Intra-community movement: The Value Added Tax -Guide

“Intra-Community shipment” – what an impressive neologism! At least a more manageable abbreviation has been established:

“i.g. Verbringung”.

But no matter how unwieldy the term may seem: online traders with EU offshore storage – and their tax advisors – have to deal with the topic and should know the most important basics about it:

- What are intra-Community shipments?

- What (diverse!) tax requirements arise from this?

- Are there solutions for the convenient handling of tax obligations?

This much should be said in advance:

Without fulfilling the tax obligations arising from intra-Community shipments, participation in fulfilment offers such as FBA, CEE & Co. can quickly become an expensive pitfall. Fortunately, there are convenient solutions.

Extensive turnover tax consequences when using foreign warehouses

In the course of internationalisation, sooner or later online traders will ask themselves whether they should also use foreign warehouses.

Marketplaces such as Amazon or Zalando make it possible for you to sell your goods online effortlessly even in other EU countries via the suppliers’ local warehouses there.

To this end, industry leader Amazon has built up an EU-wide cross-border fulfilment network for its merchants in recent years. And Amazon is constantly trying to increase the use of the “Fulfillment by Amazon” programme by offering various incentives to retailers.

Participation in these international fulfilment programmes offers online retailers one or more of the following benefits, depending on the platform:

- Lower shipping costs than shipping from Germany

- Lower storage costs than in Germany

- Reduced delivery time due to storage in your customer’s country

The large marketplaces therefore offer you an – initially very simple and attractive – internationalisation of your sales.

