological autonomy, and a shared product vision will ensure that the integration delivers real value – not just on paper, but in everyday operations.

For customers, this means: a fully integrated workflow. For employees of both companies: new opportunities, more resources, and broader career paths. “I’ve always promised my team that they could grow as far as they wanted,” says Gostomzik. “And now, with TAXDOO, I can keep that promise.”

Conclusion: The Best of Both Worlds – Finally United

The acquisition of accountDigital by TAXDOO is not your typical merger. It’s a signal of transformation in the e-commerce industry: from fragmented processes to integrated platforms, from isolated solutions to true partnership.

Merchants benefit from maximum transparency and automation. Tax advisors gain clean data and a lighter workload. Together, they gain one thing above all: time for what really matters. “We want merchants to not even notice accounting and VAT compliance anymore,” Gothmann concludes. “That’s our vision: TAXDOO AND DONE.”

See the full interview with the founders – and get a firsthand look at how the future of accounting and VAT compliance is being redefined.

This is where Taxdoo comes in, introducing our new feature “Transaction Data – Detailed View”.

This powerful addition to the Taxdoo dashboard is designed to help tax professionals and online sellers quickly find answers to questions about their data, eliminating the need for manual data analysis and reducing the risk of costly errors.

Pain Points Addressed:

- Difficulty in tracking and analysing transaction data from multiple sources, leading to potential errors and time-consuming manual work.

- Inability to easily identify trends and outliers in net revenue and taxes, hindering decision-making and strategic planning.

- Limited understanding of how aggregated numbers are calculated, causing confusion and potential misinterpretation of financial data.

With Taxdoo’s “Transaction Data – Detailed View” you can:

- Easily visualise net revenue and tax trends using graphs, allowing for better decision-making and insights into business performance.

- Quickly spot outlier periods, enabling proactive measures to address potential issues or capitalise on opportunities.

- Gain a clear understanding of transaction types and how calculations are performed, reducing confusion and increasing accuracy.

- Effortlessly dive deeper into transaction-level data, using filters such as period, country of taxation, type of transaction, and VAT rate to focus on specific areas of interest.

Going deep into the Taxdoo dashboard

Step 1: Login

Log in to your dashboard with your username and password.

Step 2: Transaction data section

Once you are logged in to your dashboard, go to Transaction data.

Step 3: Select the country

In order to get to the ‘Detailed view’, in the country data subsection, select the country or transaction type.

Step 4: Going through the filters

With this new tool you will have the ability to dive deeper from aggregated view to transaction level view, understand how aggregated figures are calculated on the basis of individual transactions, and quickly obtain more aggregated information using various filters, such as:

- Period

- Country of taxation

- Type of transaction

- VAT rate.

- You can also search for a specific transaction by transaction ID.

If you want to know the data of other countries just go to the filter, and choose the country you need.

Step 5: Revising the data

Once you have selected the filters you want, all the detailed information will be shown below.

This way you understand the data of the individual transactions even better!

With Taxdoo’s detailed transaction view, you can find the information you need even faster and easier. And understand even better how your figures are made up. So you save a lot of time and are always on the safe side.

Book a demo with our experts!

Explore our YouTube channel and discover important information explained by our experts for tax professionals and online sellers.

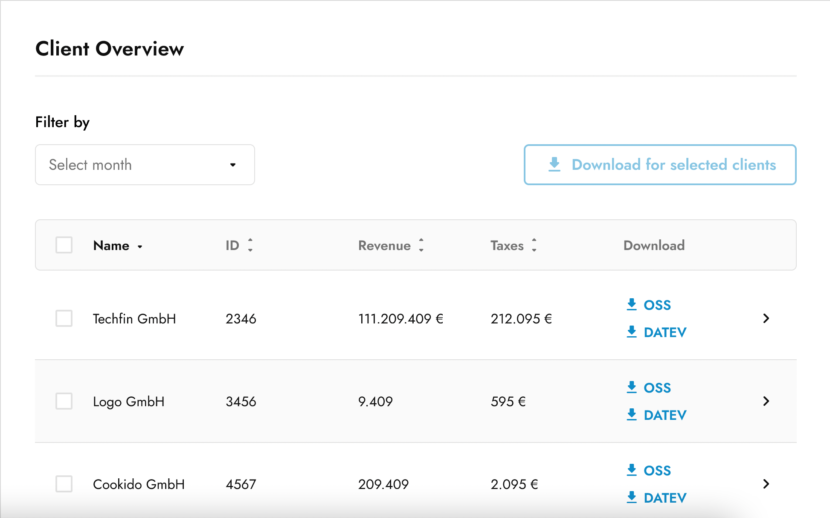

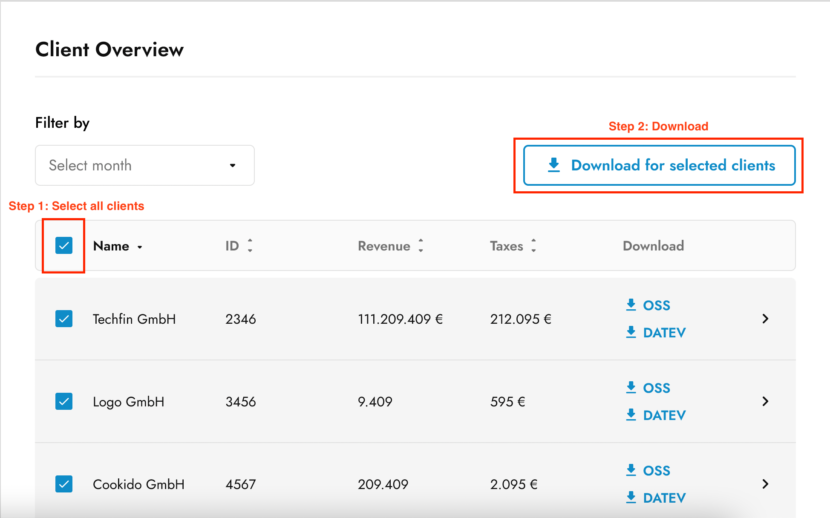

We heard that when you work a lot with accounting exports (DATEV) and One-Stop-Shop (OSS) filings, you tend to repeat certain actions over and over again.

For example, to download DATEV report for client X would usually take you 5 steps:

- Log in to Taxdoo dashboard

- Select client X

- Go to Transaction Data section

- Select period YYYY-MM

- Download DATEV export

That is of course quite a few steps especially given you have a lot of clients, where you have to repeat the exact same thing.

To help you deal with such tasks, we would like to introduce to you our latest feature ‘Client overview’.

Below, we would like to provide 2 major use cases.

1. Download multiple files for multiple clients (batch download)

Select a period you are interested in, then specify the clients by checking the boxes on the left side (if you would like to select all clients, simply tick the box at the top row) and then click on ‘Download for selected clients’. We will immediately generate a zip file with all the reports available for specified period and clients.

You can also download individual OSS and/or DATEV reports by simply clicking on the blue labels on the right side under ‘Download’ column.

