Direct DATEV Amazon interface: What can it do, what not?

DATEV eG is by far the largest software provider for the tax consulting professions in Germany. Many tax advisors are therefore members – or comrades – of DATEV.

For a long time, they had demanded more functionalities from DATEV in the area of online trade or e-commerce – especially the direct import of Amazon sales.

This function is now there. We explain what it can and cannot do.

Processing of the Amazon turnover in the DATEV accounting programme

… DATEV is making this functional extension available to its members for DATEV programmes from version 15.0.

You can find out more about this directly at DATEV – a classification follows here.

Reading in the Amazon-disbursement reports

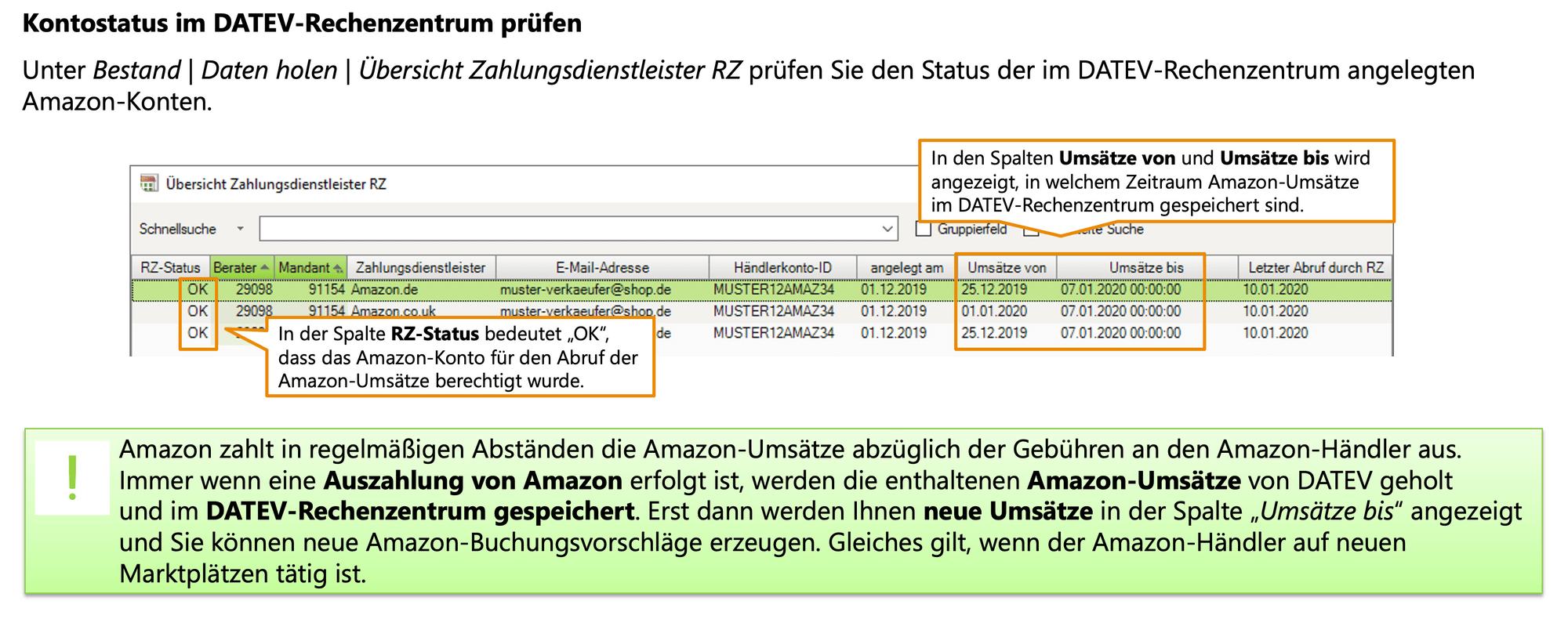

An important data basis that DATEV can access directly are the so-called disbursement reports from Amazon, which are often generated in a 14-day cycle – and are carried out separately for each Amazon marketplace in Europe.