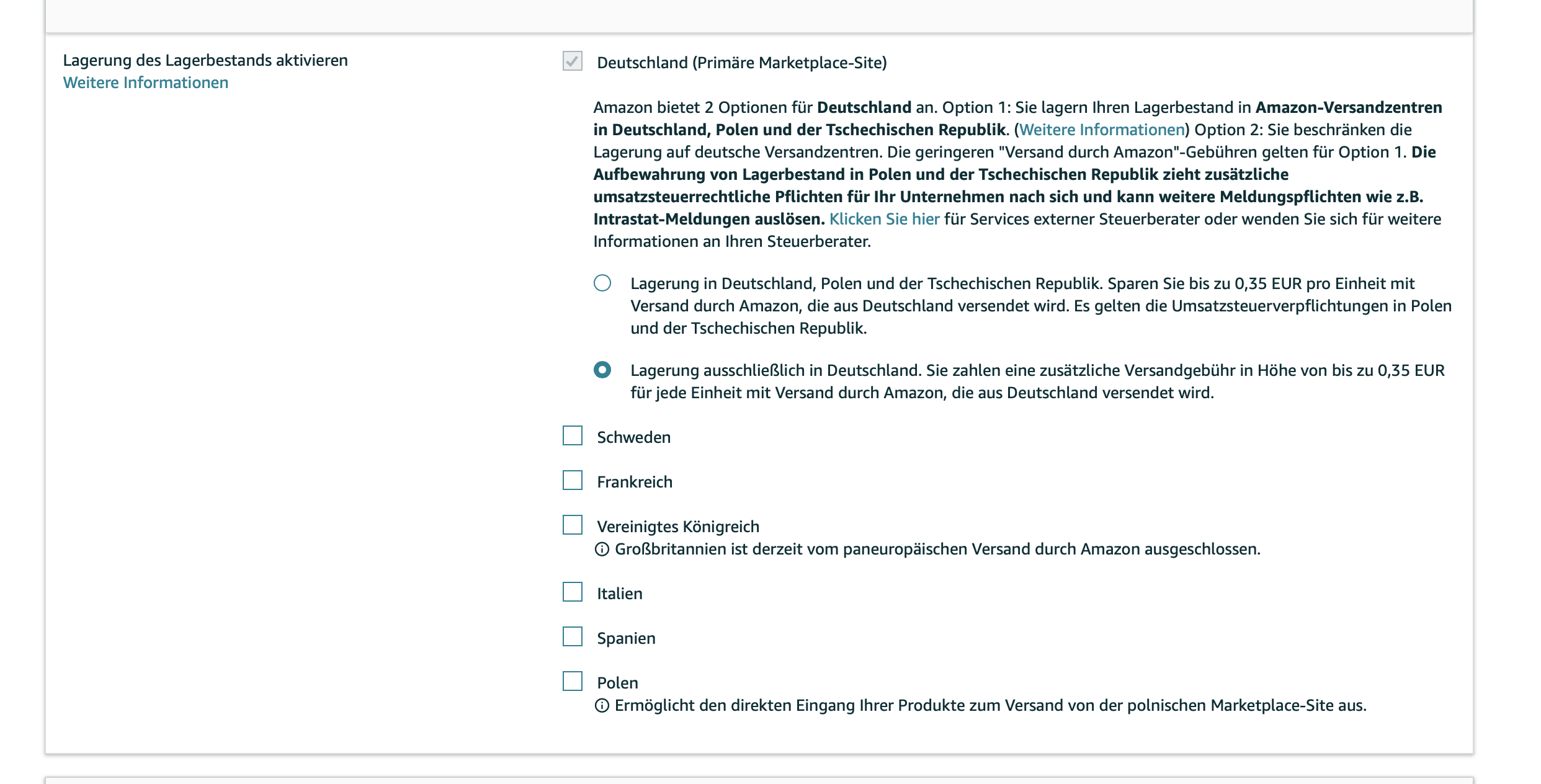

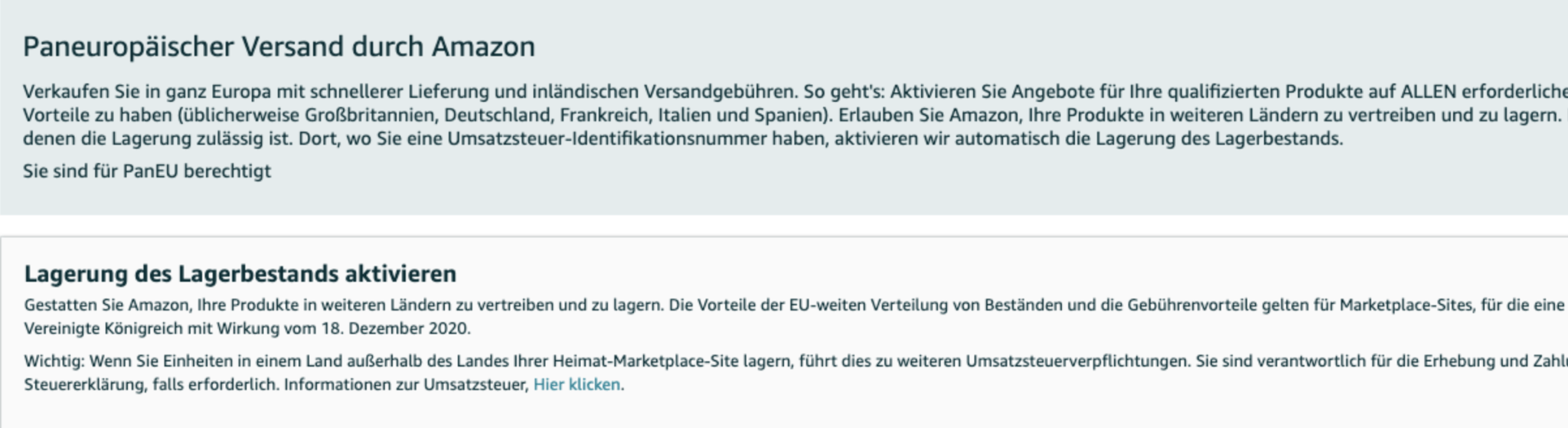

Goods from pan-EU sellers are often relocated many times by Amazon

For some time now, the focus has been on the “Pan-European Shipping” (PAN EU) programme from Amazon. Amazon has already set up numerous warehouses within the European Union (EU) and in the United Kingdom (UK) and is continuing to expand these capacities. Currently, FBA sellers can use warehouses in the following member states as part of the PAN EU programme:

- Germany

- France

- Italy

- Poland

- Sweden (new since summer 2021)

- Spain

- Czech

- UK (Great Britain): currently not part of the programme

In order to be able to sell your products within the framework of Pan-European Shipping, you must agree that Amazon may ship your goods to the countries you have selected.

