Less effort. More mandates. The accounting and VAT software for e-commerce

- Sales, fees, payments – all in one software

- Secure, automated VAT assessment and EU-wide reporting

- GoBD-compliant exports for DATEV

- More efficiency through transparency

Why Taxdoo simplifies your tax office routine

Less manual effort

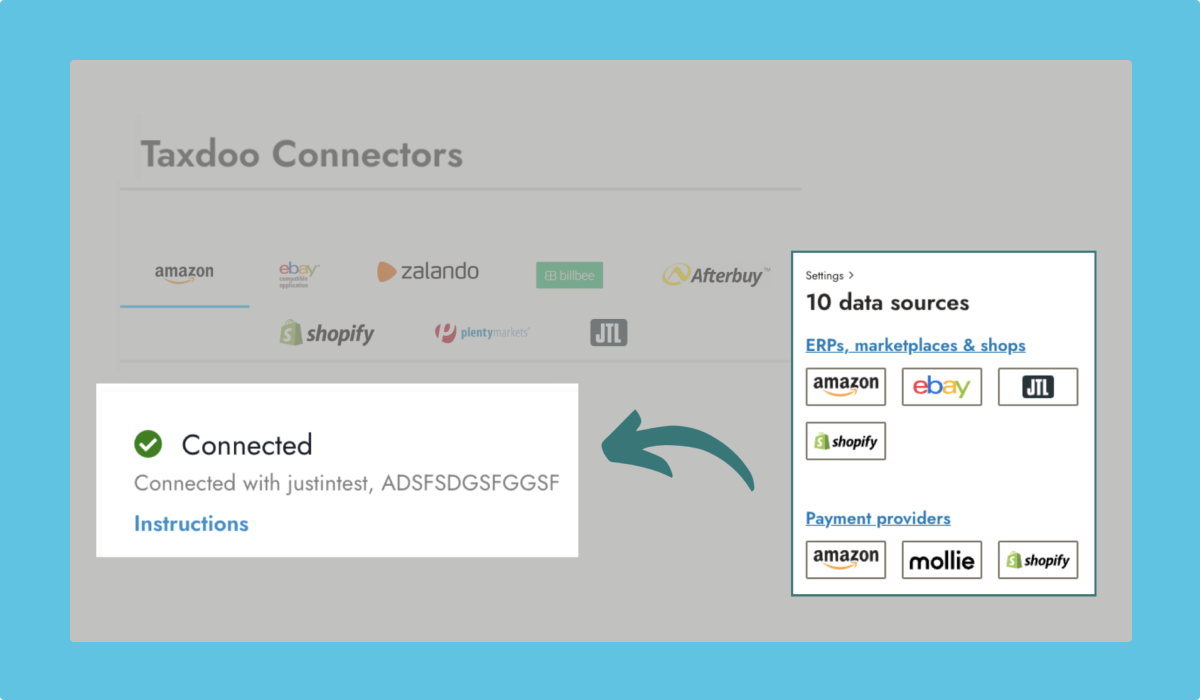

Thanks to the automatic import of data from all channels and the automated and standardized processing, Taxdoo increases efficiency in accounting.More security

By combining technology and tax expertise, every transaction is automatically assessed and booked for VAT purposes. These standards create security.More transparency

Each transaction on the sales and payment side is recorded individually and can be traced and verified from the data source to accounting and tax returns in accordance with the GoBD.Figures that speak for us:

Our Solution

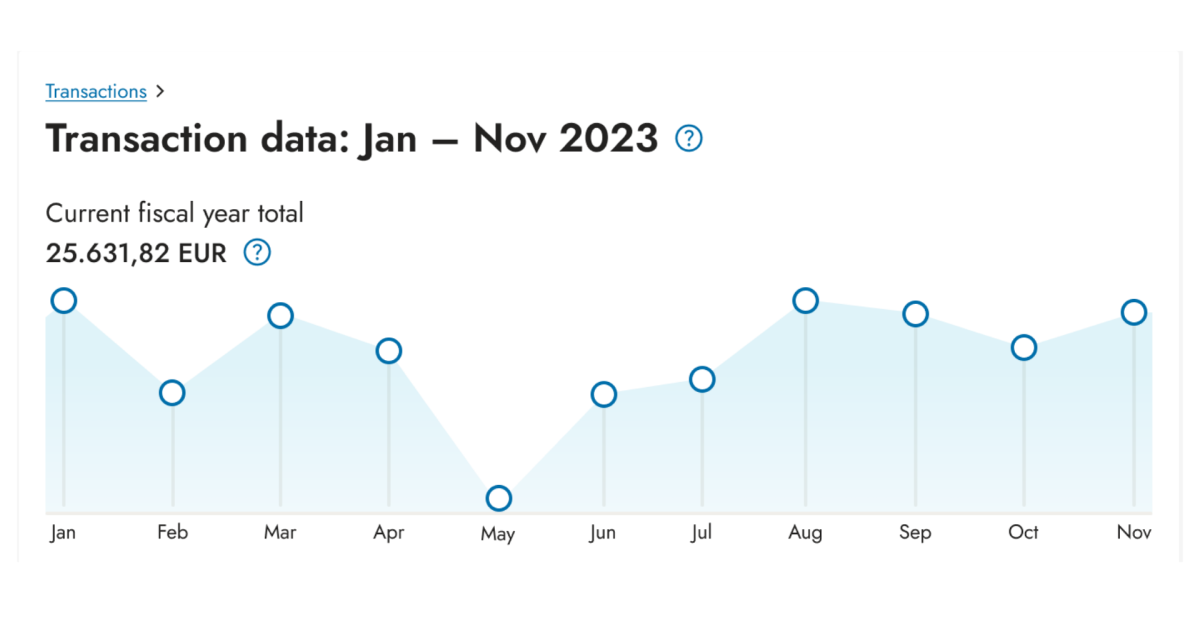

Make decisions based on transparent data

The booking of all revenues and payments from the 15 most important marketplaces and shop, payment and ERP systems is shown in your clients' dashboard. Fees are shown separately. You can find all of your clients' transaction data reliably and transparently in one place – this reduces errors and avoids penalties.