2. Spot obvious anomalies fast and dive deeper

When you are in the client overview, you see clients and their respective revenues and taxes paid for a particular period. Imagine that a client that typically makes between 100.000 to 120.000 euros per month all of a sudden makes 20.000 euros. That would raise an eyebrow and should lead to further investigation. To dive deeper, simply click on any place in the client row (other than selection box and individual downloads) and you will be taken to ‘Transaction data’ section of a specified client and respective period.

Additional bonus is that you are also able to sort your clients by name, id, revenue and tax paid amounts.

If you have suggestions or further feedback on how to improve your experience, please always feel free to reach out to us!

In 2021 e-commerce was turned upside down in terms of VAT due to the biggest EU VAT reform in the last decades. But the limitations of the new One-Stop-Shop soon became clear for e-commerce sellers. In practice the desired simplification of VAT compliance for cross-border sales was not as helpful as expected.

Note: You can find more information here on what has changed significantly for online sellers as a result of EU VAT reform in 2021.

In 2022 further changes to EU VAT regulations are now up for discussion as part of the “VAT in the Digital Age” initiative.

The good news is that the challenges for VAT-payers have been recognised, and possible solutions will be focused on in 2022.

How did the European Commission come up with the ‘VAT in the Digital Age’ package?The initiative has its origins in a conference of the same name held in 2019. Organised by the European Commission, several tax experts from tax authorities, companies and universities came together to discuss opportunities and challenges that new technologies bring for VAT.

In July 2020 the EU Commission published an Action Plan for Fair and Simple Taxation, which also took into account the results of the conference. Among other things, the package contains concrete measures for the modernisation of VAT regulations in the EU. These measures have now been considered in the EU Commission’s work programme for 2022, under the heading ‘VAT in the Digital Age’.

In this article you can find out what is planned and how you can participate in shaping the development of the planned measures.

The EU Commission’s Work Programme for 2022 Sounds Promising: VAT in the Digital Age

After the conference organised by the European Commission under the title ‘VAT in the Digital Age’ in 2019, it was clear: the digital economy and the development of new business models pose new challenges for tax administrations.

It should now be focused on how tax administrations can increasingly use digital technologies to:

- combat tax fraud

- reduce administrative burden for tax administrations, and

- reduce the costs of tax obligations for companies.

In addition, the EU Commission is examining whether the current VAT regulations are adapted to businesses in the digital age.

The above was summarised in the action plan under ‘VAT in the Digital Age’.

The Initiative: VAT in the Digital Age

As you already know, the aim of the initiative is to modernise current VAT law considering digital technologies.

The package includes three key aspects:

- VAT reporting obligations and electronic invoicing

- VAT treatment of the platform economy

- A single EU VAT registration

But what is actually up for discussion with respect to the key aspects of the initiative?

Digital Reporting Requirements and E-Invoicing

Some EU countries already have different systems for digital reporting obligations such as Real Time Invoice Reporting in Hungary, reporting in SAF-T format in Poland or SII in Spain. There’s also e-invoicing like the SDI system in Italy.

The economic situation during the pandemic and the resulting tax losses have increased the need for action by the member states, so more and more EU countries are striving for a solution (of their own). Last but not least, the recapitulative statement – which every cross-border e-commerce business has heard of – is also a digital reporting obligation.

What Is Planned?

The EU Commission’s objective is to create a single framework for (digital) reporting obligations relevant for VAT purposes. In this context, it is also considering creating a legal basis for mandatory e-invoicing.

More easily said than done.

What is currently subject to discussion is, for example, whether a partial reporting obligation (exclusively for cross-border supplies) or a full reporting obligation should be introduced, which would also cover local transactions. Apart from that, there would be the possibility of transaction data being stored in a mandatory format and only having to be provided in the context of an audit.

The current legal framework also does not yet provide any justification for mandatory electronic invoices. Countries that have already introduced such mandatory e-invoicing systems (such as Italy) or are planning to do so in the future (e.g. Poland) had to apply separately for this special measure derogating from the EU VAT Directive. So the new initiative also concerns the implementation of a legal basis for this.

Will All EU Countries Have to Adapt to the Same System?

The biggest challenge at this point is to ensure that the legal framework is neither too narrow nor too broad. If the requirements are too narrow, all taxpayers – including those so-called “tax honest” entrepreneurs – will be faced with an increased administrative burden.

However, the past has shown that tax fraud exists to very different degrees in different EU countries.

If, on the other hand, the requirements are defined too vaguely or only in the context of non-binding recommendations, there is once again the risk that EU countries could introduce deviating rules or systems. In this case, VAT payers would have to deal with the respective local requirements and implement them in their own processes.

Also: Some EU countries have already introduced their own systems which required significant effort and investment for both the EU country and the taxpayers. That’s why the outcome of current discussions is also likely to be driven politically.

It is not yet possible to estimate whether and to what extent the framework for digital reporting obligations and e-invoicing will be defined. The EU Commission already points out that such an implementation, including the establishment of the IT infrastructure, could take until 2030.

Tax Treatment of the Platform Economy

In 2021 new rules for a deemed supplier for VAT purposes were introduced for the distribution of goods via an electronic interface (this includes many marketplaces, for example) in certain cases. The electronic interface – the deemed supplier – will be treated as if it had acquired the item from the seller and sold it to the end customer itself.

But does that also apply to services? Many services can also be obtained via electronic interfaces – e.g. when thinking of booking a holiday accommodation. In terms of VAT, completely different rules apply in this case.

This is mainly due to the fact that the newly introduced rules concerning the deemed supplier refer exclusively to “distance sales of goods” and “supply of goods” but not to services.

Complexity and Uncertainty in the Platform Business

The above shows that platforms are treated differently for VAT purposes depending on the products or services offered.

In addition, e-commerce always has to be compared to traditional trade. An unequal tax treatment could lead to advantages or disadvantages in competition.

Needless to say that for e-commerce sellers such developments are of great interest if goods are being sold via electronic platforms. Whether and to what extent the existing rules for the supply of goods will be (or will have to be) adapted in the future, is currently not foreseeable. However, we will keep you posted about any further developments.

Expansion of the OSS? The aim of a single VAT registration

The third pillar of the initiative is no less ambitious than the first two. For entrepreneurs this point should be of particular interest. Especially if you as an online seller – despite the introduction of the OSS – continue to maintain VAT registrations in other EU countries because you use warehouses there. Great opportunities for simplification are possible.

Registrations Lead to Significant Effort for Companies

The EU Commission has recognised the administrative and financial obstacles to cross-border trade that can arise from a wide range of registration obligations.

Best case scenario: You are a Taxdoo customer and have never been confronted with these practical problems, as we take care of exactly these nerve-wracking issues for you. You didn’t know that we can take care of that for you? Find out how here.

Everyone else will most likely have rather unpleasant memories: the registration process is different in every country, often needs to be done in the national language and with the help of local tax advisors. Once the first hurdle of registration is accomplished, regular VAT returns follow different intervals according to national requirements.

In the future individual VAT registration and returns may no longer be necessary. According to the Commission, such obstacles may prevent VAT payers from making their contribution to tax revenue. For this reason, it should be examined how VAT registration and VAT return obligations can be reduced.

Will Supplies to Other EU States Become Easier?

The aim is precise:

Preferably a single VAT registration should be sufficient to be able to operate in the entire EU market.