Once you have agreed in principle to pan-European storage, Amazon can move thegoods between the individual storage locationsflexibly and without involving you again, practically as often as you like.

The tax consequences resulting from these transfers and relocations when using programmes such as Amazon CEE or PAN-EU are extensive and risky. And they directly affect you, because:

Any transport of your goods from one warehouse to another across EU borders constitutes an “intra-Community transfer” attributed to you for tax purposes.

And you have to document and report these movements. We will describe in detail how and where.

From a tax perspective, however, the challenges already begin before you actually use these cross-border logistics structures.

Therefore, in the following we will take a look at which tax obligations you must observe before you start with EU relocations.

I.g. shipments arise from the use of foreign EU warehouses

The flexible transfer of goods between different warehouses in other EU countries leads to registration and reporting obligations for tax purposes in the country of departure as well as in the country of destination of the goods.

But let’s take a step-by-step look at how the individual processes involved in such a transfer are to be viewed from a VAT perspective.

The first step in using a foreign warehouse will always be that you – or the marketplace provider such as Amazon on your behalf – move the goods to a foreign warehouse. This results in two transactions that are relevant for VAT purposes.

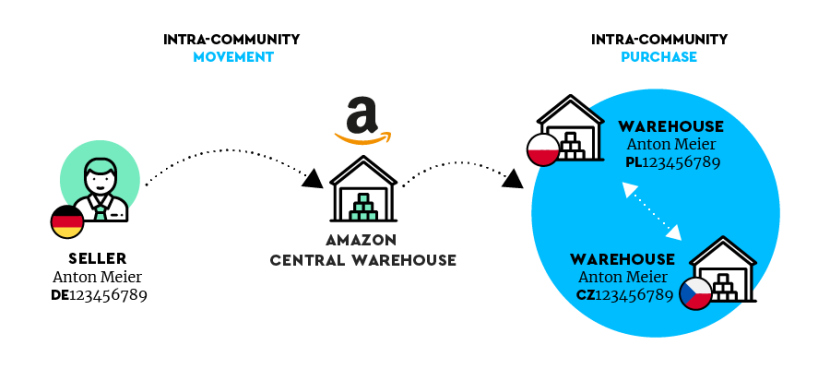

Let us take the dealer Anton Meier from Germany as an example.

Anton Meier delivers goods to a warehouse in Poland because the storage and shipping fees there are lower than for a German warehouse. From there, his goods can be dispatched to the Czech Republic or France, for example – in other words, to wherever demand and/or storage capacities demand it from the point of view of the marketplace.

In this example, we will now take a closer look at shipments to Poland. However, the following also applies to shipments to all other EU countries.

Intra-Community shipments arise from cross-border entries or transfers in EU warehouses of goods.

In the country of departure of the goods: Intra-Community transfers or: I deliver to myself

In our example, Anton first has his products shipped from Amazon to a warehouse in Poland. Under certain conditions, which we will discuss below, this is a tax-free supply by Anton from Germany to Poland to himself – a so-called intra-Community transfer.

Since the transfer of goods is cross-border, the VAT law virtually acts as if you were delivering the products to yourself, e.g. from Germany to Poland.

As a result, a delivery is fictitious, although no sale has taken place at the time of the transfer.

This fictitious delivery is generally tax-free, so you do not have to pay tax to the tax office.

In order for the tax office to grant you tax exemption for intra-Community transfers and so that you do not have to pay tax (retrospectively) for this transfer of your own goods, you must fulfil a number of conditions.

These requirements have become drastically stricter since 01.01.2020 – with the introduction of the so-called “quick fixes”. But more on that later.

In the country of destination of the goods: intra-Community acquisition

In our example, if Anton’s goods now arrive in the Polish warehouse, Anton makes a so-called intra-Community acquisition in Poland from a VAT perspective. This acquisition is taxable and subject to Value Added Tax in Poland – currently 23%.

As a result, however, the tax payment burden from this transaction will generally be zero, as our trader should have an input tax deduction from the intra-Community acquisition in the same amount.

Ultimately, however, the Polish tax authorities know through this procedure that the trader has brought goods to Poland in order to sell them from there.

