Amazon in Sweden, storage, shipping: VAT liability for FBA traders?

The chapter Amazon Sweden already began in autumn 2020, when shipping to Sweden was made available for international sellers. At that time, this was still limited to deliveries from other warehouses in the EU, without on-site storage in Sweden itself.

As is well known, the launch of Amazon Sweden was somewhat bumpy in several respects. For example, many product texts were translated sub-optimally into Swedish, and for some sellers, shipping to Sweden was automatically activated without prior notification from Amazon . The latter also had VAT consequences. The latter also had VAT consequences.

It is therefore all the more important that you, as an (FBA) seller, are able to include the VAT consequences in your planning in good time with the newly added storage in Sweden and shipping from Sweden.

Tax liability in Sweden for Amazon sellers?

As in the other EU countries, you as an online trader can become liable for VAT in Sweden for 2 reasons:

- Either your sales to private customers in other EU countries exceed the EU-wide threshold of EUR 10,000 per year, which has been in force since 01.07.2021, and you will then have to pay tax on your sales to Swedish private individuals in Sweden at the VAT rates applicable there

and/or - You store your goods in a Swedish warehouse.

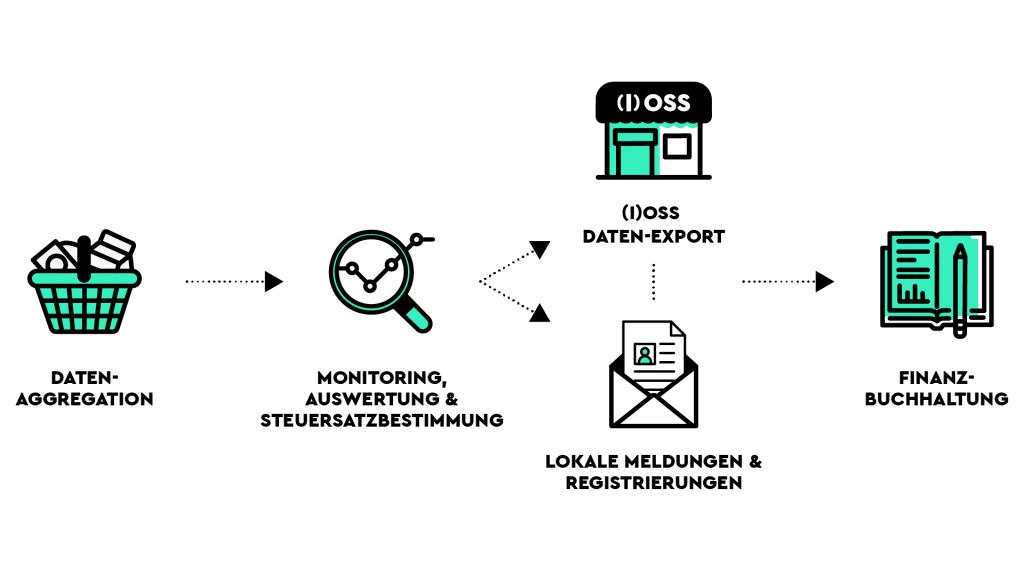

Reason 1: If you have exceeded the EU-wide threshold of EUR 10,000 and sell to Swedish private customers, you can process the VAT returns for this via the “One-Stop-Shop” (OSS) in your country of domicile as of 1 July 2021.

If you have your registered office in Germany, you can file the returns for Sweden as part of the quarterly OSS return to the Federal Central Tax Office. You do not need to register for VAT in Sweden for this.

For clarification: You have already exceeded the threshold if you make net sales of EUR 10,000 per calendar year to private customers in EU countries other than Sweden. Since 1 July 2021, the country-specific supply thresholds no longer exist and the new EU-wide threshold applies in total (!) across all EU countries.

