Carolin Schmidt

Carolin ist a Certified German Tax Advisor and Expert for VAT in an international context. Prior to working for Taxdoo in the field of VAT & E-Commerce she has been advising multinational companies on VAT.

29. April 2022

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

What the EU has planned sounds very promising. VAT returns and paying VAT in EU countries could become simpler and more digitalised....

11. January 2022

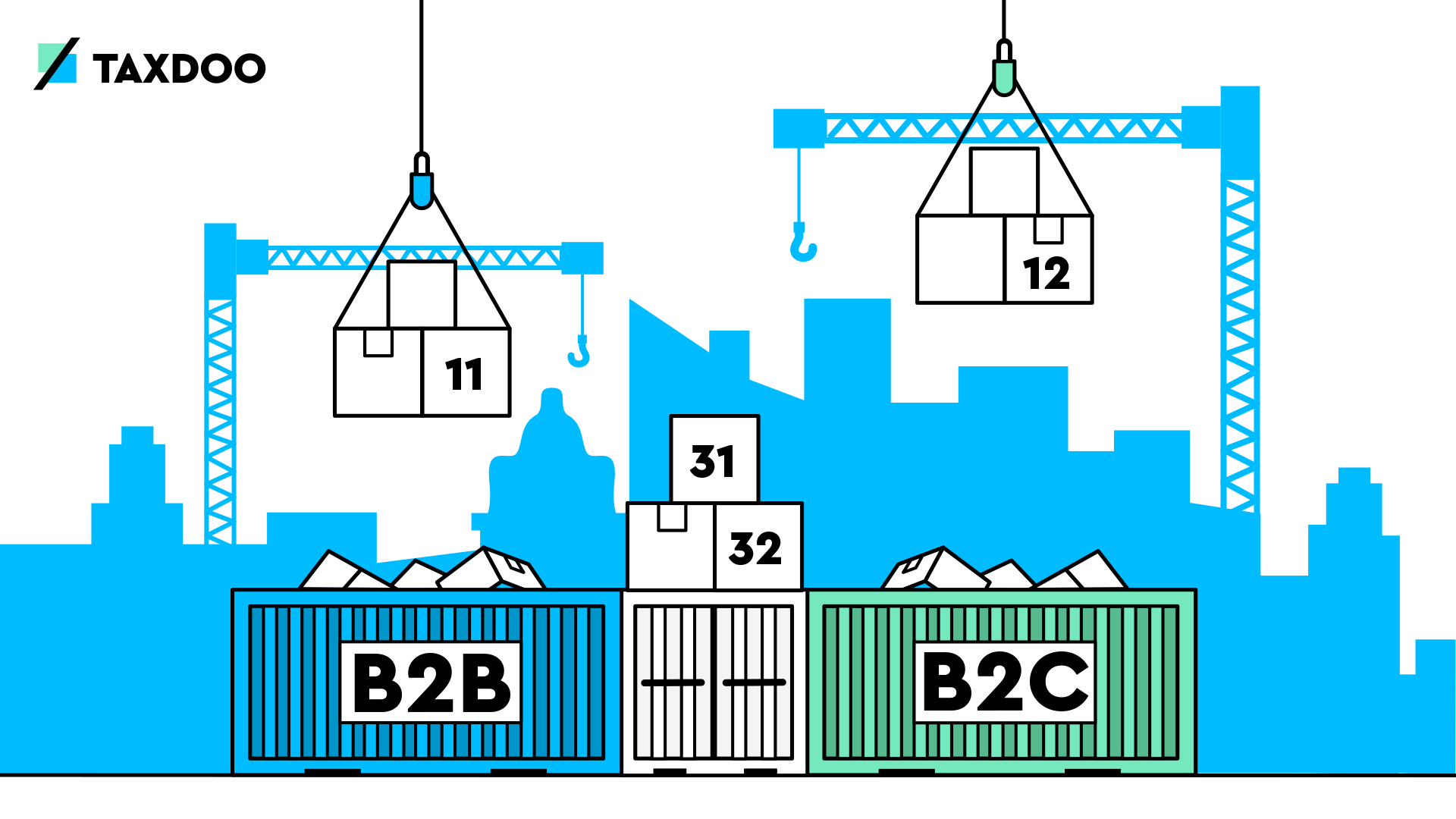

Types of transactions for Intrastat declarations from 2022: A New List

Intrastat declarations have remained mostly unaffected by previous tax reforms. From 2022, however, this will change: The list of the ‘Type of...