So far, so good. However, intra-Community transfers and intra-Community acquisitions mean that you must be registered for VAT in both the country of departure and the country of destination of the goods.

In the following section we explain why this is the case and what obligations you have to fulfil.

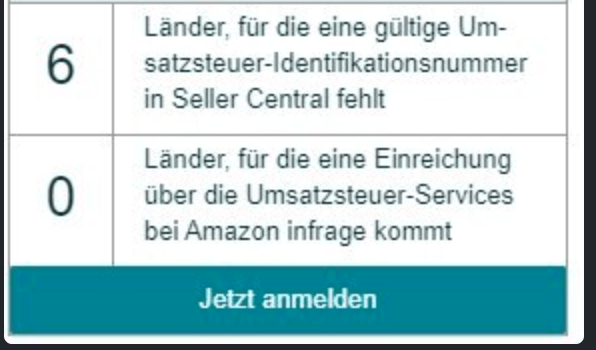

For the declaration of intra-Community shipments, VAT IDs are required in both countries.

As can be seen from the example, our trader Anton must submit prior declarations for the declaration of intra-Community shipments in Value Added Tax both in the country of departure and in the country of destination (in this case Poland). Depending on the country, this must be done monthly or quarterly.

In order to be able to submit advance tax returns to Value Added Tax and to obtain tax exemption on your above-mentioned shipments, you must be registered for tax purposes in the respective country.

You must therefore haveapplied for and received a local VAT ID in each case. This can take many weeks in some EU countries.

For this reason, you should be registered for taxin the respective countries in good time before you ship your goods there – orhave them shipped by Amazon, Zalando & Co.

Intra-Community transfers without VAT ID in the respective destination country can be very expensive

Intra-Community transfers are only tax-exempt in the country of origin – among other conditions – if the recipient, i.e. the trader himself in the country where the goods are stored, has a valid VAT ID there at the time of the transfer.

Otherwise you will have to pay tax on shipments – i.e. deliveries to yourself that do not generate any revenue!

A local tax number, as issued to foreign traders in some EU countries in the past, is no longer sufficient for obtaining tax exemption on i.g. shipments since the tightening of tax regulations with the introduction of the so-called “quick fixes” in 2020.

The following example quantifies the problem:

A Pan EU trader with an annual turnover of €5 million who is not tax registered in the six Pan EU states with their own VAT.-IDs will have to pay on average €500,000 Value Added Tax on their shipments – per year.

How and where do I declare i.g. shipments?

The tax declaration of the intra-Community transfer is made both in the country of departure and in the country of destination, in our example in Germany and in Poland, in the Value Added Tax advance returns. In the following, we will show you what exactly you have to declare and where.

Intra-Community transfer declaration in the Value Added Tax- Pre-declaration in the country of departure

In the German advance return Value Added Tax you report the net amount of the tax-exempt intra-Community supply in field 41

In the country where the transfer starts – here in Germany – you declare the tax-free intra-Community supply (transfer). You enter the cumulative purchase prices of all transferred goods of a month or a quarter in field 41 of the Value Added Tax advance return.

Declaration of intra-Community acquisition and input tax deduction in the country of destination

Declaration of intra-Community acquisition in the Polish Value Added Tax advance return with simultaneous deduction of input tax (symbolic representation based on the German VAT form and with EUR amounts)

In the country where the transfer ends – here in Poland – you declare the taxable intra-Community acquisition in the advance return at Value Added Tax and at the same time claim the input tax deduction, so that the balance is basically zero.

The assessment basis is again the purchase prices, which in the case of Poland you would still have to convert into zloty. (Note: We have not done this here for didactic reasons in order to show that the 100,000 euros that you declare in Germany should also correspond to 100,000 euros in Poland in order to avoid questions from the Polish tax office).

A standard tax rate of 23% currently applies in Poland. For reasons of comprehensibility, we have not used a Polish Value Added Tax advance return (UStVA), but symbolically a German UStVA with Polish tax rates.

