Intrastat and customs declarations – Changes as of 2022

For many years, there were no changes to the EU’s Intrastat system. In 2022, however, major adjustments were implemented that will have a significant impact on the obligations for Intrastat declaration, both at home and abroad for many online merchants.

Anyone who sells goods internationally will come across the term Intrastat sooner or later. The declaration for intra-trade statistics records cross-border movements of goods within the European Union and, as suggested by the name, is intended to serve statistical purposes.

Have you heard of Intrastat, but are unsure about the specific details? You will find comprehensive information surrounding Intrasat under ‘topics’ on our website.

For those of you who are already familiar with the Intrasat declaration, things are about to get interesting. As of January 2022, amendments have been made to reporting obligations.

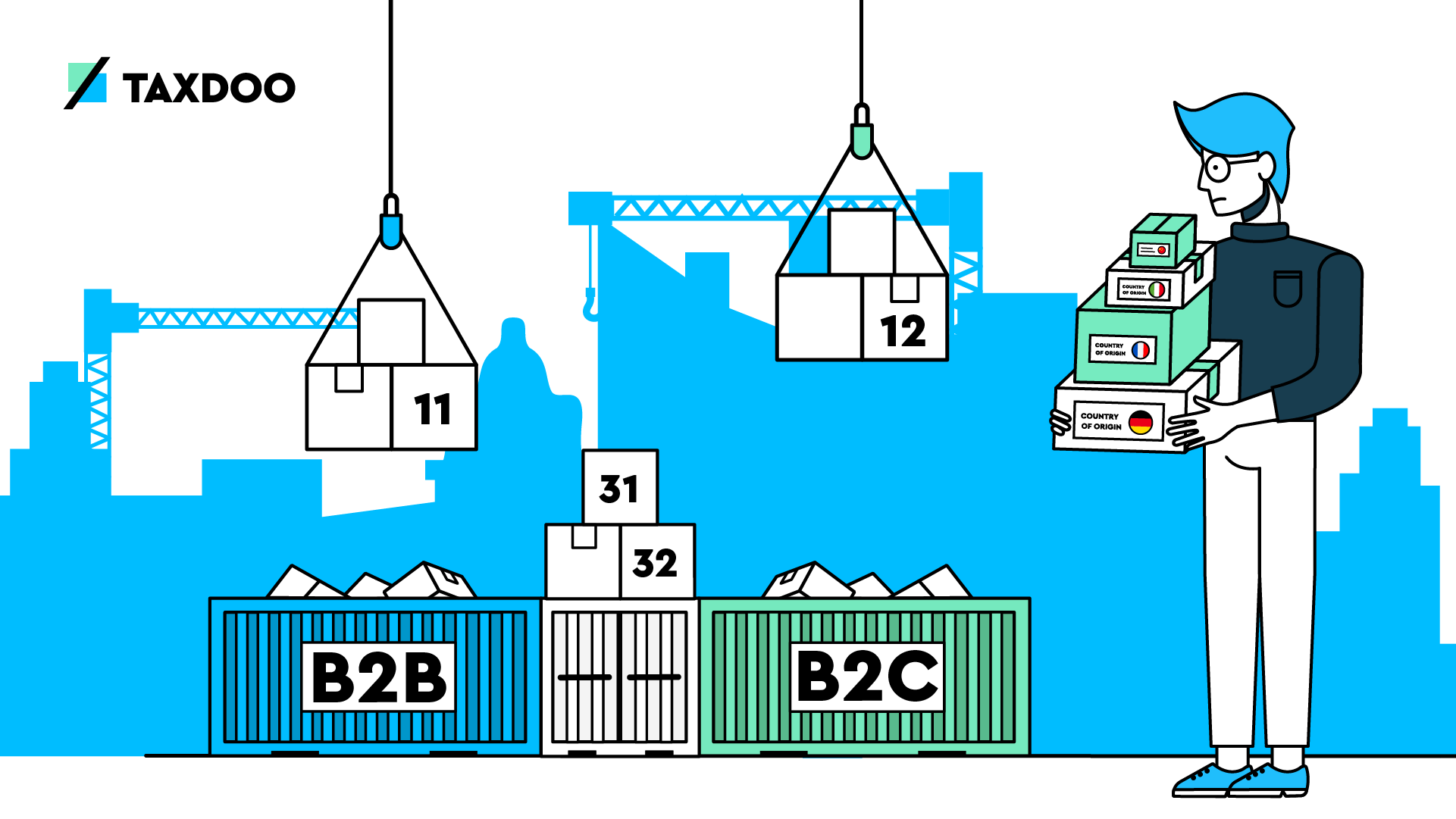

In particular, online merchants will be facing new requirements, such as the distinction between sales made to other companies (B2B sales) or private customers (B2C sales).