How this can be achieved has been the subject of discussions in expert groups for quite some time now. The most obvious way forward would be to extend the OSS scheme to the types of transactions that cannot be reported right now.

This includes, for example, intra-community movements of goods and corresponding intra-community acquisitions as well as local sales from warehouses. From the perspective of online sellers, the desired changes are clear.

But from a broader VAT perspective such an expansion of the system is complex, as the world of VAT goes far beyond e-commerce. For this reason, various options are being discussed as to what extent an extension of the OSS can be made to B2B supplies of goods, B2B supplies of services, B2C supplies of goods, etc.

At the same time, the expansion of the so-called reverse-charge mechanism is also a topic of discussion. In such cases, the tax liability is transferred to the recipient of the service. Such regulation has been implemented, for example in Italy or Spain for local supplies of goods made by companies not resident in these countries.

Example:

If an online seller not resident in Spain sells their goods from a Spanish warehouse to a Spanish business customer, the reverse-charge mechanism applies to this supply. The online seller does not have to pay the VAT for this sale. They can issue an invoice with reference to the transfer of the tax liability to the B2B buyer, and the latter is obliged to pay the VAT directly to the Spanish authorities. This can avoid VAT registration in Spain for the online seller.

While the goal is fixed, the way to get there is all the more difficult. To what extent a complete expansion of the OSS is actually feasible, what happens to possible input tax amounts, and what the role of the reverse-charge mechanism will be in this context is not clear. We will definitely follow the developments and keep you up to date.

What Is the Impact of “VAT in the Digital Age” on IOSS?

Lastly we would also like to inform you about the Import-One-Stop-Shop (IOSS) developments in this context.

The IOSS scheme (like the OSS) already pursues the goal of a single registration for VAT purposes in the EU when goods are imported from third countries. However, this is only applicable to consignments that do not exceed an intrinsic value of €150.

In the course of the VAT in the Digital Age package, the Commission is now considering abolishing the €150 euro limit and extending the IOSS to all supplies of goods from third countries to the EU. A mandatory application of the currently optional taxation scheme is also under discussion.

Why is this subject to discussion? Initial experience has shown that the IOSS system is unfortunately quite prone to errors and that, in particular, the IOSS numbers issued exclusively to registered users are abused in practice. In order to enable secure tax collection, these problems must be tackled at the same time.

What’s Next for ‘VAT in the Digital Age’?

As you can see, the impact can be significant, but at the same time, a lot of details are still up for discussion.

All in all the intentions are, from our perspective, quite positive and should bring simplification for both VAT payers and tax authorities. As you may have noticed though, there is not yet a specific proposal from the European Commission to amend the VAT Directive.

The initiative is still at an early stage and so far discussions have mainly been held in expert groups.

In 2022, however, the initiative and respective details will be made increasingly public. A proposal by the EU Commission to amend the VAT Directive is planned for the third quarter of 2022. It’s still a long way to the implementation of the possible changes into national law.

How Can I Contribute?

As mentioned in the beginning, every individual can make a contribution and help shape the upcoming reform. How can you do that?

The EU Commission launched a public consultation on 20 January 2022 containing a questionnaire with various questions on the individual points of the initiative. The questionnaire was published in order to take into account the opinions of VAT payers and other market participants.

Anyone can take part in the consultation until 5 May 2022.

Based on the results of this survey and a study conducted recently, the EU Commission will decide on the course of the initiative.

Is Taxdoo Participating to Raise Awareness of the Challenges in E-Commerce?

The questionnaire is very extensive and complex. We will follow our general approach and try to take off any burden relating to VAT possible.

Taxdoo will submit its own statement as part of the consultation, to draw attention to the challenges faced by online sellers and their tax advisors with the existing VAT rules and the planned changes.

In the coming weeks we will also take you on a journey of the possible outcome of future EU VAT rules. You will find blog posts on key elements of the initiative, which will go into more detail on the relevant topics. Subscribe to our newsletter to stay up to date, you can do that at the bottom of this page.

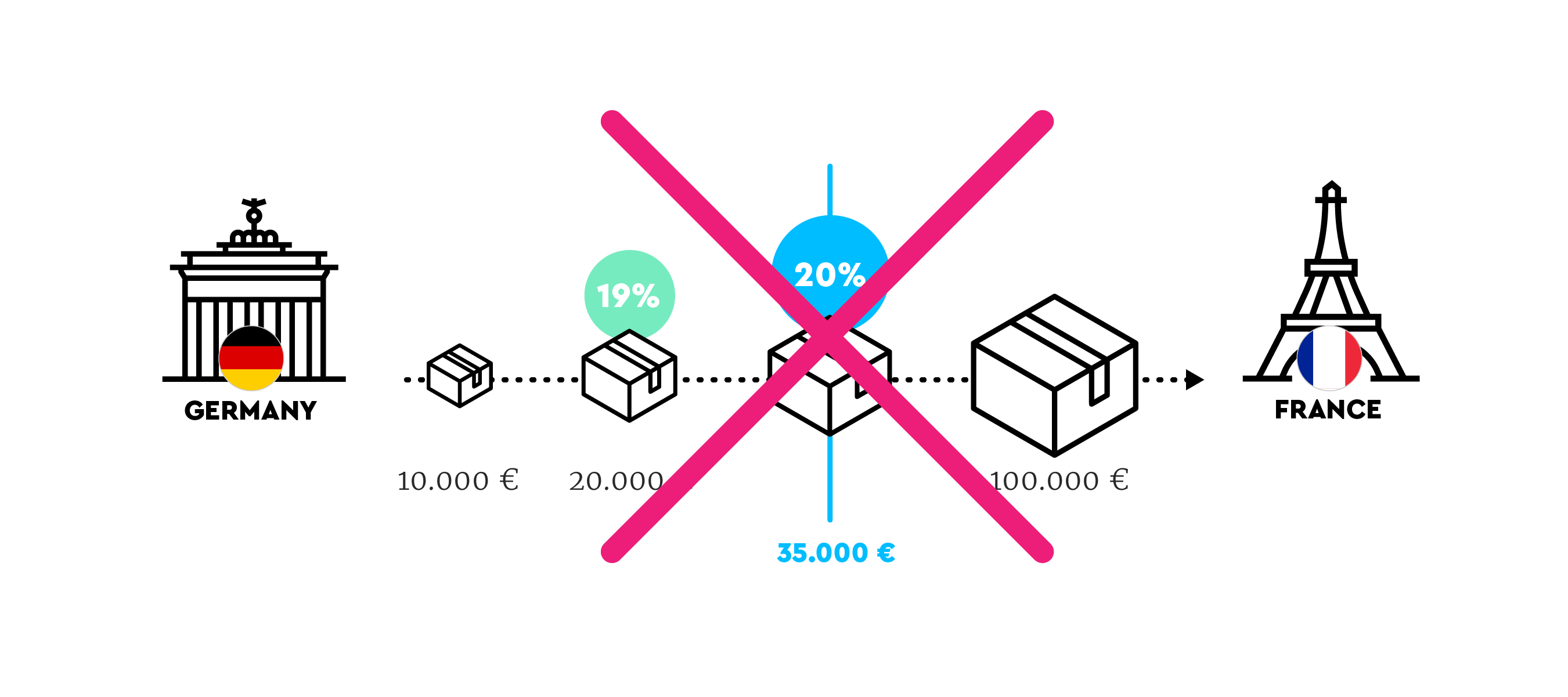

Significant reform has simplified EU VAT compliance especially for e-commerce businesses and tax advisors, but it comes with a number of challenges.