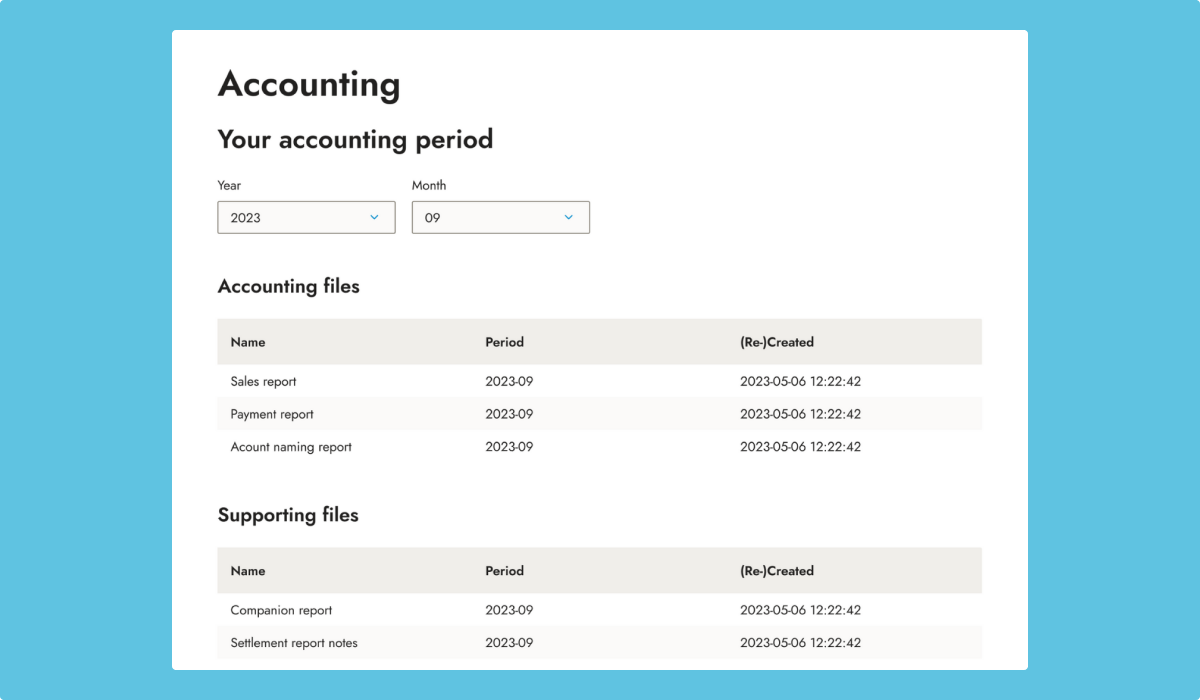

Save time and avoid errors with the DATEV function

With the DATEV add-on, you receive your clients' data in DATEV format. Thanks to our corresponding accounting logic, the add-on supports the DATEV OPOS and clearing functions. This avoids manual effort for the allocation of sales and payments and increases data accuracy and legal certainty.

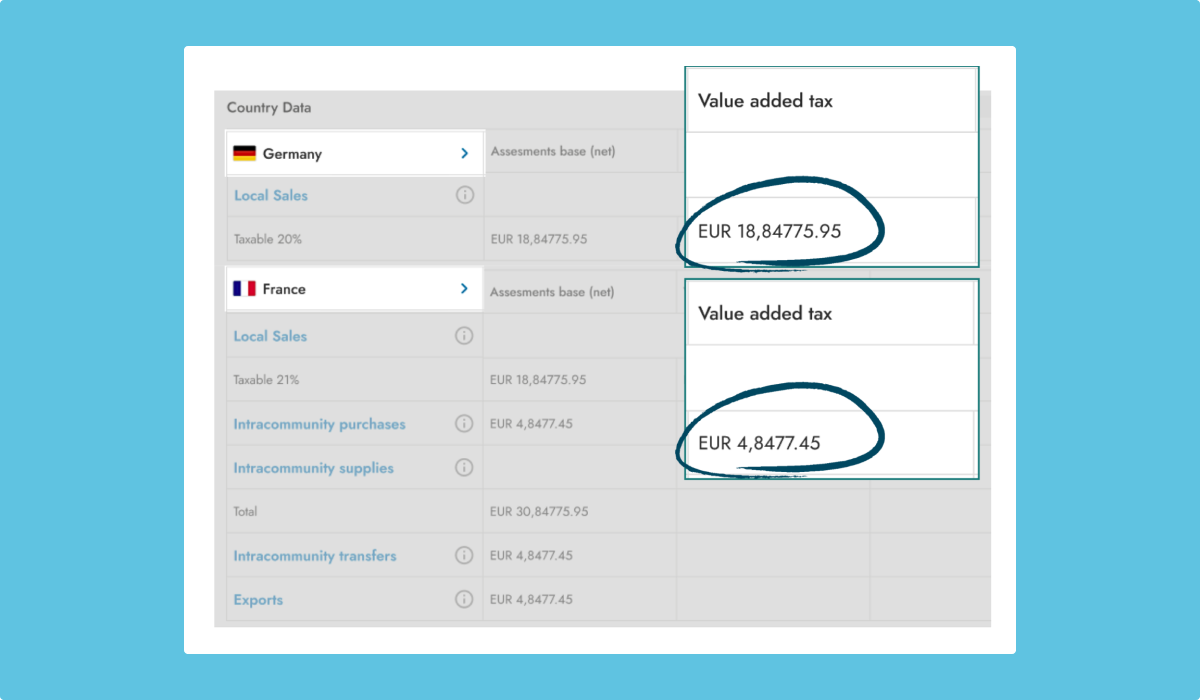

Receive compliant VAT evaluations

Our VAT logic was developed by tax and accounting experts and evaluates your clients' transaction data automatically and with audit-proof precision. Special cases and reduced tax rates are also taken into account. This offers you legal certainty and frees up time for other e-commerce mandates.