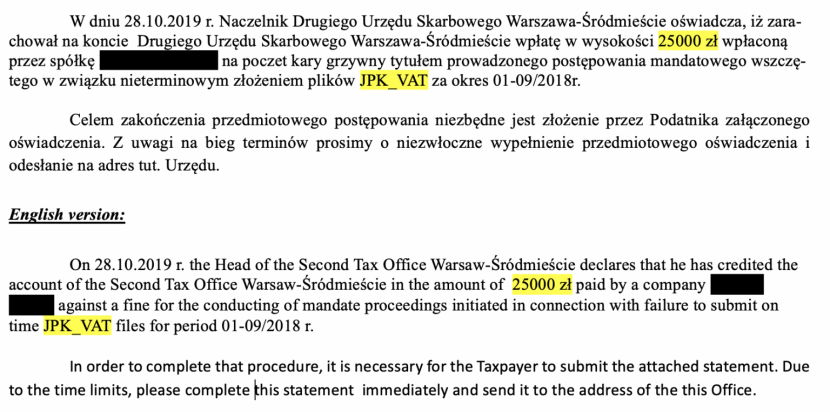

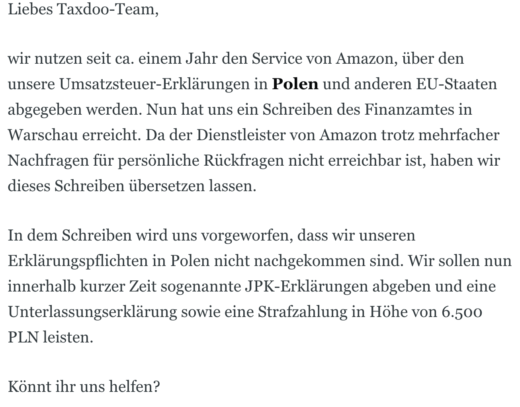

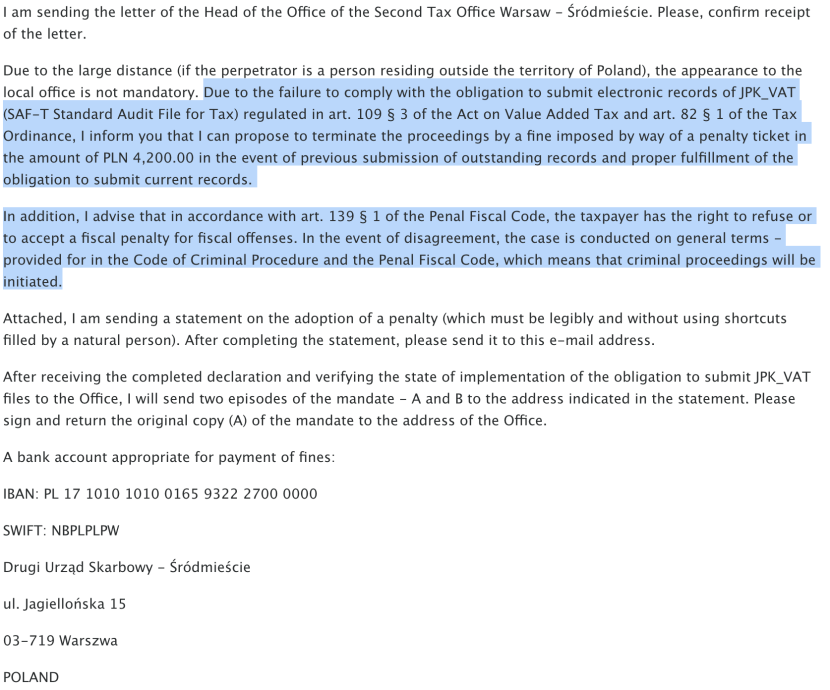

Special feature in Poland: Without submission of JPK declarations, there are high risks associated with i.g. shipments.

We regularly receive enquiries from new customers like these:

Screenshot of the letter from a Amazon seller about missing JPK declarations in Poland

This problem is now well known and, thanks to Taxdoo, has been taken up in one of the leading magazines focusing on digital topics – the t3n.

Poland is one of the first countries in which online traders had to submit a declaration based on all transactions – the so-called JPK declaration – in addition to a classic Value Added Tax declaration.

Extract of a file with data for the JPK notification in Poland

Since October 2020, the JPK declaration has completely replaced the traditional Value Added Tax declaration in Poland. This is likely to further exacerbate the tax challenges for e.g. Amazon Pan EU and CEE traders.