In this blog post you can find out everything you need to know about the One-Stop-Shop (OSS) scheme, including registrations, returns, scope and exceptions. Get informed about your VAT obligations for cross-border sales in the EU.

We Can Help

We offer an automated solution for the One-Stop-Shop. You can learn more about it in a personalised live demo which you can book here.

Summary: The Most Important Facts About the One Stop Shop

Here are the most important facts that you as an e-commerce business or tax advisor should know and observe following the introduction of the OSS on 1 July 2021:

- The previous distance sales thresholds of individual EU countries (between €35,000 and €100,000) for sales to customers abroad no longer apply.

- Now an EU-wide distance sales threshold of €10,000 applies to all EU countries.

- This makes the majority of e-commerce sellers liable for VAT in every EU country to which they send even one parcel.

- VAT from such distance sales can be declared for all EU countries via the OSS. This means that you must determine the right VAT rate for every transaction.

- OSS reports must be submitted quarterly within one month of the end of the previous quarter.

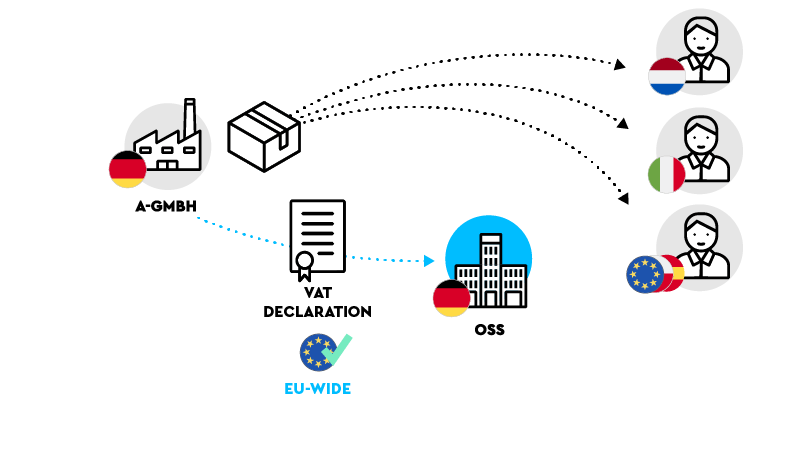

- You have to pay VAT centrally when using the OSS to your relevant tax authority. The relevant tax authority then sends the VAT amounts to the relevant EU countries.

- Local VAT registrations and submission of VAT returns in other EU countries will no longer be necessary for such distance sales when using the OSS.

- Use of the OSS scheme is voluntary.

- If you use warehouses (or fulfilment structures) abroad, e.g. with Amazon Pan-European FBA or Amazon Central Europe, you still have to carry out local VAT registrations and submit VAT returns in the EU country where the warehouse is located.

- You cannot report B2B sales in the OSS. Therefore, you still have to file VAT returns for such supplies.

- Online sellers cannot declare local B2C supplies. That means if you sell goods to a consumer and the goods do not leave the country, that supply has to be reported in a local VAT return.

- When using the OSS, every transaction has to be checked to see if it actually qualifies for the OSS, or needs to be reported via a local VAT return. Taxdoo can handle this distinction automatically and make it available in a form that is ready to upload.

- Taxdoo can also provide you with all transaction data for OSS reporting in a structured form, as well as handle the necessary registrations and returns in other EU countries.

Watch our short video about the OSS:

Now you have an overview of the OSS we will tell you about it in more detail.

New Tax Obligations with the One-Stop-Shop Scheme in (Almost) All EU Countries

Until 2021 distance sales thresholds applied for each EU country. When you exceeded a country’s threshold – anywhere between €35,000 and €100,000 – meant:

- Each sale above the threshold, including the one taking you over the threshold, had to be taxed in the destination country with the correct VAT rate, varying between 17% and 27%.

- You had to notify the local tax authority in the destination country and register for VAT.

- VAT returns had to be submitted on an ongoing basis to the local tax authority, and you had to pay VAT on those sales.

Important: You’ll still need to deal with distance sales thresholds for a few more years for company audits and special VAT audits, since you can be audited by the tax authorities several years later.

The OSS has simplified many aspects of VAT for e-commerce sellers. It means VAT returns and payments in other EU countries can be made in just one country.

But this will only be possible for certain types of transactions. Sellers that take part in Amazon’s Pan-European FBA programme, or use other cross-border fulfilment systems, will require other solutions to be VAT-compliant.

EU VAT E-Commerce Package: Distance Sales since 1 July 2021

The EU’s VAT e-commerce package, which all EU countries had to implement into national law by 1 July 2021, means the end of all national distance sales thresholds. Instead there is now just one EU-wide threshold of €10,000.

What Transactions Are Relevant for the €10,000 Threshold?

The new €10,000 threshold is relevant regarding all sales to EU consumers. The following transactions fall within the threshold:

- Intra-community distance sales and

- Digital services (e.g. streaming or e-books)

If the threshold is exceeded, all subsequent distance sales to other EU countries (intra-community distance sales) are taxable in the destination country. The country of destination is always where the goods are located at the end of the dispatch or transport. As a result even one sale to another EU country – for example from Poland to Lithuania –requires a VAT registration, subsequent filing of VAT returns and paying VAT in Lithuania. To sum up: a lot of work for many online sellers which can be handled with the OSS (see in a moment).

Since the VAT reform took effect in the middle of 2021, the question arises as to how the different old distance sales thresholds and the new one need to be calculated for 2021.

Application of the Standard Distance Sales Threshold in the 2021 Tax Period: Distance Sales Thresholds Are Not Halved

In terms of the standard threshold of €10,000 for distance sales and digital services, many of you are asking yourselves how this distance sales threshold should be applied in the 2021 reporting period, during which both the old system of distance sales regulations, including national distance sales thresholds, and the new OSS rules, come together.

Please note that for 2021, the turnover threshold of €10,000 should not be applied on a pro rata basis in line with the old regulations.

You would therefore be justified in asking where the simplification in this VAT reform for online trade comes in.

The answer lies in the technology of the OSS.

What is the One-Stop-Shop?

The OSS is a platform locally developed by each EU country and serves as a single point of contact for VAT compliance for certain transactions.

Online sellers that become liable to pay VAT in other EU countries as a result of their distance sales can report their sales through the OSS and also settle their VAT payments on the platform. The VAT is then distributed to the relevant EU countries.

This means that you do not have to register for VAT purposes in each individual EU country to file VAT returns because you have exceeded the €10,000 EU-wide threshold.

The following special features of the OSS procedure create additional incentives to use this technology:

- Anyone reporting their intra-community distance sales (distance sales) through the OSS doesn’t have to issue invoices for these supplies.

- The reporting period splits the year into quarters; January to March, April to June, July to September and October to December.

- OSS reports must be submitted by the end of the following month, so by 31 January, 30 April, 31 July and 31 October of each year for the previous quarter.