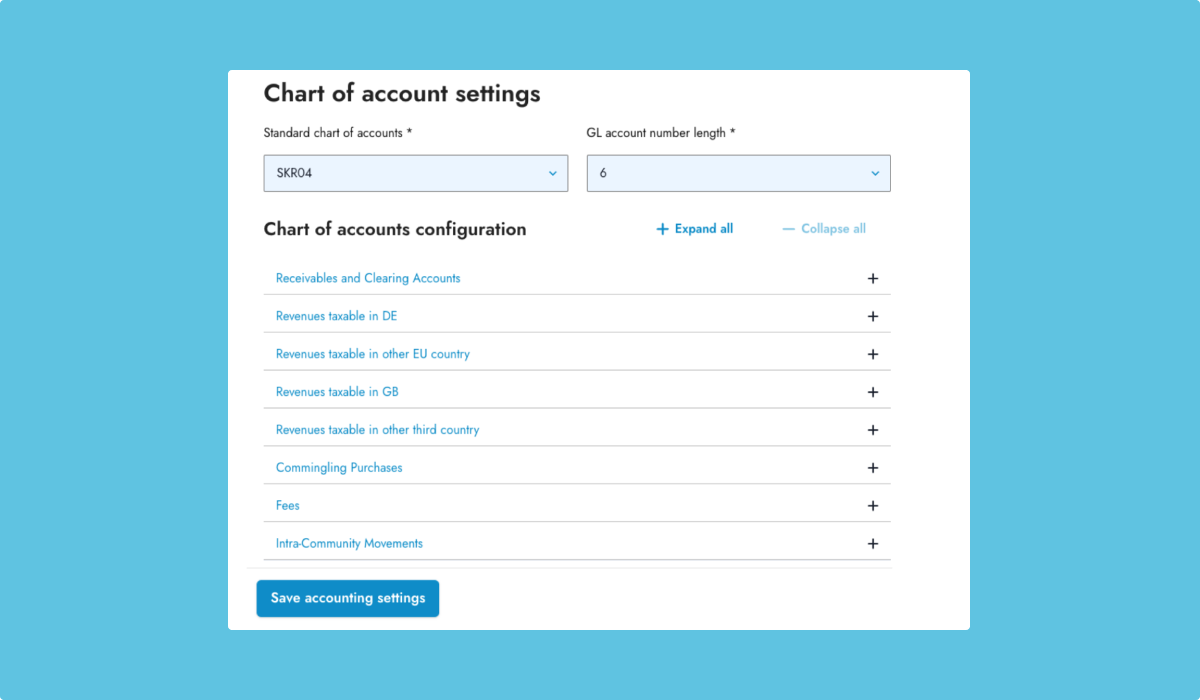

Find discrepancies quickly

The granular and customizable general ledger accounts for accounts receivable and clearing accounts, sorted by source, provide you an optimal overview and comparability of the data. Changes can also be easily tracked. This allows you to easily identify and efficiently process discrepancies and balances in your clients' accounting.

What other tax firms say

Find out how DHW Steuerberatung supports its clients completely digitally and, together with Taxdoo, ensures that the profession becomes more open to digital topics.

Christian Deák Managing Director • DHW Steuerberatung

In this success story, you can find out why Marcus Dein's digital tax firm no longer wants to do without Taxdoo's solution.

DEIN Digitaler Steuerberater Managing Director • DEIN Digitaler Steuerberater

Read how GTK Kröger focuses entirely on e-commerce in all its facets and why Taxdoo's automated solution is indispensable.

Tanja und Kai Kröger Partner • GTK Kröger Steuerberater

Read the success story to find out why Wendl & Köhler have been using Taxdoo's software solution for many years.

Dirk Wendl Managing Director • Wendl & Köhler

Our services for tax advisors in brief

Tax firms benefit from these Taxdoo services and more.

- Advice from qualified accounting specialists

- DATEV export

- Quality assurance by VAT experts

- VAT registrations and reports incl. OSS

- GoBD conformity and audit compliance

- Documentation of transfers

- Data preparation also for GE

- Digital and automated mandate processing

- Dashboard access for tax consultants

Events and training for tax advisors and tax firm employees

Let's get real – experience Taxdoo live (and in color)

Find out where you can meet Taxdoo's FinTech experts. We regularly organize webinars and participate in e-commerce and tax trade fairs and look forward to meeting you in person!