Things get even more complicated for those who rely on international warehouse structures such as, for example, the framework of the Amazon Pan EU program.

In this blog post, we would like to get you up to date about the new Intrasat declaration requirements and point out new pitfalls. For a better understanding, it is of course important to understand how amendments actually come about.

Why are there changes made to Intrastat?

Intra-trade statistics are only one of many statistical declarations collected within the European Union. Nonetheless, since its introduction, intra-trade statistics has been perceived as a very cumbersome system of collection. As such, it was decided early on that the effort required should be reduced, while data quality is still maintained.

The planning and implementation of the Intrastat adjustments took several years:

- In 2016, the project to modernise Intrastat was initiated at a European level

- In 2019, the legal foundations were established

- Implementation was set for the start of 2022

The result of the modernised form of the statistical survey is a more comprehensive exchange of the data collected for Intrastat between the EU member states.

Moving forward, microdata for intra-trade statistics will be exchanged between the EU member states, which should reduce the collection of import data in the long term. As a result of this, it is essential to improve the quality of the export data (i.e., dispatches sent from a member state). The data on these dispatches can then be used as the basis for the corresponding arrival in the other respective member states.

This means that those obliged to provide data, which for example could be you as an online merchant, have an additional declaration obligation for the dispatch report. There are also changes that have been made to the arrival reports. Below, you can find out exactly which data these changes concern.

At this stage, we can safely assume that the changeover phase will, once again (who would be surprised?), result in additional work for individuals liable to pay tax. Therefore, you should definitely address the Intrastat changes that will apply from 2022 sooner rather than later.

New Intrastat requirements from 2022: VAT identification number and country of origin of goods

Two new requirements will be introduced with the goal of increasing the quality of dispatch data to take advantage of the possibility of decreasing the collection of import data in the long run. These new details, however, are not particularly surprising as they can already be provided voluntarily. In some EU countries, they were even mandatory.

For the remaining countries, however, the following information is mandatory as of January 2022:

- The country of origin of goods

- The VAT identification number of the recipient

As previously mentioned, these additional declaration obligations only concern the dispatch report and not the arrival report.

As easy as this change may seem at first glance – the devil is in the details.

The field for the VAT identification number, for example, must also be filled in even if you are selling to a private individual. So, which number should be provided there? As tax experts like to say, ‘’It depends…’’.

What exactly you need to look out for with these two new specifications, we have explained to you in our blog article ‘VAT identification number and country of origin for Intrastat reporting: New requirements from 2022’.

Further Intrastat changes from 2022: The nature of transactions

As previously mentioned, there are also changes to the arrivals report, and the previous information we have provided is specifically in regard to the dispatch report.

Additional changes made to Intrastat are in regard to types of transactions. This concerns both the arrival and dispatch reports. Herein lies a particular difficulty in the implementation of the new requirements for Intrastat declaration.

What is it all about?

In order to inform the Federal Statistical Office about what kind of transaction is involved, i.e. e.g.,

- A sales transaction

- A return

- A financial lease (yes, even in these cases goods are moved to a foreign EU country)

There is a field ‘Type of Transaction’ included in the Intrastat declaration. Key numbers are stored for the individual transactions. Until now, or rather, until the end of 2021, the applicable Intrastat key numbers for online merchants were very clear:

- For your purchases/sales and movements to a warehouse, you were required to report the key number 11.

- In the case of returns, you were to report one of the following numbers: 21, 22 or 23.

As of January 2022, however, this will become somewhat more complicated. A distinction must be made whether a sale is made to a private individual or another company/merchant. The cases in which a distribution warehouse is involved must be closely monitored.

In a separate article, we have presented all the important Intrastat changes for online merchants in relation to types of transactions. If you are obliged to submit Intrastat declarations, you should definitely read this article.

Customs declarations (import and export declarations) have also been affected

As it is, no Intrastat declaration needs to be submitted for sales that are sent beyond the European Union borders. In these cases, the data relevant for statistical purposes can be collected from the customs declarations.