- The payment is also due when the OSS declaration is due.

- The OSS declaration as well as the payable VAT have to be transferred to just one national tax authority.

- Corrections to incorrect OSS declarations or refunds must be made in your next OSS declaration. This means that previous OSS declarations do not need to be corrected, as this is always done in the current OSS declaration.

That may sound good regarding the OSS, but there are some negative aspects you have to keep in mind.

Who Benefits from the One-Stop-Shop and Who Will Find It More Complicated?

Anyone who has dealt with VAT regulations for some time knows that reforms tend to set off a race between the tortoise and the hare – between rigid standards and agile reality. Particularly in the dynamic environment of e-commerce, major legal reforms that seek to simplify things seem predestined to fail.

This can also be seen with the OSS. While some may benefit from the scheme, e-commerce as a whole does not.

What Transactions Cannot Be Reported via the One-Stop-Shop?

In e-commerce, the OSS will only be a fundamental simplification for companies that dispatch products from a single central warehouse to consumers in other EU countries.

This is due to the fact that only distance sales can be reported through the OSS – i.e. sales from one EU country to customers in other EU countries. Consequently, you cannot report the following transaction types via the OSS, which will be explained in the following:

- Local B2C and B2B supplies

- Intra-community transfers of goods

- B2B supplies of goods

Local B2C and B2B Supplies

Local supplies (B2B and B2C) which never cross the border of another EU country, cannot be reported in the OSS.

Intra-Community Transfers of Goods

Another important topic which is also not covered by the OSS but is commonly used in the e-commerce world relates to so-called intra-community transfers of goods. If you for example use fulfilment structures such as FBA (Pan-European and Central Europe) your goods might be transported cross-border from one fulfilment warehouse to another although no sale is the reason for that. This intra-community movement has to be reported for VAT purposes.

In the case of intra-community transfers of goods, you basically have two transactions to consider:

- In the country of departure of the goods, this is generally considered a tax-exempt intra-community supply of goods.

- In the country of destination of the goods, there is generally a taxable intra-community acquisition. The VAT paid for this intra-community acquisition is regularly deductible as input VAT in the destination country, provided that the other input VAT regulations are also met.

In case you have such intra-community transfers of goods please be aware that you have to be VAT registered in the country of destination to declare the intra-community acquisition and have a valid VAT identification number (‘VAT ID’) in the country of destination available. Furthermore, for such transfers you have to issue a so-called pro-forma invoice and a so-called recapitulative statement as well as supporting documents. All these aspects are relevant so that intra-community supply is also tax-exempt in the country of departure.

Unfortunately you cannot declare intra-community transfers of goods via the OSS, so these still require a local VAT registration in the country of destination in order to be VAT compliant.

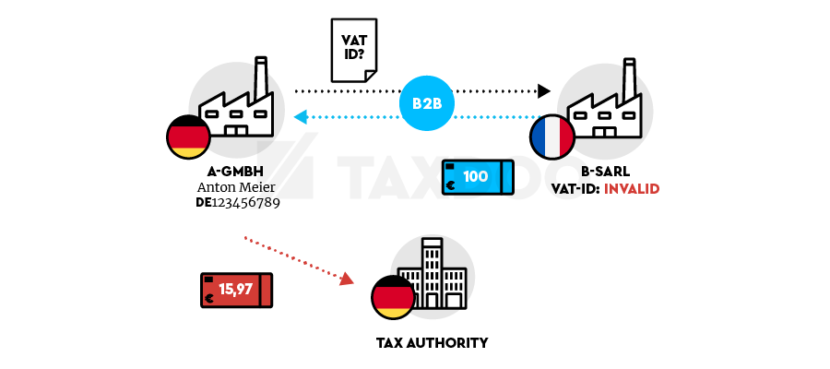

B2B Supplies of Goods

As already said, B2B supplies of goods which you supply locally cannot be reported via the OSS. The same applies regarding supplies of goods which you supply to another taxable person and which – indeed – cross the border of another EU country.

The question at this point is: How do you distinguish consumers from other taxable persons as different VAT consequences arise from this, especially in a highly automated process such as e-commerce?

The answer from a legal point of view is quite easy: A distance sale can be assumed if your customer does not provide you with a valid VAT ID of another EU country. But you still have to ask if there is one available and if you receive one, you also have to check if the VAT ID is valid.

From a technical point of view, Taxdoo can help you do that. Find out more about the importance of checking VAT IDs, how to do it, and how Taxdoo does it, in our blog post on the subject.

One-Stop-Shop for Marketplaces

From 1 July 2021 marketplaces, or so-called operators of ‘electronic interfaces’, also face a new VAT regulation; the so-called deemed supplier rule. Electronic interfaces are – for example – online marketplaces such as Amazon or Alibaba where online sellers can sell their products. Usually, online sellers have to declare VAT for their sales, but in some scenarios the operator of the electronic interface (e.g. Amazon or Alibaba) must declare and pay VAT instead, because they are treated as a deemed supplier. The operator of the electronic interface is the deemed supplier if the recipient of the goods is a consumer if:

- Goods are within the EU and the online seller is located outside the EU (third-country).

- Goods are outside the EU and need to be imported into the EU. Here the intrinsic value should not exceed €150. Please be aware that the location of the online seller is not relevant for that scenario.

If one of the scenarios apply, the operator of the electronic interface is the deemed supplier and has to declare and pay VAT. Generally, the same VAT aspects apply here for the electronic interface as for the online seller concerning the OSS. So, the operator can use the OSS to declare intra-community distance sales. However, the operator can also report local supplies of goods if he is the deemed-supplier.

This special regulation shows that both – electronic interfaces as well as online sellers – have to be aware of VAT implications and to be sure who actually owes VAT for a certain transaction.

Note: The background to this regulation is that marketplaces based in the EU are often more accessible to the European tax authorities than online retailers based in third countries. In order to reduce the administrative burden at this point and to avoid local registration of interface operators in all EU countries, operators of electronic interfaces can use the OSS procedure.

Amazon Seller?

On the Taxdoo blog you can find out more about VAT for Amazon FBA or VAT for Amazon Pan-European. You can also see all our posts about Amazon.

OSS and Issuing Invoices

Generally you are obliged to issue invoices for taxable transactions. This also applies regarding distance sales. But if you report these distance sales via the OSS, the invoice obligation is waived.

Which VAT Rate for What Product in Which EU Country? The Challenge Only Grows!

With the new regulations regarding distance sales, more and more online sellers are faced with highly complex topics regarding VAT rates. Even if you use the OSS, this challenge still remains on you.

The subject of VAT rates in the EU is quite complicated. EU law allows the following range:

- Standard tax rate: Here the range in the EU is between 17 and 27 percent. The legal minimum is 15, and there hasn’t been an upper limit for several years.

- Reduced tax rate I: This must be at least 5 percent and less than 15 percent – the application is limited to the products listed in Appendix III of the VAT Directive.

- Reduced tax rate II: The same conditions apply as for the reduced tax rate I.

- Zero Tax Rates: As the name suggests, the tax rate here is zero percent. This is not to be confused with a tax exemption.

- Special rates: These can be chosen at will – but always only after approval (and often a time limit) by the EU Commission.

