Interface: Zalando

Scale your business now without worrying about the VAT and financial accounting – thanks to the strong partnership between Zalando and Taxdoo.

Manage taxes and accounting in just four steps

Covering everything from the evaluation of your sales to the filing of tax returns in other EU countries and financial accounting: With Taxdoo you can master your tax challenges of e-commerce.

-

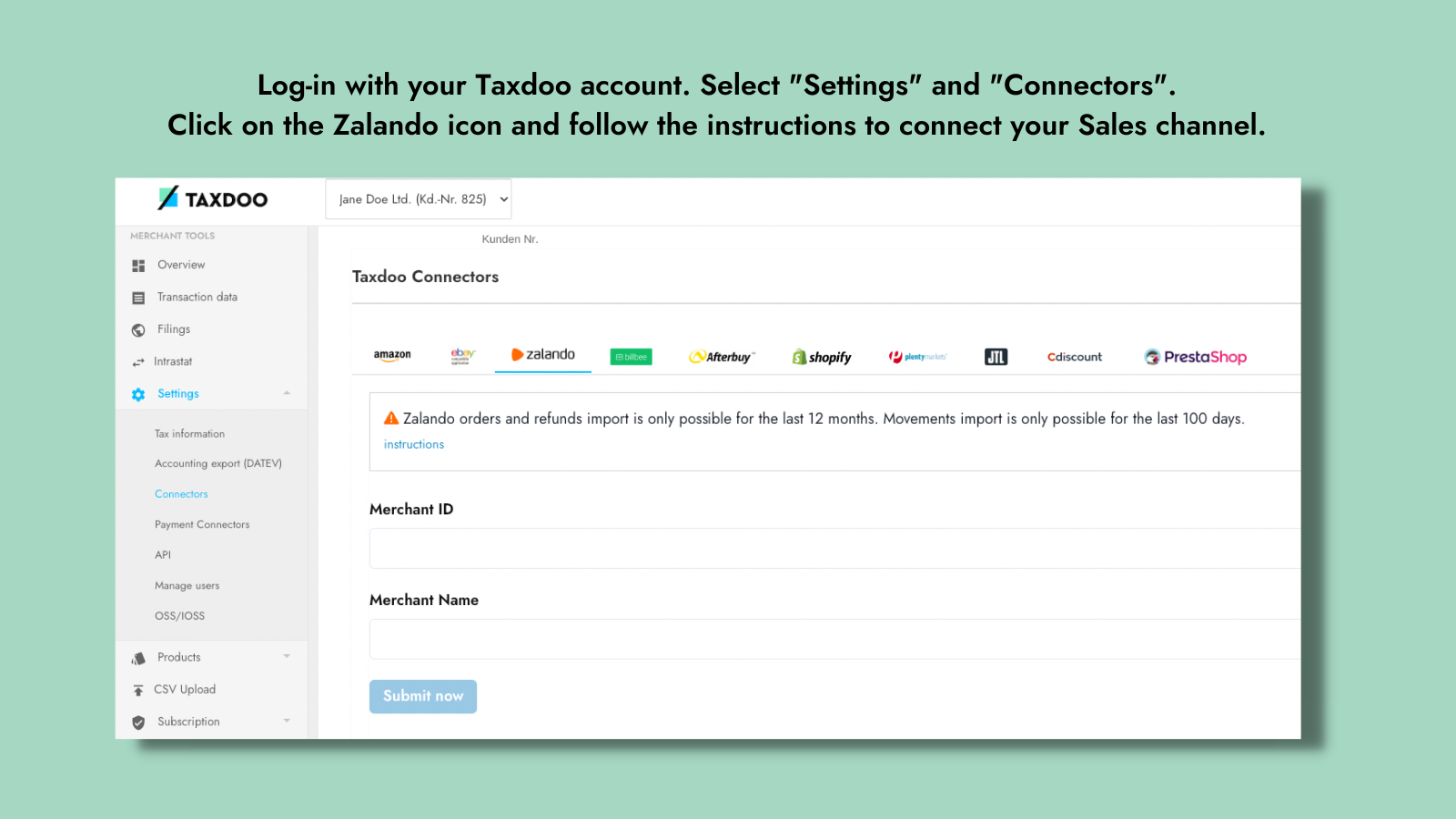

01Data collection

Via interfaces with the most popular marketplaces, shop and ERP systems, Taxdoo collects all transaction data automatically – without any manual effort.

