Amazon Poland and the Czech Republic, CEE and Value Added Tax

The Amazon CEE programme stands for “Central Eastern Europe” and is a logistics service offered by Amazon . It allows Amazon FBA merchants to store their goods in Amazon warehouses in Germany, Poland and the Czech Republic and have shipments delivered directly from there to customers. CEE is also known as the “Amazon Central Europe Programme”.

Amazon promotes the CEE programme with shipping advantages for traders.

You could also put it the other way round: Amazon imposes shipping penalty fees on all traders who do not allow Amazon to store their goods in Poland and the Czech Republic as well. After all, these fees have been falling recently. Since 08.06.2021, the shipping surcharge per unit is now 35 cents (previously 50 cents). For “Small & Light” items, the surcharge is now 25 cents.

The more packages, the greater the savings from CEE, but …

So far, Amazon FBA sellers based in Germany and participating in the CEE programme have had a significant advantage in terms of shipping fees.

This is because they were able to save on the shipping surcharge compared to traders who ship exclusively from logistics centres in Germany.

The reduction of the shipping advantage from 50 cents to 35 cents makes participation in the “CEE” programme somewhat less monetarily rewarding than before, even though it should still be attractive in principle for very many Amazon sellers.

This change also affects the calculation that should be carried out by any Amazon seller who intends to activate the Amazon CEE programme.

Because the cost-benefit calculation for CEE is only simple at first glance.

For example, a retailer with 1,000 parcels per month saves €350 per month or €4,200 per year in FBA fees – a large retailer with 50,000 parcels per month saves €17,500 per month or €210,000 per year.

However, there is one major hurdle: the Value Added Tax.

Only if the VAT obligations that go hand in hand with participation in the CEE programme are also complied with does the calculation add up. Otherwise, additional tax payments and penalties at the Polish and Czech tax authorities could cost considerably more than the fee advantage saves.

In the following, we explain what needs to be taken into account in terms of VAT and how these challenges can be solved as automatically as possible and thus safely.

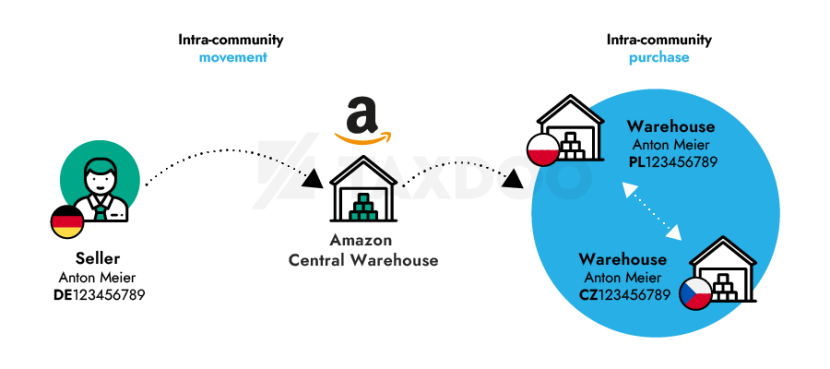

This already begins with the transfer of goods to Poland and the Czech Republic.

The stock transfer of goods to Poland and the Czech Republic is a taxable transaction

Whenever goods are permanently transferred to another EU state, e.g. for a planned sale, the following happens for VAT purposes:

In order for the state to which the goods are brought to know about this, you must declare a so-called intra-Community transfer there. This transfer is a tax-free delivery in Germany.

When the goods arrive in Poland or the Czech Republic, a so-called intra-Community acquisition occurs.

This acquisition must be regularly declared to the tax authorities in the recipient country (Poland or the Czech Republic).

Important:

In order to avoid taxation of the generally tax-free intra-Community shipments, it is imperative that the VAT registration in Poland and the Czech Republic takes place before the CEE programme is activated. Only after receiving the local VAT ID numbers, which can take several weeks, can goods be shipped to Poland or the Czech Republic without tax risks.

Through the tax declarations of the intra-Community deliveries or acquisitions, both states (e.g. Germany and Poland) then know that their goods have been transferred there.

In the country where the transfer starts – here in Germany – you declare the tax-free intra-Community supply (transfer). You enter the cumulative purchase prices or production costs of all transferred goods of a month or a quarter in field 41 as the basis of assessment.

In the country where the transfer ends – here in Poland – you declare the taxable intra-Community acquisition and claim the input tax deduction, so that the balance is basically zero.

The assessment basis is again the purchase prices or production costs, which in the case of Poland you would still have to convert into zloty, which we have not done in this example for didactic reasons.

Where will the sales be taxed afterwards?

