Types of transactions for Intrastat declarations from 2022: A New List

The Intrastat reporting system will be modernised as of 2022. We have already given you an overview of the relevant changes in our blog post ‘Intrastat – Changes from 2022’ on the amendments made to Intrastat reporting as of January 2022.

In this article, we would like to present one of the upcoming changes in more detail as it will require action, especially for online merchants. This concerns the type of transaction. If you already submit Intrastat declarations or are expecting a reporting obligation in the near future, you should definitely be aware of this issue.

To recap: What changes need to be considered for Intrastat declarations from 2022?

In total, you can expect three relevant changes starting in 2022:

- You must indicate the country of origin of goods

- The VAT ID, or a substitute number must be provided

- Types of transactions are now determined by new criteria

We have already written about the first two changes in our prior blog post. The provision of these two pieces of information (country of origin and VAT ID) was previously possible on a voluntary basis, whilst in some countries it was even mandatory. These changes only affect the dispatch report.

The changes made to Intrastat regarding the type of transaction, on the other hand, must be addressed in both the arrival and dispatch reports. Information on the underlying transaction is transmitted in the Intrastact declaration by identifying the type of transaction.

Therefore, it is a question of the reason behind the cross-border of movement of goods (e.g., a purchase transaction, a contract processing transaction, or commission transactions).

Below, we clarify the exact changes to the types of transactions.

From January 2022: New Intrastat list for types of transactions – also for online trade