Without submitting these monthly JPK returns, the tax office in Warsaw will deactivate your Polish VAT number within a short period of time.

This means that your shipments to Poland will become taxable (see above) – even if you seem to have done everything right.

What do traders have to document for the tax office in the case of intra-Community shipments?

Unfortunately, the construct of tax-free intra-Community delivery is very often used for a fraud model—the so-called carousel transactions or missing traders. This conceals professional criminal structures that evade annual turnover taxes in the tens of billions of dollars.

For this reason, such deliveries are subject to high documentation and proof obligations towards the tax authorities.

Whenever you make a VAT-exempt delivery, the tax office will take a close look and check whether you were actually allowed to make use of the tax exemption in accordance with the Value Added Tax Act (UStG). In this respect, you must document and prove your tax-exempt intra-Community shipments properly.

If your tax-exempt intra-Community supplies/transfers exceed certain thresholds, the person in charge at the tax office will receive an automatic check notice. Often he will then write to you or your tax advisor and ask you to provide evidence for the reported tax-free supplies.

German tax offices more frequently request proof from online retailers for shipments through fulfilment platforms such as Amazon

What do you need for the proof of tax-free intra-Community shipments?

Pro forma invoice as proof for each i.g. shipment

In the case of tax-exempt intra-Community transfers, a so-called pro forma invoice must be issued for each individual transfer transaction.

In the case of intra-Community shipments, the pro-forma invoice serves not only as book evidence, but also as documentary evidence, as there is no classic proof of arrival in the case of intra-Community shipments.

The pro forma invoice is an invoice with your German address and German Value Added Tax identification number as the sender.

At the same time, you are also the invoice recipient with the address of the warehouse in the receiving country (℅) (in the above example, the address of the Polish warehouse) and your foreign Value Added Tax identification number of the receiving country.

This pro forma invoice should contain the minimum information listed in § 17d paragraph 3 UStDV.

The net charge for this invoice is made up of your purchase prices or replacement costs.

Recapitulative statements are also obligatory for i.g. shipments

In order for intra-Community deliveries and transfers to be exempt from Value Added Tax , you must also have reported them in your recapitulative statement (ZM) (according to § 4 No. 1 lit. b UStG). In it, you declare the following information:

- the VAT ID in the receiving country

- the assessment basis

- and the type of turnover

The reason for this is that the data from the ZM is exchanged throughout the EU. In our example, this data is reported to the Polish tax authorities so that the tax office in Poland can then check whether Anton has reported the same amount as an intra-Community acquisition there.

This ensures that the tax authorities in the EU always have an overview of the whereabouts of your goods – right up to the taxable sale to the end consumer.

Attention: In some countries there are also recapitulative statements in which you must also declare your intra-Community acquisitions. These are the so-called EC Purchase Lists.

Intrastat declarations

If your intra-Community shipments or intra-Community acquisitions exceed certain threshold values, you have to submit further reports to the respective statistical offices in the form of the so-called intra-trade statistics (Intrastat). In Germany, the Federal Statistical Office is responsible for this.

An overview/guide to the Intrastat procedure including references to current threshold values in the EU states can be found here.

Record and verify I.g. shipments conveniently and automatically – with Taxdoo

Cross-border storage and transfers in foreign EU warehouses therefore lead to a large number of tax-relevant transactions (transfers). You must record these individually for accounting purposes and declare them for tax purposes, both at home and abroad.

You can do this completely and reliably online with the Value Added Tax platform from Taxdoo.

Taxdoo can automatically read out all relevant raw data from marketplaces (Amazon, ebay, …) and ERP systems (e.g. JTL and Plentymarkets) and

- provide accurately processed data on all shipments ,

- Document shipments (pro forma invoices),

- Provide data for recapitulative statements and Intrastat,

- Createaccounting exports (DATEV format),

- Aggregate and export all data for OSS messages

- Submit tax returns abroad,

- and much more.

For each product and each EU state, Taxdoo can also automatically determine the correct tax rate.

Simply click here and arrange your free initial consultation, in which we will personally answer your questions and present the concrete benefits of our automated Value Added Tax solutions to you and/or your tax advisor.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

One-Stop-Shop (OSS) EU VAT for E-Commerce