This range of VAT rates, which is fully utilised by many EU countries, makes determining the right VAT rate in the context of the new regulation effective 1 July 2021 particularly challenging for e-commerce.

How can an online retailer with a range of 5,000 products and tax obligations in all EU countries from 1 July 2021 determine the VAT rates for all 5,000 products and all EU countries with legal certainty?

Ultimately, this will only be possible in an automated manner – for example via a unique product feature such as the so-called customs tariff number. With the help of the customs tariff number, each product can be classified worldwide, so that the All in all, there are quite a few challenges that the new legal regulation brought with it. We have summarised these in a checklist. VAT rates can also be determined automatically – then via corresponding databases.

Import-One-Stop-Shop for Distance Sales from Third Countries

As part of the change in the law on 1 July 2021 a single point of contact for imports – the so-called Import-One-Stop-Shop (IOSS) – was also introduced. The IOSS can be used to report distance sales imported from a third country with an intrinsic value of up to €150.

The IOSS can be used by entrepreneurs based in the EU as well as by entrepreneurs based in ‘third countries’ (non EU countries). Entrepreneurs have to file a corresponding registration with the responsible tax authority for the special scheme.

The IOSS can only be used once the tax authority has issued an IOSS identification number to the entrepreneur. In contrast to the OSS, IOSS reports must always be sent to the tax authority on a monthly basis.

Find out more about Taxdoo’s IOSS solution here.

Are You OSS-Ready? Checklist for the One-Stop-Shop Process

- Ensure that you can determine VAT rates automatically and throughout the EU – ideally via the customs tariff number!

- Register for the OSS! We will show you how to do this below.

- If you take part in the Amazon Pan-European programme – or similar programmes – then you have to identify your distance sales and then report them via the OSS, but all other transactions (B2B transactions, input taxes and local sales) continue to have local registrations in other EU countries.

- Make sure regularly that if point 3 applies to you, you do not report transactions twice (OSS and local registration) or not at all! This can happen quickly due to the added complexity.

Conclusion about the One-Stop-Shop: Additional Requirements for VAT Obligations for Most Online Retailers

The legal reform on 1 July 2021 is extensive and complex for you as an online retailer. But you can take the following key facts with you as a conclusion:

- Abolition of national delivery thresholds and the introduction of an EU-wide sales limit of €10,000.

- Tax liability in (almost) all EU countries, even if only small sales are made in individual countries.

- Central reporting of distance sales via the OSS procedure in the country of domicile of the online retailer (local registrations are no longer necessary for this)

- Necessity of local registrations when participating in Amazon’s Pan-European or Central Europe programmes or various fulfilment centres/warehouses

- Need for EU-wide determination of the applicable tax rates for the entire product portfolio

Design and establishment of additional VAT reporting processes necessary to map different transaction types (distance sales via OSS, intra-community transfers / purchases via local registrations)

Taxdoo Offers One-Stop-Shop Solutions and More

If you want to know more about how you can map OSS obligations, VAT compliance, financial accounting and much more efficiently and securely via one platform, then use this link to choose an appointment for your individual and free initial consultation with the e-commerce and VAT experts from Taxdoo!

Taxdoo Is the Platform for Automated and Secure VAT Processes

In addition to processing ongoing EU-wide VAT compliance, Intrastat and financial accounting, Taxdoo also maps numerous other VAT services for the leading online retailers in Europe via a unique platform.

We are able to report your remote sales automatically and more easily than ever via the OSS.

The IOSS can only be used once the tax authority has issued an IOSS identification number to the entrepreneur. In contrast to the OSS, IOSS reports must always be sent to the tax authority on a monthly basis.

Find out more about Taxdoo’s OSS solution, available with all our packages, including our free Starter package, here.

The Intrastat reporting system will be modernised as of 2022. We have already given you an overview of the relevant changes in our blog post ‘Intrastat – Changes from 2022’ on the amendments made to Intrastat reporting as of January 2022.

In this article, we would like to present one of the upcoming changes in more detail as it will require action, especially for online merchants. This concerns the type of transaction. If you already submit Intrastat declarations or are expecting a reporting obligation in the near future, you should definitely be aware of this issue.

To recap: What changes need to be considered for Intrastat declarations from 2022?

In total, you can expect three relevant changes starting in 2022:

- You must indicate the country of origin of goods

- The VAT ID, or a substitute number must be provided

- Types of transactions are now determined by new criteria

We have already written about the first two changes in our prior blog post. The provision of these two pieces of information (country of origin and VAT ID) was previously possible on a voluntary basis, whilst in some countries it was even mandatory. These changes only affect the dispatch report.

The changes made to Intrastat regarding the type of transaction, on the other hand, must be addressed in both the arrival and dispatch reports. Information on the underlying transaction is transmitted in the Intrastact declaration by identifying the type of transaction.

Therefore, it is a question of the reason behind the cross-border of movement of goods (e.g., a purchase transaction, a contract processing transaction, or commission transactions).

Below, we clarify the exact changes to the types of transactions.

From January 2022: New Intrastat list for types of transactions – also for online trade

As of January 2022, movements of goods are to be declared according to a new list for the types of transactions. Some of the previously existing types of transactions will be further subdivided in future, whilst others will be increasingly grouped together.

There will be additional distinctions for online merchants moving forward. This is because the new list requires a distinction between B2B and B2C sales. In addition, movements of goods in stock must be declared separately.

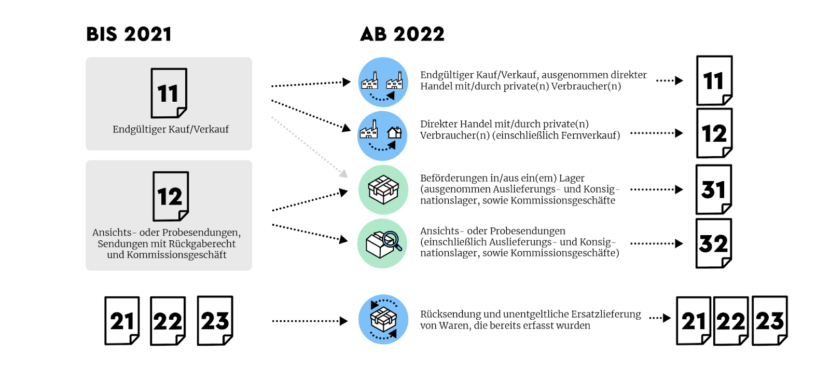

Sounds confusing? It is! Take a quick look at the following illustration:

Not to worry, Taxdoo can adapt and take care of all of this for you automatically. If you would like more information on this topic, please read the following. Here, we clarify all the new changes individually and let you know what you need to bear in mind in each case.

In the following, we will explain what you need to keep in mind.

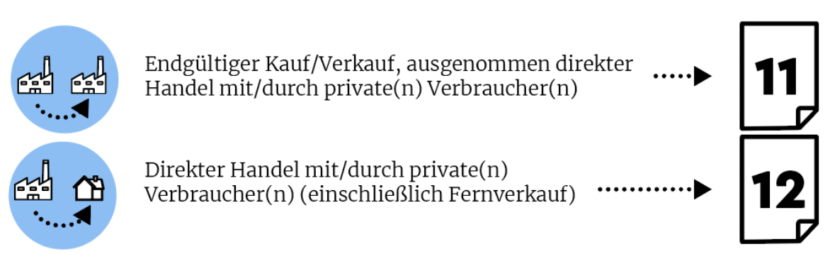

Distinction between B2B and B2C sales – types of transactions 11 and 12 according to Intrastat

Moving forward, you are required to distinguish between sales to companies (B2B) and sales to private individuals (B2C).

