VAT-EN

Everything you need to know about sales tax or VAT, at home or abroad.

29. April 2022

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

What the EU has planned sounds very promising. VAT returns and paying VAT in EU countries could become simpler and more digitalised....

27. April 2022

One-Stop-Shop (OSS) EU VAT for E-Commerce

The One-Stop-Shop is part of a significant EU VAT reform for e-commerce. Find out everything you need to know about it here.

10. January 2022

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022

The Intrastat declaration is probably one of the least popular types of declaration that companies are required to submit for their cross-border...

14. December 2021

Reform of (reduced) VAT rates from 2025 – 12 percent on everything?

At the ECOFIN meeting on December 7, 2021, EU member states decided that EU countries will have more freedom to apply reduced...

30. September 2021

Amazon PAN EU: What should be considered at Value Added Tax?

With Amazon PAN-EU, traders of all sizes can open up a market of many hundreds of millions of inhabitants with shipping in...

17. September 2021

Intra-community movement: The Value Added Tax -Guide

In this blog post we explain why you, as an online trader with EU storage, should know what is behind "intra-Community transfers"...

6. September 2021

Amazon’s Value Added Tax calculation service (VCS) and OSS

1. September 2021

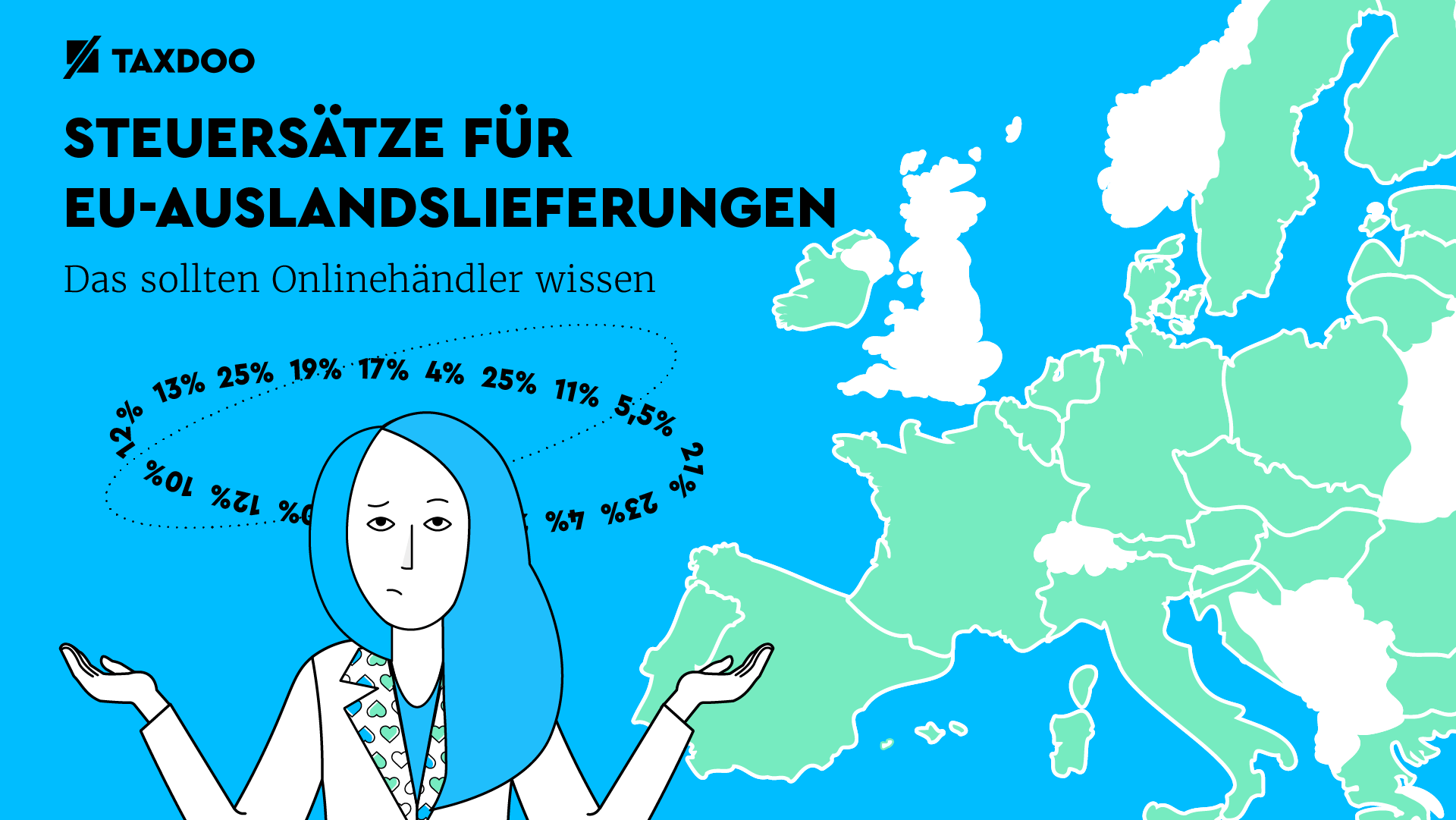

VAT rates in the EU for foreign deliveries

The EU VAT reform with the abolition of local delivery thresholds and the OSS have made it clear: determining tax rates in...

26. August 2021

Amazon in Sweden, storage, shipping: VAT liability for FBA traders?

In 2020, Amazon added Sweden as a new European marketplace. Since August 2021, local storage in Sweden is also possible. In this...