Amazon-EN

6. September 2021

Amazon’s Value Added Tax calculation service (VCS) and OSS

26. August 2021

Amazon in Sweden, storage, shipping: VAT liability for FBA traders?

In 2020, Amazon added Sweden as a new European marketplace. Since August 2021, local storage in Sweden is also possible. In this...

24. August 2021

Marketplace liability and Amazon: check the VAT.-IDs of all Amazon sellers

The tightening of VAT obligations for marketplaces as of 01.07.2021 is intended to ensure that VAT revenue for sales on online platforms...

12. August 2021

Direct DATEV Amazon interface: What can it do, what not?

The direct DATEV Amazon interface: long requested, now available. The automatic collection of Amazon payment data offered by DATEV supports financial accounting...

16. June 2021

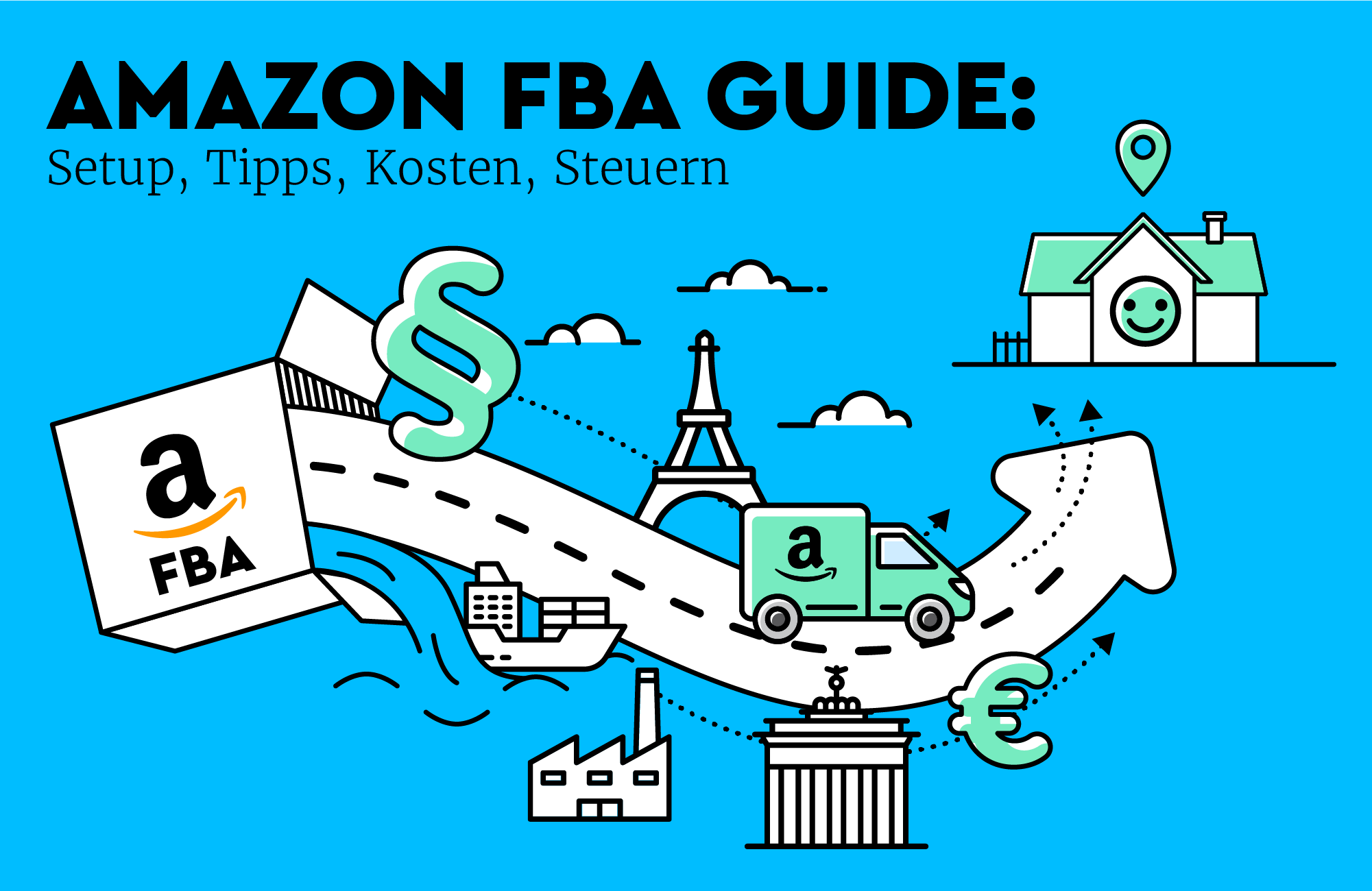

Amazon FBA Guide: Setup, Tips, Costs, Taxes

Are you planning to launch your own Amazon FBA shop? Or do you want to expand your existing FBA business, e.g. with...

15. June 2021

Amazon FBA and Value Added Tax

Fulfillment by Amazon (FBA) is a service that many retailers on Amazon Marketplace can no longer do without. FBA means that Amazon...

3. April 2021

Use Amazons Value Added Tax-Calculation Service (VCS) despite weaknesses?

At the Value Added Tax- calculation service of Amazon one hardly comes past. Therefore one should be aware of the weaknesses and...

24. September 2020

Revival of Amazon FBA to Switzerland

In this article, you will find out what needs to be taken into account when reviving Amazon FBA to Switzerland and how...

28. August 2020

Amazon USA: Recording sales correctly, and frequent errors

Sales via amazon.com are increasing among German retailers. We explain common mistakes and announce that Amainvoice will soon be able to display...