The following screenshot from a DATEV document illustrates this. You can see for which Amazon marketplace and which time period the corresponding data is available for accounting.

Booking proposals

Subsequently, the user is provided with booking suggestions. Individual adjustments can also be taken into account over time by means of the DATEV learning file.

That all sounds good. What is missing?

What is still missing for complete Amazon accounting in the sense of the GoBD?

Let’s take as a reference an online retailer with 5,000 or even 50,000 outgoing sales per month, of which usually 50 to 60 per cent are cross-border.

The trader or his tax advisor will not be able to read in this transaction figure individually via the DATEV interface, evaluate it for tax purposes and book it in a reasonable amount of time.

Nevertheless, according to § 146 para. 1 sentence 1 AO, he is obliged to record each transaction individually.

He will therefore need a platform that can map these and the following still missing functionalities.

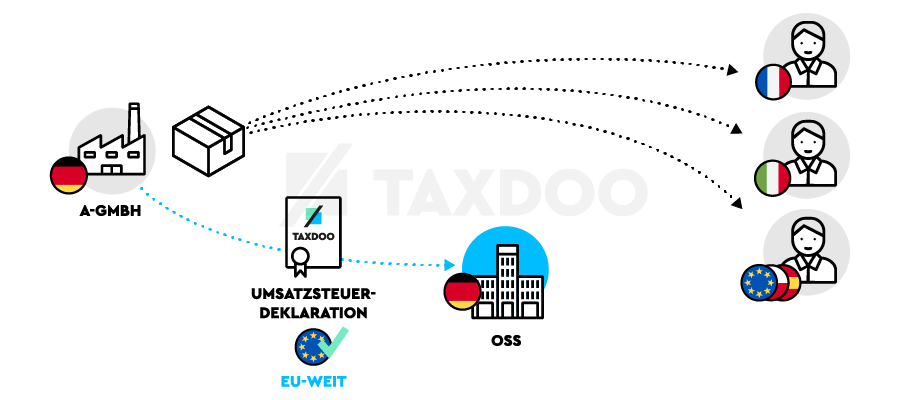

VAT valuation of every transaction – a MUST in times of OSS

Since 1.7.2021, almost every cross-border transaction in the EU is taxable in the country of destination. Some of these transactions can even be reported in the country of residence via the One Stop Shop (OSS).

The prerequisite for this is that a tax rate has been assigned to each transaction in advance. Considering that many EU member states have four – and in some cases five – VAT rates, more automatic mechanisms are needed here as well.

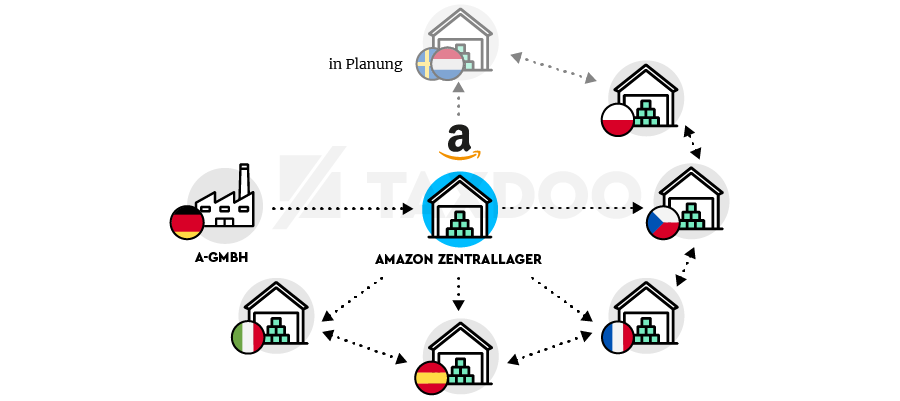

If traders also use cross-border fulfilment systems from Amazon , e.g. Pan EU or CEE, there will be a hard cut and they will have to switch to another technology.