-

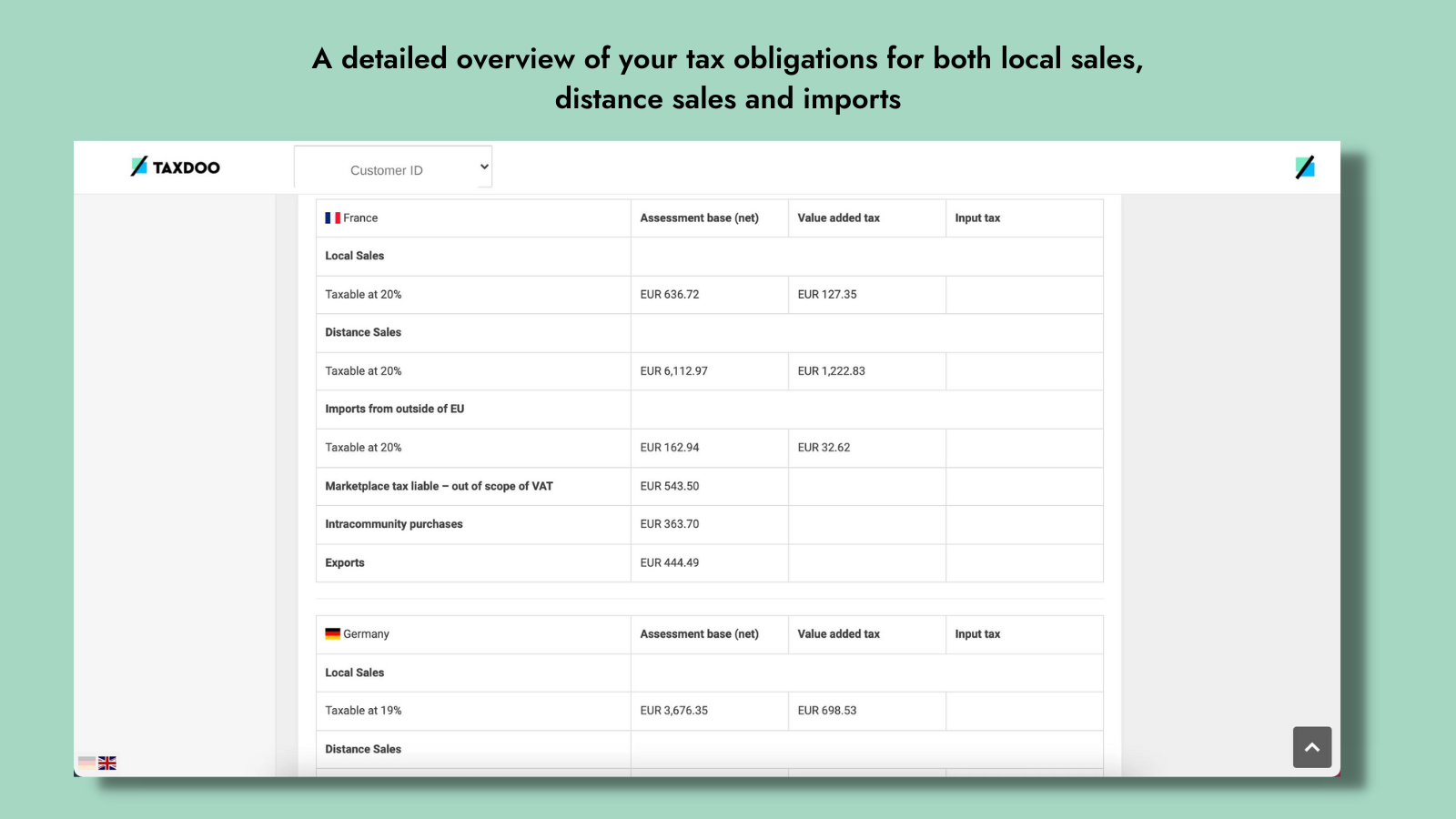

02Evaluation and monitoring

The data is evaluated for the purposes of the VAT in an automated process – e.g. as regards the EU-wide sales threshold or the use of warehouses in other EU countries. We furthermore help you determine the country-specific tax rate.