If you sell goods to private individuals, you will need to enter these transactions into your Intrastat declaration with the new key number 12. This is a great advantage because until now, online merchants with B2C sales could have experienced enquiries from the Federal Statistical Office when validating data.

Please note that the Federal Statistical Office and the tax authorities exchange information on the data reported in the Intrastat declaration and the advance VAT return.

Normally, for example, intra-community supplies that are included in the advance VAT return are to be declared in the same amount as dispatches in the Intrastat delcaration. In this way, a comparison of the data for plausibility can be carried out.

New transaction types in the Intrastat declaration enable the reconciliation of reported eCommerce data between the authorities

So far, B2B and B2C sales have been declared to Intrastat collectively under key number 11. This is done regardless of whether taxation takes place in Germany or elsewhere in the EU. The only decisive factor is that the movement of goods begins in Germany and ends in another EU member state.

However, sales to private individuals are not taxable in Germany once the distance selling threshold of EUR 10,000 has been exceeded. At this point, sales no longer need to be recorded as domestic turnover in the German VAT return. These sales usually flow into the item (in Germany) non-taxable sales, but since this is a collective item, no conclusion can be drawn about B2C sales.

As a result, a reconciliation between the Intrastat declaration and the advance VAT return has, until now, not been possible.

By subdividing the key numbers 11 and 12 according to the category of recipients, it is now possible to distinguish between sales to private individuals and companies – in Intrastat at least.

In addition, a comparison with the data reported via the OSS scheme should also be possible going forward. Distance sales to other EU member states can thus be identified.

In the cases where online merchants have registered for the One-Stop-Shop, the declarations should therefore be reconcilable and enquiries made by the Federal Statistical Office can be avoided.

Movements of goods in the type of transaction 31 according to Intrastat

As previously mentioned, from 2022 onwards, movements of goods in stock must also be declared separately to Intrastat. All transactions for which a transfer of ownership is only planned and for which the recipient has not yet been determined now fall under the new key number 31.

If goods are sent to a distribution warehouse in the EU (i.e., an intra-community supply/purchase), this movement of goods is declared to Intrastat under the key number 31.

If you now take the new regulation of the type of transaction into account, you will come across the following phrasing for key number 31:

Transport to/from a warehouse (excluding distribution and consignment warehouses, as well as commission business)

We have already explained the case of a movement of stock to a warehouse, but what happens in the case of a movement from a warehouse?

There are two possible cases: the goods are either moved to another distribution warehouse, or sold.

Variant 1, i.e., a movement of goods to another distribution warehouse, is also a sale to a warehouse. Therefore, key number 31 must be used in this circumstance.

Variant 2, i.e., the sale of goods – this leads to a question, and not only because it is a movement from a warehouse (31?) and at the same time a sale (11 or 12?) – but because, Germany has devised a unique regulation that does not exist in other countries.

Sale from a warehouse – does this fall under key number 11, 12 or 31 in the Intrastat declaration?

The guidelines of the Federal Statistical Office state the following for sales from a warehouse: One must pay close attention to the residency of the merchant.

Example: You are a German online merchant (i.e., you have your registered office in Germany) and transport goods from a warehouse in the Netherlands to Germany for temporary storage. This operation is a movement of goods to a warehouse and is reported under the key number 31.

You then sell these goods to a private individual located in Poland. These sales are to be reported under the key number 12 as of January 2022.

For our next example, we’re only going to change one aspect of the aforementioned case: You are not registered in Germany, but in Austria. You simply use a warehouse in Germany and are VAT registered there.

Variation example: In this case, you also report the movement of goods to your warehouse in Germany under the key number 31.

With regard to the sale made to the private individual in Poland, however, you must ensure that you do not declare this sale under key number 12, but rather number 31.

Sounds confusing? That’s because it is! But, that’s simply the way the German regulation is.

Furthermore: The criterion of residency can only be found in the Federal Statistical Office’s notes if you look closely. Example 10 provides information on the solution for companies not resident in Germany. However, you can find the specific criteria in the decision tree found in the explanatory videos provided by the Federal Statistical Office.

Residency criterion for exports made from warehouses is now clearly regulated

With the publication of the Guide to Intra-Community Trade Statistics 2022, the criterion of residency and the use of key number 31 for the type of transaction in the case of a supply from a warehouse have now been clearly defined.

Despite being found in the small print under the list for the type of transaction, the guide clearly states:

If goods are sent abroad again from a warehouse in Germany (temporary storage in Germany) and the goods are owned by a person resident abroad, this must be declared with key number 31 as in the case of storage, even if the re-dispatch is, for example, based on a purchase transaction.

Despite an underlying purchase transaction (in our example above to the Polish private individual), the sale to a person resident abroad from a distribution warehouse is declared under the key number 31.

B2B, B2C, warehouse – 11, 12, 31? In which cases are which types of transactions to be used in the Intrastat declaration?

Since the new regulations can quickly lead to confusion, we would like to give you a brief overview of when you have to report what and how:

For merchants based in Germany (e.g., your company is based in Germany)

For merchants not resident in Germany (i.e., you do not have a registered office, management or a branch in Germany)

For merchants not resident in Germany, the nature of the transaction is quite clear according to the German regulations. It is nevertheless important to make a distinction as to which recipient is involved – this is because it depends on this information as to which VAT identification number is to be used.

In this case, the Federal Statistical Office has also developed a unique system for Germany. You can read more about this in our blog post on the new mandatory information required in the Intrastat declaration.

Commission business, consignment stock and call-off stock – Other types of business that fall under key number 32 according to Intrastat

In addition to the types of transactions already mentioned, key number 32 can regularly prove to be relevant to online merchants. As with key number 31 for warehouse transactions, these are also transactions where a transfer of ownership has not yet taken place, but is merely planned.

The difference to number 31 however, is that the potential recipients are a limited number of companies or private individuals to whom the ownership of the goods is to be transferred following the movement of said goods.

The key number 32 is thus intended for the following unique cases in Intrastat declarations:

- Commission business

- Consignment stock

- Call-off stocks (distribution warehouse)

If, however, the warehouse used is purely a distribution warehouse, such as in the case of the Amazon Pan-EU program, in which the potential buyer cannot yet be determined, these warehouse transactions fall under the key number 31.

Varied implementation of the Intrastat ‘Type of Transaction’ in the EU member states

Those of you who have already read our blog article on the new mandatory data in the Intrastat declaration may find themselves experiencing some déjà vu whilst reading the following information.

In order to make the determination of the type of transaction as complex as possible, the individual EU countries have structured their regulations differently.

While in Germany the place of residence is decisive for determining the type of transaction, such a distinction is not made in Poland. In the Czech Republic, on the other hand, it must be taken into account whether the merchant is registered for VAT in the country of destination.