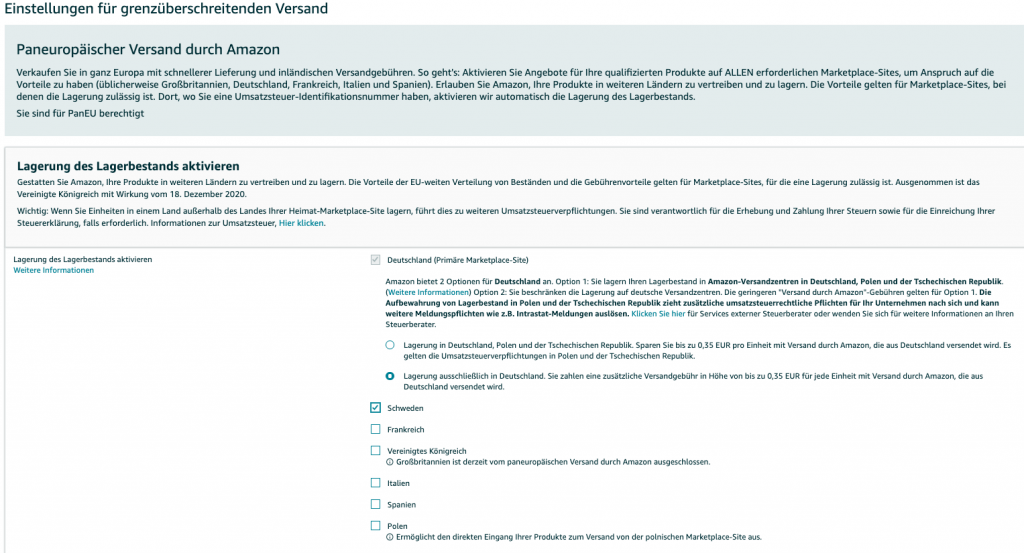

Re reason 2: In the meantime, the use of a Swedish FBA warehouse can be activated in the Amazon Seller Central Dashboard, under Settings for cross-border shipping:

As with all (FBA) warehouses in other EU countries, the same applies in the case of Sweden:

If you use such a warehouse in an EU country, you must register for VAT in that country – before you start storage.

This is because the storage immediately creates a tax liability in the country of storage.

Several transaction types related to storage in Sweden cannot (!) be processed via the OSS in your country of residence, but must be processed via a Value Added Tax identification number in the country of storage according to the reporting requirements applicable there.

These are in particular the following transactions:

- Local sales in Sweden – i.e. sales from the Swedish FBA warehouse to Swedish end consumers or businesses.

- The transfer of goods to Sweden – this process always involves so-called intra-Community transfers in the country of origin and intra-Community acquisitions in the country of destination. You can find more information on this in our guideon shipments.

Use Swedish VAT rates

Important: Both local sales in Sweden and cross-border sales from other EU countries (after exceeding the EU threshold of 10,000 euros or if you waive it) must be taxed at the Swedish tax rates.

The amount of Value Added Tax in Sweden is:

- Standard tax rate Sweden: 25%

- Reduced rates Sweden: 6% and 12%

When do you need a Swedish Value Added Tax registration (VAT ID)?

In summary: If you sell to Swedish private customers and do not store in Sweden, you can comfortably handle all VAT returns for Sweden via the OSS of your country of residence and do not have to be registered for VAT in Sweden.

However, as soon as you store goods in Sweden – for example via the FBA warehouse there – you need to register for VAT in Sweden.

Only two steps to the Swedish VAT-ID

With Taxdoo you can apply for a Swedish VAT-ID in 2 easy steps:

Step 1

You can apply for a Swedish VAT ID in less than 5 minutes via the Taxdoo website.

Step 2

We will then ask you for the information required for VAT registration in Sweden and continue the process with this information.

The VAT registration process in Sweden usually takes several weeks. Once the registration process is initiated, we will issue you with a certificate of the start of the VAT registration process, if required, which can be submitted to the respective marketplace on a provisional basis; this confirms that you are currently applying for a VAT ID in Sweden.

If you want to know more about this topic,

… then use this link to arrange your individual and free initial consultation with the Value Added Tax- and e-commerce experts from Taxdoo!

Taxdoo automatically takes care of the VAT obligations in Sweden for you – both the report to the OSS in Germany and the VAT reports required in Sweden in the case of FBA storage in Sweden and/or local sales. Of course with the correct Swedish tax rates.

You will receive all submitted declarations in our intuitive dashboard as well as a monthly payment request to settle the VAT debt in Sweden.

You no longer have to monitor any deadlines yourself, can rely on correct tax data being submitted to the right offices and, with Taxdoo, have a central point of contact for questions.

You need pro-forma invoices to document your shipments to the warehouse in Sweden for the tax authorities? No problem: Taxdoo also generates pro forma invoices automatically!

If required, we also offer our services for other EU countries, e.g. within the framework of the Amazon Pan EU programme.

Simply click here to arrange a no-obligation live demo, in which we will personally show you and/or your tax advisor the advantages of our automated Value Added Tax solution via screen transmission and answer your questions.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

One-Stop-Shop (OSS) EU VAT for E-Commerce