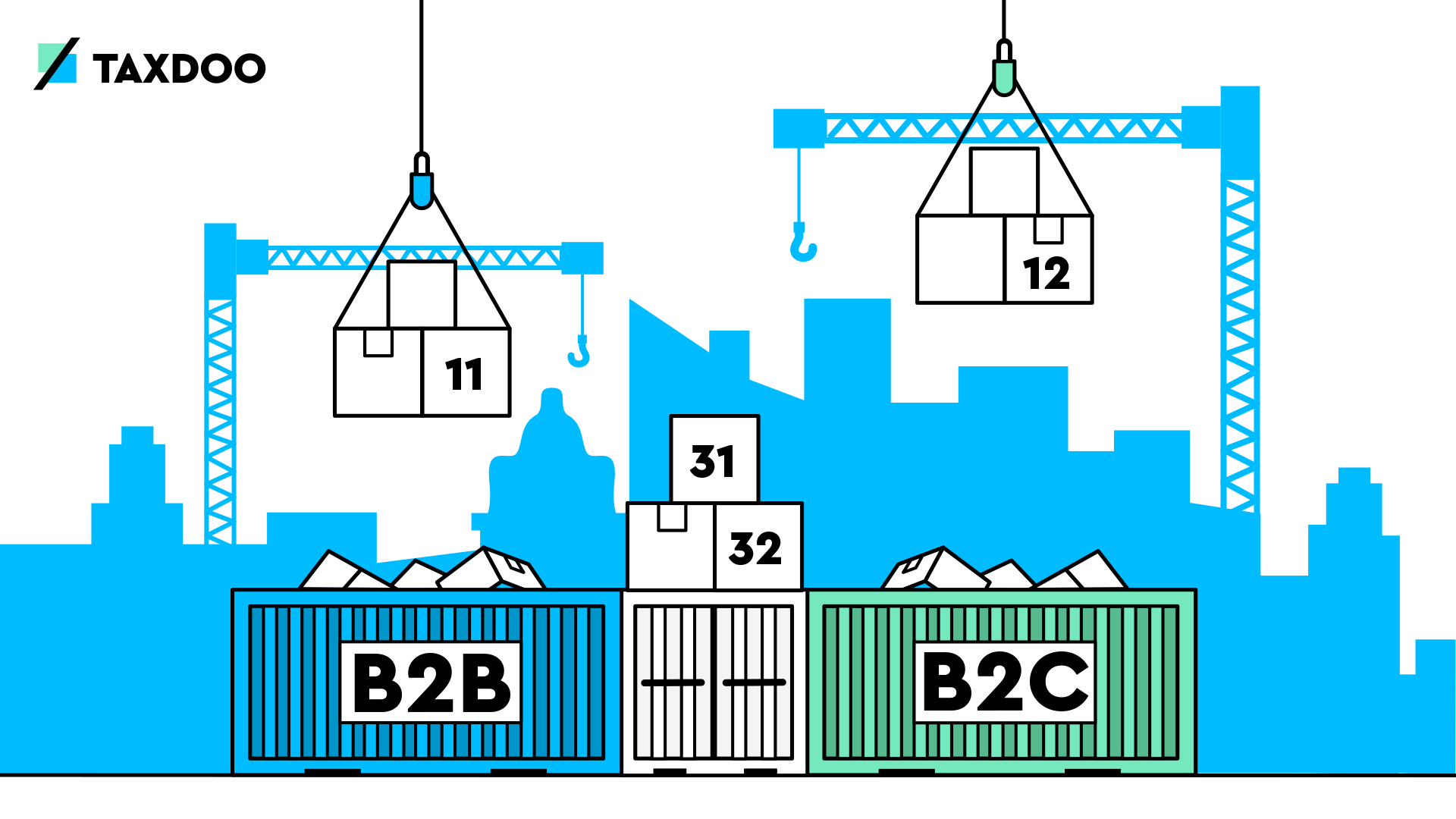

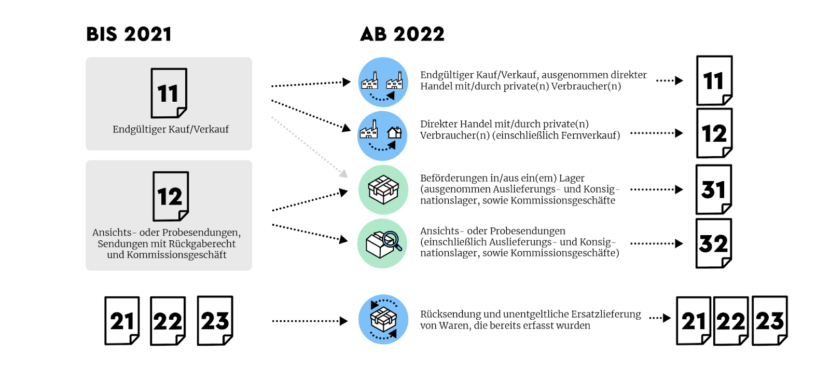

As of January 2022, movements of goods are to be declared according to a new list for the types of transactions. Some of the previously existing types of transactions will be further subdivided in future, whilst others will be increasingly grouped together.

There will be additional distinctions for online merchants moving forward. This is because the new list requires a distinction between B2B and B2C sales. In addition, movements of goods in stock must be declared separately.

Sounds confusing? It is! Take a quick look at the following illustration:

Not to worry, Taxdoo can adapt and take care of all of this for you automatically. If you would like more information on this topic, please read the following. Here, we clarify all the new changes individually and let you know what you need to bear in mind in each case.

In the following, we will explain what you need to keep in mind.

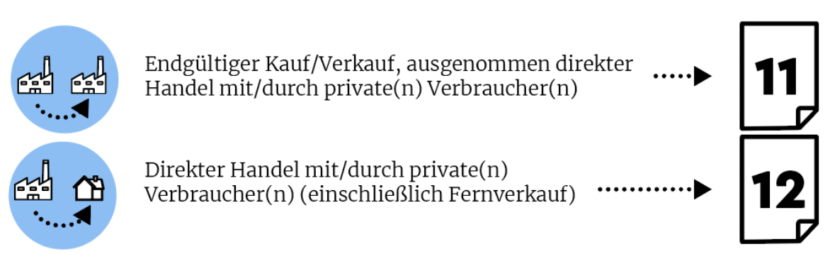

Distinction between B2B and B2C sales – types of transactions 11 and 12 according to Intrastat

Moving forward, you are required to distinguish between sales to companies (B2B) and sales to private individuals (B2C).

If you sell goods to private individuals, you will need to enter these transactions into your Intrastat declaration with the new key number 12. This is a great advantage because until now, online merchants with B2C sales could have experienced enquiries from the Federal Statistical Office when validating data.