Using these examples alone, we can see that three different countries have three different implementations of the new regulations. Online merchants are expected to adopt each new regulation as soon as they have a reporting obligation in the respective countries.

Customs declarations are also affected

As we have already explained in our article on the changes from 2022, the new list for the types of transactions also applies to customs declarations. Below, you will find what you need to keep in mind and why you need to make changes to your Intrastat declarations before they are submitted.

Our conclusion regarding the modernisation of Intrastat: It’s becoming more complicated!

Unfortunately, as is so often the case, our conclusion is that things are not getting any easier for online merchants. After the introduction of the One-Stop-Shop on July 1, 2021, the modernisation of the Intrastat system is now resulting in a similar situation.

In order to determine the types of transactions, online merchants will need to distinguish between the type of transaction and the category of recipients to whom the goods are sent. In the case of Germany, it will also be relevant where the merchant is resident. In all other countries, there is the possibility for a deviation in the regulations, which means that merchants need to look carefully!

However, we have saved the best news for last: We have adapted to the new changes and are happy to relieve you of this burden!

Your way out: Let Taxdoo create your Intrastat declarations

Are you already a Taxdoo customer? Then make sure that you have booked all the necessary add-ons for Intrastat reporting. We will take care of everything else!

As usual, you can use your customer dasboard to see in which countries you are required to register for Intrastat.

For everyone else: Arrange a free and non-binding live demo today and see for yourself the added value Taxdoo can offer.

As of January 2022, there will be changes in the reporting of intra-trade statistics. A comprehensive report on the changes, where they come from and what you as an online merchant need to be aware of is explained in our blog post ‘Intrastat – Changes from 2022’. In this article, we would like to clarify the details of the two new requirements in the German Intrastat dispatch report. This is because, as simple as the changes sound, there are a few points you need to consider.

Which Intrastat regulations will be affected from 2022?

In Germany, there is certain information that can currently be voluntarily submitted by declarants. However, two of these fields will become mandatory for your future Intrastat declarations:

- The country of origin of goods

- The VAT identification number of the recipient

In a selection of EU countries, this information has already been made compulsory. In Germany, this will now also be the case as of January 2022.

In the following post, we will explain the most important aspects of these two new specifications.

What is the ‘country of origin’ for Intrastat declarations?

The country of origin of goods in the context of Intrastat is not the country from which you ship the goods. Instead, the origin of goods is determined by where the goods were wholly obtained or manufactured. In the case of further processing, the decisive factor is where the last significant processing took place.

Above all, you must not confuse the country of origin with the country of departure from where the goods are sold. Of course, in some cases it may be the same country. However, if you send your goods from a warehouse, in many cases the country of origin will be different from the country from which you send your goods.

Example:

If you buy your goods from a manufacturer in China, the country of origin is China. With regard to the Intrastat this means: If you sell this product from a warehouse in Germany to a private end-customer in the Netherlands, you must enter the code ‘CN’ in the field for country of origin in your German Intrastat dispatch report.

In addition to the country of origin, as of 2022 it will also be necessary to state the VAT identification number in Intrastat declarations. There will also be additional special features to consider here, which we will explain to you below.

The VAT identification number in Intrastat

Stating the VAT identification number may sound simple at first, however, this is unfortunately not always the case.

Starting in January 2022, there will be a distinction included in the Intrastat declaration between B2B turnover and B2C turnover. This is where the first question arises:

Which VAT identification number do I enter when I send my products to a private customer in another EU country?

So far, the Federal Statistical Office has no clear guideline:

If the recipient is a private person, the fictitious number QN99999999 should be entered.

However, it is not as clear as it seems. The Federal Statistical Office has concretised this issue in the Guide the Intra-Community Trade Statistics 2022, which was published (in German) in December 2021. This is because the fictitious number is not always to be taken into account when selling to private individuals.

Important:

Those who have already researched the changes in Intrastat reporting will probably not yet know these details. Until now, the Federal Statistical Office had published a guide and detailed explanations on the changes from 2022. This did not yet contain all the details of the new requirements for the VAT identification number. In particular, the dependence on OSS usage was not apparent from these documents. Therefore, there may be need for adjustment.

Intrastat: VAT ID for B2C sales depends on OSS usage

The new guideline of the Federal Statistical Office now focuses on merchant’s OSS registration.

The decisive factor is whether you have registered for the One-Stop-Shop.

If you take part in the OSS scheme, you can use the fictitious VAT ID number QN99999999 for your sales to private individuals.

If, however, you are not registered for the One-Stop-Shop but use local registration in the respective receiving member state, you should not use this number.

You should instead use your own VAT ID number for registration in the receiving member state.

Special case: Obliged to report to Intrastat, but fall below the turnover threshold

Moreover, if your B2C sales are below the turnover threshold for distance sales, you will generally neither use the OSS nor be registered in the receiving member states. In these cases, for VAT purposes, taxation takes places in the country of departure of the goods. However, these sales must still be reported for Intrastat purposes. In this constellation, you simply act as if you were registered for the OSS i.e., you declare with the fictitious number QN99999999

Good to know:

This distinction of the VAT identification number for B2C sales is a national regulation in Germany that only affects German Intrastat declaration. In other countries, however, there is no such distinction.

VAT ID in Intrastat declarations for B2B sales and movements of goods

In the case of sales to other companies (i.e., your B2B turnover) and also your movements of goods to foreign warehouses, it becomes somewhat easier – at least with regard to the VAT identification number. In your Intrastat declaration, you are to enter the VAT identification number of the recipient, i.e., either the B2B customer or your own VAT ID in the receiving member state.

In summary: The specification of the VAT ID for the Intrastat declaration depends on the recipient and your OSS registration

When stating the VAT identification number, a distinction must be made according to whom the recipient of your sale is (B2C, B2B, or a movement of goods between warehouses) and, in the case of sales to private individuals, whether you are registered for the OSS.

You should also implement this new distinction according to official guidelines. The Federal Statistical Office is in regular contact with the tax authorities and will in future also receive information regarding distance sales you declare via the OSS scheme.

In these cases, contradictory information could lead to queries from the authorities. Therefore, implementing the requirements according to the valid deadlines is advisable and saves you time and effort down the track.

Further changes as of January 2022

It does not stop with the Intrastat changes to the VAT identification number. Another significant change concerns the field ‘Type of Transaction’. This also comes into effect from January 2022 and affects both the arrival and dispatch reports.

Here, too, are important new features for online merchants. As such, we cover the changes concerning the ‘types of transactions’ separately in our next Intrastat article. If you are obliged to submit Intrastat declarations, you should not miss it.

Taxdoo & Intrastat

Does this sound complicated? No need to worry! Our tax experts have already dealt in detail with all the changes to Intrastat reporting and can handle them completely, correctly and securely for you.

You can simply book our Intrastat add-on in your customer dashboard under the ‘Add-on’ function. If you have already activated our Taxdoo add-on for Intrastat declarations, you can sit back and relax. We provide you with Intrastat declarations with all the changes from 2022 already applied.

Would you like to learn more about Taxdoo and our Intrastat service?

Then arrange a free and non-binding demo with one of our VAT experts. We will answer any questions you may have and explain how Taxdoo can best support you and your VAT needs. We look forward to meeting you!