10. January 2022

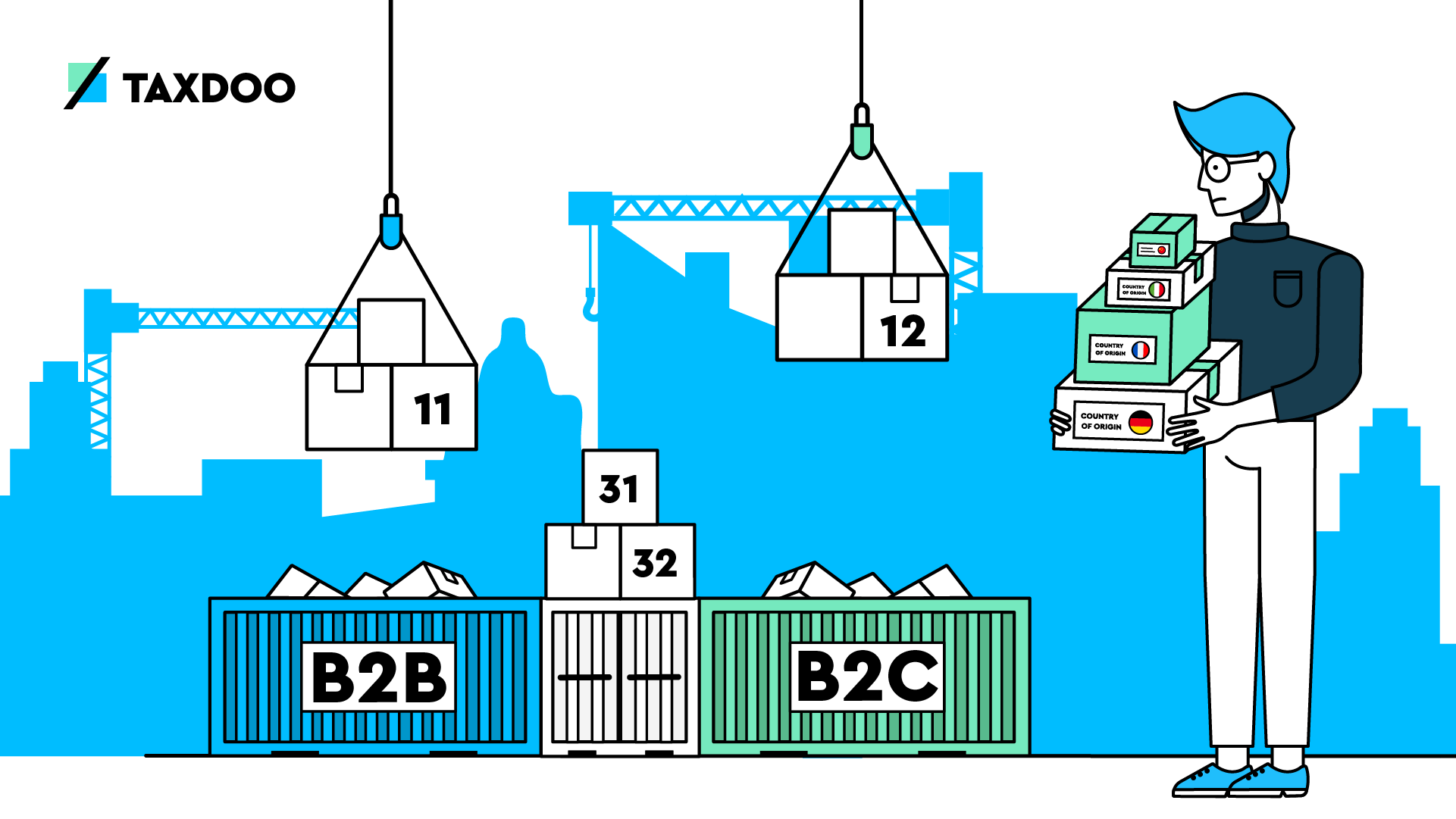

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022

The Intrastat declaration is probably one of the least popular types of declaration that companies are required to submit for their cross-border...

Intrastat and customs declarations – Changes as of 2022

Are you an online merchant and do you submit monthly Intrastat declarations? If yes, then you should not miss this news! As...