Please note that the Federal Statistical Office and the tax authorities exchange information on the data reported in the Intrastat declaration and the advance VAT return.

Normally, for example, intra-community supplies that are included in the advance VAT return are to be declared in the same amount as dispatches in the Intrastat delcaration. In this way, a comparison of the data for plausibility can be carried out.

New transaction types in the Intrastat declaration enable the reconciliation of reported eCommerce data between the authorities

So far, B2B and B2C sales have been declared to Intrastat collectively under key number 11. This is done regardless of whether taxation takes place in Germany or elsewhere in the EU. The only decisive factor is that the movement of goods begins in Germany and ends in another EU member state.

However, sales to private individuals are not taxable in Germany once the distance selling threshold of EUR 10,000 has been exceeded. At this point, sales no longer need to be recorded as domestic turnover in the German VAT return. These sales usually flow into the item (in Germany) non-taxable sales, but since this is a collective item, no conclusion can be drawn about B2C sales.

As a result, a reconciliation between the Intrastat declaration and the advance VAT return has, until now, not been possible.

By subdividing the key numbers 11 and 12 according to the category of recipients, it is now possible to distinguish between sales to private individuals and companies – in Intrastat at least.

In addition, a comparison with the data reported via the OSS scheme should also be possible going forward. Distance sales to other EU member states can thus be identified.

In the cases where online merchants have registered for the One-Stop-Shop, the declarations should therefore be reconcilable and enquiries made by the Federal Statistical Office can be avoided.

Movements of goods in the type of transaction 31 according to Intrastat

As previously mentioned, from 2022 onwards, movements of goods in stock must also be declared separately to Intrastat. All transactions for which a transfer of ownership is only planned and for which the recipient has not yet been determined now fall under the new key number 31.

If goods are sent to a distribution warehouse in the EU (i.e., an intra-community supply/purchase), this movement of goods is declared to Intrastat under the key number 31.

If you now take the new regulation of the type of transaction into account, you will come across the following phrasing for key number 31:

Transport to/from a warehouse (excluding distribution and consignment warehouses, as well as commission business)

We have already explained the case of a movement of stock to a warehouse, but what happens in the case of a movement from a warehouse?

There are two possible cases: the goods are either moved to another distribution warehouse, or sold.

Variant 1, i.e., a movement of goods to another distribution warehouse, is also a sale to a warehouse. Therefore, key number 31 must be used in this circumstance.

Variant 2, i.e., the sale of goods – this leads to a question, and not only because it is a movement from a warehouse (31?) and at the same time a sale (11 or 12?) – but because, Germany has devised a unique regulation that does not exist in other countries.

Sale from a warehouse – does this fall under key number 11, 12 or 31 in the Intrastat declaration?

The guidelines of the Federal Statistical Office state the following for sales from a warehouse: One must pay close attention to the residency of the merchant.

Example: You are a German online merchant (i.e., you have your registered office in Germany) and transport goods from a warehouse in the Netherlands to Germany for temporary storage. This operation is a movement of goods to a warehouse and is reported under the key number 31.

You then sell these goods to a private individual located in Poland. These sales are to be reported under the key number 12 as of January 2022.

For our next example, we’re only going to change one aspect of the aforementioned case: You are not registered in Germany, but in Austria. You simply use a warehouse in Germany and are VAT registered there.

Variation example: In this case, you also report the movement of goods to your warehouse in Germany under the key number 31.

With regard to the sale made to the private individual in Poland, however, you must ensure that you do not declare this sale under key number 12, but rather number 31.

Sounds confusing? That’s because it is! But, that’s simply the way the German regulation is.

Furthermore: The criterion of residency can only be found in the Federal Statistical Office’s notes if you look closely. Example 10 provides information on the solution for companies not resident in Germany. However, you can find the specific criteria in the decision tree found in the explanatory videos provided by the Federal Statistical Office.