Sales from Poland and Czech Republic to Germany and other countries

A large part of the goods in the CEE warehouses in Poland and the Czech Republic are in many cases sold back to Germany and other EU countries.

Where and at what rate are these sales taxable?

To do this, we need to distinguish whether you are selling to business customers, to a third country outside the EU, or to end consumers in the EU.

As far as you sell cross-border B2B (sales to business customers) or to a third country outside the EU (e.g. Switzerland, UK), the answer is simple: you always declare everything tax-free where the delivery to the customer begins, i.e. in Poland or the Czech Republic.

In the case of sales to end consumers in the EU, on the other hand, the sale is regularly taxable in the country of destination. That is, where the shipment is going. For a delivery from Poland to Germany, the German Value Added Tax is due. For a delivery from a Amazon CEE warehouse in the Czech Republic to France, the French Value Added Tax applies, etc.

Once you have exceeded the EU-wide delivery threshold of EUR 10,000, you must bear in mind that you are liable to pay tax from the first cent in the respective country of destination.

In the following table we have summarised for which type of delivery you have to pay tax where and at which tax rate:

| Recipient of the delivery | Shipping from | Shipping to | Where is tax paid? |

| Business customer (B2B) | Poland or Czech Republic | other EU country, e.g. Germany | VAT.VA in Poland or the Czech Republic (generally tax-free) |

| Customer in third country outside EU | Poland or Czech Republic | Third country, e.g. Switzerland | VAT.VA in Poland or the Czech Republic (generally tax-free) |

| Private end customer | Poland or Czech Republic | Other EU country, e.g. Germany, France, Spain, etc. | in the respective country of receipt at the tax rate applicable there (if the EUR 10,000 limit is exceeded) |

Table: Tax obligations when using the Amazon CEE programme with dispatch from a fulfilment centre in Poland or the Czech Republic: Deliveries to end consumers (B2C) are taxed in the country of destination if the new EU-wide delivery threshold of EUR 10,000 is exceeded or a waiver of this threshold has been declared.

If you do not use the One-Stop-Shop, you would have to register for VAT in the respective receiving countries of your B2C sales in order to pay the Value Added Tax and submit the required returns there regularly.

If you are registered for the OSS, you can report these cross-border B2C sales (=”distance sales”) centrally via the One-Stop-Shop in your country of residence. It is important that if you use the OSS, you report all distance sales through the OSS and all other transactions, such as the transfers described above, continue to be reported locally.

You can read more about the One-Stop-Shop here.

Note on the old VAT 21 regulation until 30.06.2021: The process for submitting a written application for a supply threshold waiver in Poland, such as the previous VAT 21 form, has been completely abolished since 01.07.2021 with the abolition of local supply thresholds. This is due to the fact that the country of destination principle has been consistently enforced since 01.07.2021 anyway.

What does not change with the OSS procedure: If you use Amazon FBA warehouses, you still have to register in all the countries in which you use warehouses and then regularly submit the country-specific VAT returns.

How can you or your tax advisor meet the above tax obligations in Poland and the Czech Republic?

With Taxdoo you can automatically fulfil your VAT obligations for Poland and the Czech Republic.

The VAT obligations through participation in the Amazon CEE programme may seem complex, but the good news is: Taxdoo can automatically fulfil all VAT obligations in Poland and the Czech Republic for you.

In addition to the above-mentioned Value Added Tax advance tax returns, there are other forms that have to be submitted in Poland, for example: The recapitulative statement (ZM) and Standard Audit File – Tax (SAF-T) in Poland and the so-called control notification in the Czech Republic.

Our system will provide you with all submitted declarations as well as a monthly payment request for the settlement of the VAT debt in Poland and the Czech Republic.

What does this solution cost with Taxdoo?

- For example, with 1,000 sales per month, the monthly costs are 247 euros for the automated handling of these VAT obligations.

- For example, if you have 10,000 sales per month, the cost is 307 euros per month.

You no longer have to monitor any deadlines, you can rely on correct tax data being submitted to the right authorities, and with Taxdoo you only have one contact person for queries. With support in German and English, from our own employees, directly from our company headquarters in Hamburg.

You need pro-forma invoices to document your shipments to warehouses in Poland and the Czech Republic for the tax authorities? No problem: Taxdoo also generates pro forma invoices automatically!

If required, we also offer our services for even more EU countries, e.g. within the framework of the Amazon Pan EU programme. And if you want to use Pan EU or the Amazon CEE programme for the first time, we can also take care of the one-off tax registrations in Poland and the Czech Republic for you in advance.

Simply click here and arrange a live demo, in which we will personally show you and/or your tax advisor the advantages of our automated Value Added Tax solution via screen transmission and answer your questions.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

One-Stop-Shop (OSS) EU VAT for E-Commerce