Mapping Amazon Pan EU and CEE

The present and future of online trade are strongly characterised by high-tech and cross-border fulfilment systems. Fulfilment by Amazon (FbA) is the pioneer – but no longer alone in this field.

The VAT issues behind this are complex.

- Local deliveries from foreign Amazon warehouses may, for example, be subject to the local reverse charge procedure (abroad).

- The cross-border transfers of goods, which Amazon carries out on its own authority, often represent so-called intra-Community transfers and corresponding intra-Community acquisitions. These must be recorded via separate interfaces, enriched with purchase prices and production costs and then booked. (We do not want to go into the additional obligation to prepare documentary evidence at this point).

- In some cases, Amazon also owes Value Added Tax for the trader’s sales. This must be recognised, otherwise it leads to double taxation.

Then there is also the increasing relevance of B2B online trade.

Automated checking of B2B transactions – intra-Community deliveries

More and more Amazon traders are selling their products in parallel on the B2B marketplace Amazon Business. This is possible almost at the push of a button and creates new sales markets.

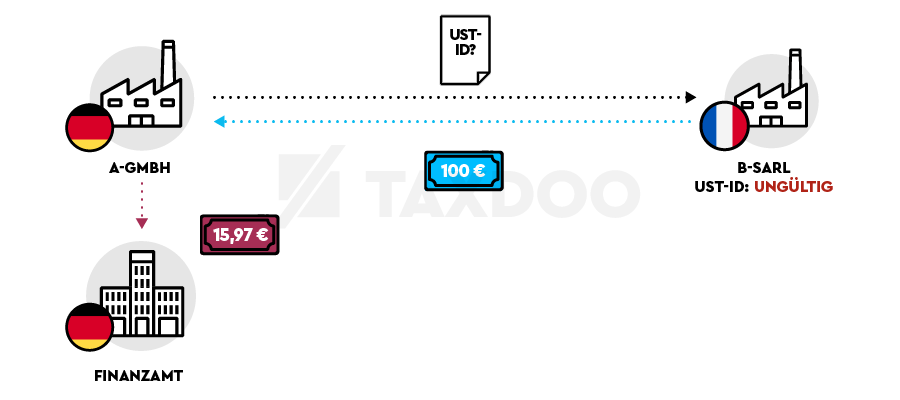

The risk lies in cross-border transactions – the so-called intra-Community deliveries.

These are generally tax-exempt, as the purchaser must regularly declare a so-called taxable intra-Community acquisition. As of 1 January 2020, the tax exemption only applies if a valid foreign Value Added Tax identification number (VAT ID) was available at the time of the delivery.

This should already be checked at the time of delivery or before posting.

Risk note: If an invalid VAT ID is transferred to the accounting system and sent to the BZSt, e.g. as part of the recapitulative statement (ZM), the tax advisor will receive a corresponding notice from the Bonn authority a short time later. The tax authorities are thus informed.

What happens next?

We are a partner of DATEV and understand the explanations given here as constructive feedback within the framework of a partnership of equals.

In addition, we have gained very competent and prominent reinforcement in the area of DATEV, with whom we will shed further and even deeper light on this topic in the coming weeks and months.

Be curious!

Helen’s and Rogers (the authors of this article) Conclusion: DATEV has taken a good step towards e-commerce.

Online trading is so agile and the frequencies of technological change are becoming shorter and shorter that Taxdoo and DATEV currently complement each other perfectly and will continue to do so in the future.

Taxdoo as a scalable platform in the field of accounting and Value Added Tax for Amazon and more

You want to learn more about how Taxdoo makes your life as a tax advisor or trader easier?

Then book a personal live demo via this link!

Our experts will explain what we can do and how we can easily connect your or your clients’ setup to our platform.

Weitere Beiträge

Amazon’s Value Added Tax calculation service (VCS) and OSS

Amazon in Sweden, storage, shipping: VAT liability for FBA traders?