Taxdoo Blog

Topics between e-commerce, Value Added Tax, accounting, invoicing and automation – especially with foreign reference.

30. July 2025

Private Equity Eyes Tax Firms: A Changing Landscape in German Tax Advisory

Private Equity in der Steuerberatung spaltet derzeit die Steuerkanzleien. Für das Manager Magazin durfte ich daher für einen großen Überblicksartikel ein paar...

18. July 2025

Accounting in e-commerce: from a low-margin miscellaneous business to a blueprint for an efficient division of tasks between technology and tax consulting in the AI age

23. June 2025

TAXDOO Acquires accountDigital: The Future of E-Commerce Starts Now!

The founders of TAXDOO & accountDigital share insights into the reasons behind the acquisition and their vision in an exclusive interview –...

9. May 2023

For tax professionals and online sellers: Quickly find answers to questions about your data | Transaction Data – detailed view

Working in the financial sector can be challenging, with endless data to analyse and countless hours spent manually sorting through transactions. Tax...

26. July 2022

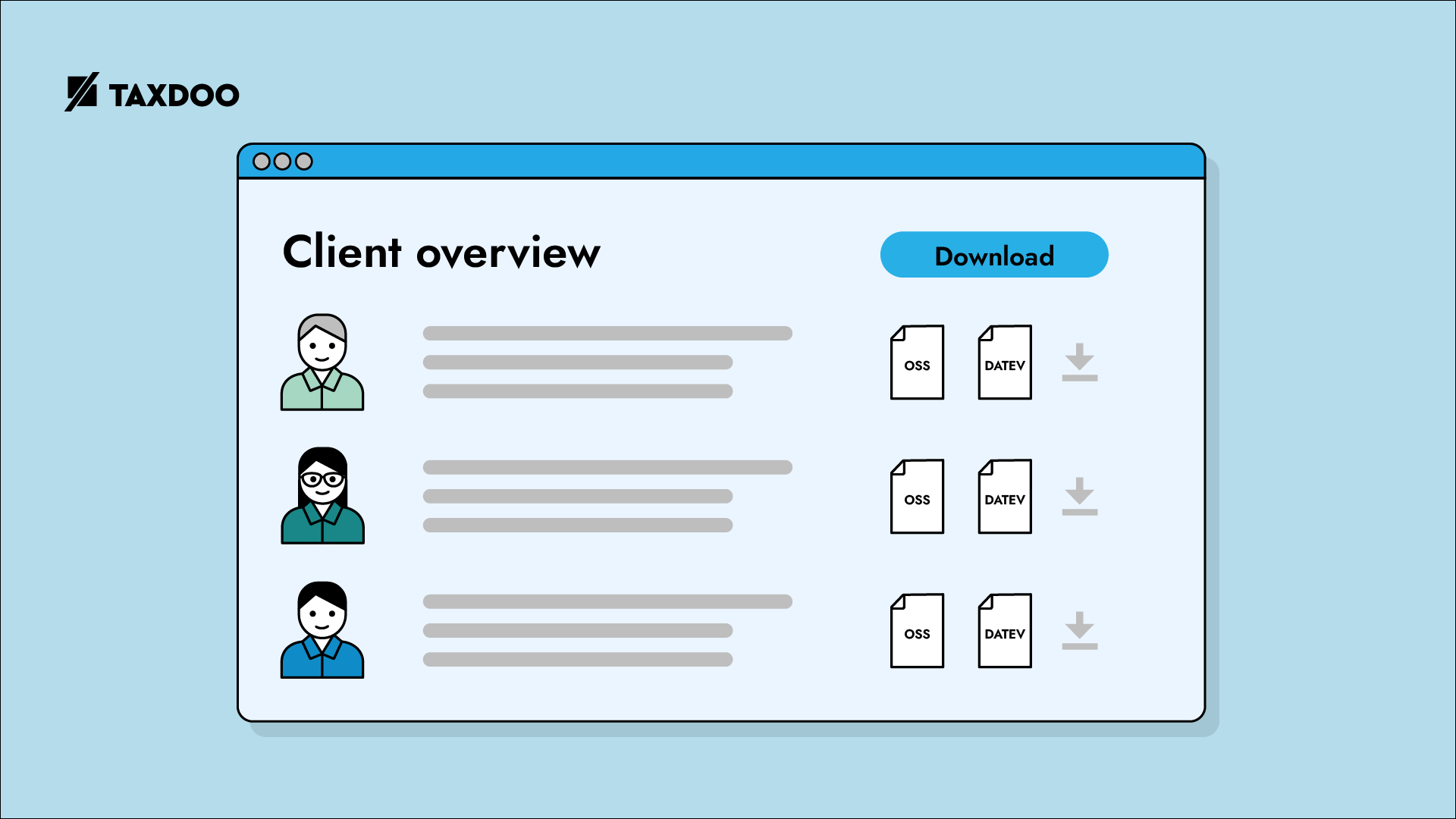

Introducing client overview! Become more efficient when working with multiple clients.

Today we would like to announce our new feature where we focus on helping accountants, tax advisors and, in general, users that...

29. April 2022

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

What the EU has planned sounds very promising. VAT returns and paying VAT in EU countries could become simpler and more digitalised....

27. April 2022

One-Stop-Shop (OSS) EU VAT for E-Commerce

The One-Stop-Shop is part of a significant EU VAT reform for e-commerce. Find out everything you need to know about it here.

11. January 2022

Types of transactions for Intrastat declarations from 2022: A New List

Intrastat declarations have remained mostly unaffected by previous tax reforms. From 2022, however, this will change: The list of the ‘Type of...

10. January 2022

VAT identification number and country of origin for Intrastat reporting: New requirements from 2022

The Intrastat declaration is probably one of the least popular types of declaration that companies are required to submit for their cross-border...