Residency criterion for exports made from warehouses is now clearly regulated

With the publication of the Guide to Intra-Community Trade Statistics 2022, the criterion of residency and the use of key number 31 for the type of transaction in the case of a supply from a warehouse have now been clearly defined.

Despite being found in the small print under the list for the type of transaction, the guide clearly states:

If goods are sent abroad again from a warehouse in Germany (temporary storage in Germany) and the goods are owned by a person resident abroad, this must be declared with key number 31 as in the case of storage, even if the re-dispatch is, for example, based on a purchase transaction.

Despite an underlying purchase transaction (in our example above to the Polish private individual), the sale to a person resident abroad from a distribution warehouse is declared under the key number 31.

B2B, B2C, warehouse – 11, 12, 31? In which cases are which types of transactions to be used in the Intrastat declaration?

Since the new regulations can quickly lead to confusion, we would like to give you a brief overview of when you have to report what and how:

For merchants based in Germany (e.g., your company is based in Germany)

For merchants not resident in Germany (i.e., you do not have a registered office, management or a branch in Germany)

For merchants not resident in Germany, the nature of the transaction is quite clear according to the German regulations. It is nevertheless important to make a distinction as to which recipient is involved – this is because it depends on this information as to which VAT identification number is to be used.

In this case, the Federal Statistical Office has also developed a unique system for Germany. You can read more about this in our blog post on the new mandatory information required in the Intrastat declaration.

Commission business, consignment stock and call-off stock – Other types of business that fall under key number 32 according to Intrastat

In addition to the types of transactions already mentioned, key number 32 can regularly prove to be relevant to online merchants. As with key number 31 for warehouse transactions, these are also transactions where a transfer of ownership has not yet taken place, but is merely planned.

The difference to number 31 however, is that the potential recipients are a limited number of companies or private individuals to whom the ownership of the goods is to be transferred following the movement of said goods.

The key number 32 is thus intended for the following unique cases in Intrastat declarations:

- Commission business

- Consignment stock

- Call-off stocks (distribution warehouse)

If, however, the warehouse used is purely a distribution warehouse, such as in the case of the Amazon Pan-EU program, in which the potential buyer cannot yet be determined, these warehouse transactions fall under the key number 31.

Varied implementation of the Intrastat ‘Type of Transaction’ in the EU member states

Those of you who have already read our blog article on the new mandatory data in the Intrastat declaration may find themselves experiencing some déjà vu whilst reading the following information.

In order to make the determination of the type of transaction as complex as possible, the individual EU countries have structured their regulations differently.

While in Germany the place of residence is decisive for determining the type of transaction, such a distinction is not made in Poland. In the Czech Republic, on the other hand, it must be taken into account whether the merchant is registered for VAT in the country of destination.

Using these examples alone, we can see that three different countries have three different implementations of the new regulations. Online merchants are expected to adopt each new regulation as soon as they have a reporting obligation in the respective countries.

Customs declarations are also affected

As we have already explained in our article on the changes from 2022, the new list for the types of transactions also applies to customs declarations. Below, you will find what you need to keep in mind and why you need to make changes to your Intrastat declarations before they are submitted.

Our conclusion regarding the modernisation of Intrastat: It’s becoming more complicated!

Unfortunately, as is so often the case, our conclusion is that things are not getting any easier for online merchants. After the introduction of the One-Stop-Shop on July 1, 2021, the modernisation of the Intrastat system is now resulting in a similar situation.

In order to determine the types of transactions, online merchants will need to distinguish between the type of transaction and the category of recipients to whom the goods are sent. In the case of Germany, it will also be relevant where the merchant is resident. In all other countries, there is the possibility for a deviation in the regulations, which means that merchants need to look carefully!

However, we have saved the best news for last: We have adapted to the new changes and are happy to relieve you of this burden!

Your way out: Let Taxdoo create your Intrastat declarations

Are you already a Taxdoo customer? Then make sure that you have booked all the necessary add-ons for Intrastat reporting. We will take care of everything else!

As usual, you can use your customer dasboard to see in which countries you are required to register for Intrastat.

For everyone else: Arrange a free and non-binding live demo today and see for yourself the added value Taxdoo can offer.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022