-

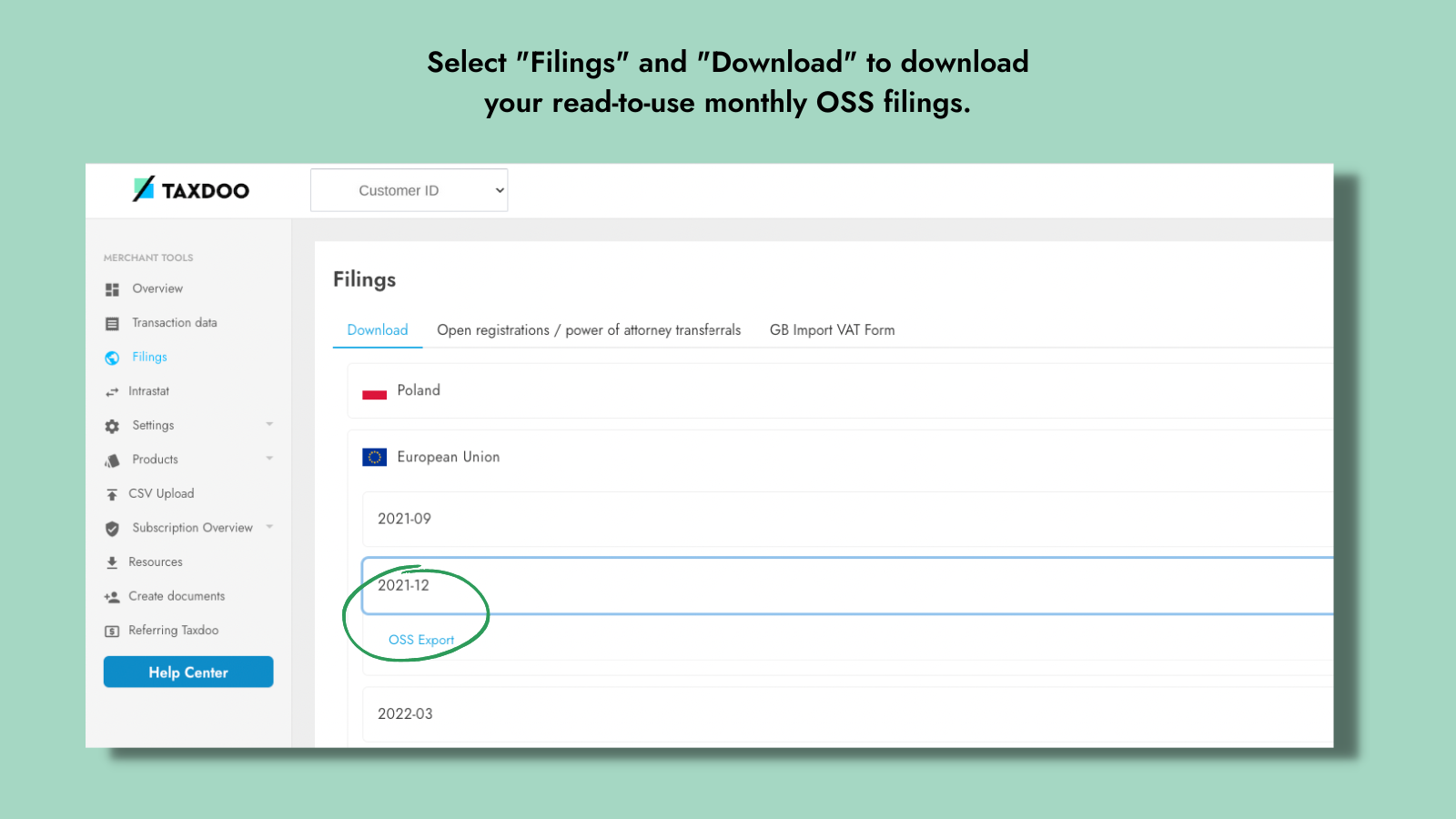

03OSS export and local reports

On request, the transaction data for the One-Stop-Shop will be exported. In addition, we can fulfil local VAT reporting obligations in the EU through our network of foreign tax consultants.