This is why you must also take into account the new list of transaction types in your customs declarations, which are typically made via the electronic portal ATLAS.

Intrastat changes in all EU countries

For those online merchants now breathing a sigh of relief, because they do not exceed the reporting threshold in Germany: Intrastat is an EU-wide system. You must therefore also monitor declaration obligations in all other EU countries.

Note:

The reporting thresholds can be adjusted annually by the respective EU member states. As such, online merchants should regularly check the valid reporting thresholds. In Germany, the reporting thresholds for the dispatch report (EUR 500,000) and the arrival report (EUR 800,000) will remain the same in 2022. Bulgaria, however, has already announced new reporting thresholds for 2022.

As we have already stated; the entire Intrastat system is to be modernised. In accordance with this, these are not only national changes that are being made, but transnational. All other EU member states are also being affected by these amendments.

Inconsistent declaration obligations are a result of varied implementation of the Intrastat changes in EU countries

Unfortunately, this means that you will need to deal with the national Intrastat regulations of each EU country individually. As such, if you are required to report in other EU member states, you will need to familiarise yourself with how the new regulations have been implemented in that country specifically.

Here, we can already assume that the details of the implementation of the Intrastat changes vary from one EU country to another.

In Germany, for example, there is a very detailed and complex set of rules regarding the declaration of the VAT identification number for sales to private individuals. In the Czech Republic, however, this is very standardised. In the Czech Intrastat declaration, you are required to differentiate between the types of transactions according to whether you are registered in the destination country or not. This, in turn, does not matter in Poland.

As you can see, these three countries have three different and complex interpretations of the new Intrastat obligations. This inevitably leads to different declaration obligations in the various EU countries.

Thus, the modernisation of Intrastat reporting at this bureaucratic level leads to a high implementation effort for all declarants who carry out international sales of goods.

When will the changes be relevant to your Intrastat declarations?

The new regulations will apply starting January 2022. By then, you must have adapted your IT infrastructure to the new requirements.

Incidentally, the submission deadline for the Intrastat declaration for the month of January 2022 is February 14, 2022.

A different deadline applies to customs declarations. Principally, the changes must be implemented as of January 1, 2022. However, if you use ATLAS for your customs declarations, January 15, 2022 is your relevant date.

Note:

ATLAS users were informed in subscriber information 0232/21 that these changes cannot be implemented in ATLAS until January 15, 2022. In the case of imports, further special features apply, which you can find in subscriber information 0250/21.

Intrastat corrections for time periods until the end of 2021 according to the old scheme

You must also be aware that all Intrastat declarations for the months before 2022 must be submitted according to the old regulation structure. If, for example, you make an adjustment for the month of May 2021 in 2022, you must use the old structure.

Don’t panic – Taxdoo can help you with your Intrastat declarations

Is everything sounding too complicated? You can now deal with these changes in detail – the Federal Statistical Office has provided 50 pages worth of information and more than 90 minutes of explanatory videos. However, after going through all of this information, we cannot rule out the possibility that you will have even more questions afterwards.

But don’t worry, we have an alternative: because we have already taken the amendments into consideration, we can completely handle the preparation of all required Intrastat declarations for you:

- If you are already a Taxdoo customer and have booked the Intrastat add-on in the countries relevant to you, you do not need to do anything else. We will implement all changes for you and ensure that the Intrastat declarations are created correctly.

- If you are a customer but have not yet booked an Intrastat add-on or are active in other EU countries? Under ‘Intrastat’ in your customer dashboard, you can see whether and in which countries you exceed the reporting thresholds.

- If you have not exceeded the respective reporting thresholds, there is nothing more you need to do.

- If you have exceeded the reporting thresholds, you should definitely check when you became a declarant. Feel free to contact us, as we can also prepare reports for you retrospectively.

By the way: You can easily book the Taxdoo Intrastat add-on under the ‘Add-ons’ function in your customer dashboard. Simply select the relevant country and direction of the movement of goods (dispatch/arrival), and we’ll take care of everything else.

Not a Taxdoo customer yet?

Then it’s time! In a free and non-binding demo, our VAT experts can inform you about how exactly we can support you with Intrastat and all your tax reporting obligations in the EU.

Weitere Beiträge

Types of transactions for Intrastat declarations from 2022: A New List

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022