-

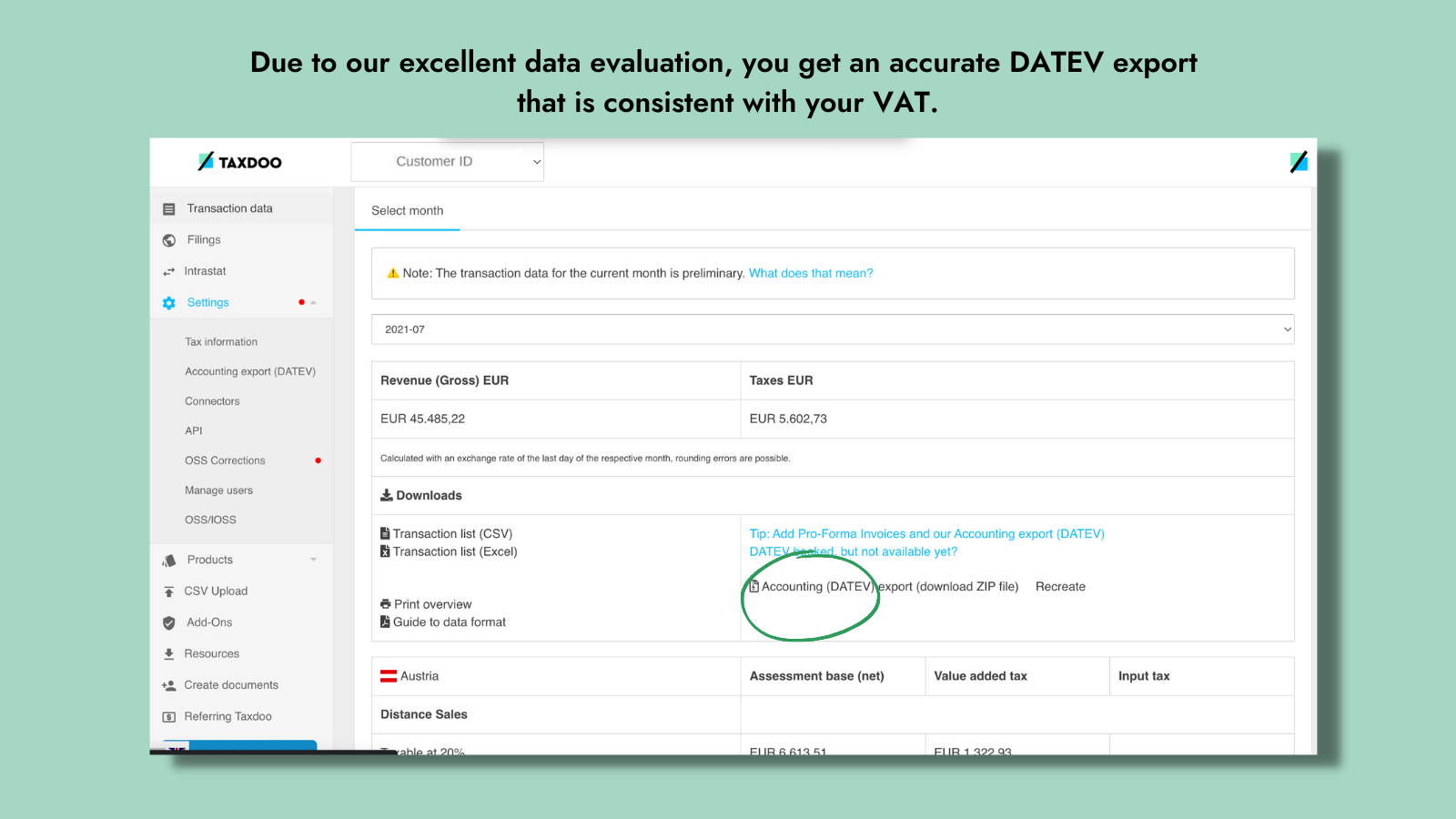

04Financial accounting

All transactions are evaluated in terms of the VAT and processed separately for each country. You can view the data on the customer dashboard and using our DATEV export, you can easily transfer it into your financial accounting – complete with sales, returns and shipments, and money transfers.

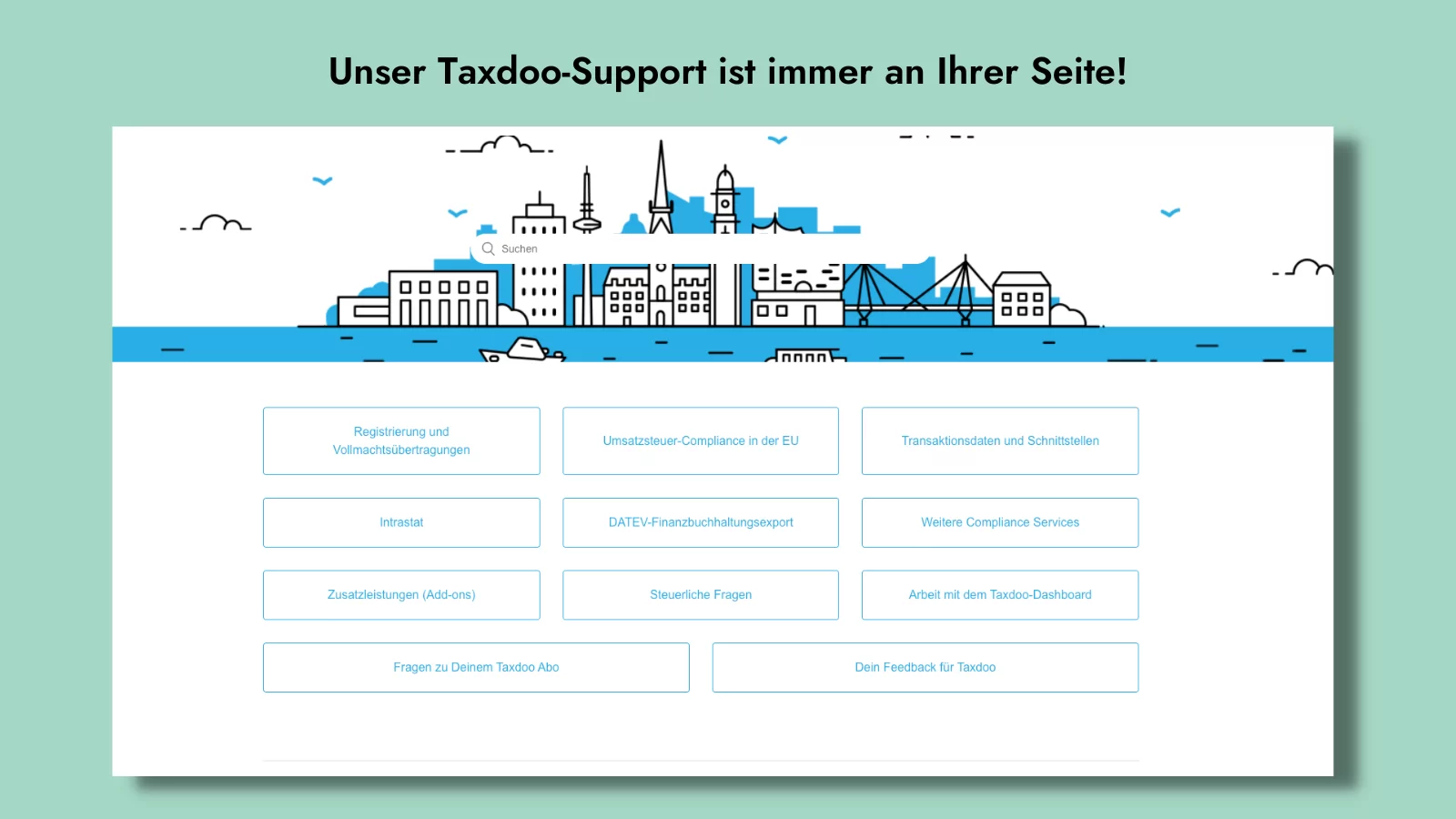

A first look at your Taxdoo dashboard

Transparency is key to us. You can view and download all filed documents at any time and check the current status of your VAT ID registration. This way, you always know what we are doing for you and which figures we report at what time, where and how.

A first look at your Taxdoo dashboard

Transparency is key to us. You can view and download all filed documents at any time and check the current status of your VAT ID registration. This way, you always know what we are doing for you and which figures we report at what time, where and how.

A first look at your Taxdoo dashboard

Transparency is key to us. You can view and download all filed documents at any time and check the current status of your VAT ID registration. This way, you always know what we are doing for you and which figures we report at what time, where and how.

A first look at your Taxdoo dashboard

Transparency is key to us. You can view and download all filed documents at any time and check the current status of your VAT ID registration. This way, you always know what we are doing for you and which figures we report at what time, where and how.

A first look at your Taxdoo dashboard

Transparency is key to us. You can view and download all filed documents at any time and check the current status of your VAT ID registration. This way, you always know what we are doing for you and which figures we report at what time, where and how.

Growing internationally with Zalando's ZIO programme – What do you need to know?

Thanks to Zalando's ZIO programme (Zalando International Outbound), you can store your goods EU-wide in the Zalando Fulfilment Centres. When a warehouse is used, a few VAT obligations should be considered in order to avoid any financial risks.

Therefore, the following is important:

- The warehousing of goods in a different EU country requires a local VAT registration and the filing of local VAT returns.

- If you should sell across borders to B2B customers, besides using the warehouse, be sure to separate the transaction data clearly for its correct reporting via the OSS.

With Taxdoo at your side, you no longer need to worry about these challenges!