OSS declaration deadlines: Submission of OSS declarations late due to BZSt error – What to do?

As we recently reported, the One Stop Shop still contains some errors. In particular, traders or clients who make use of the cross-border fulfilment structures of Amazon – e.g. within the framework of Amazon CEE or Amazon Pan EU – have received error messages after submitting their first OSS message that are not plausible.

You can find an overview of these OSS errors here.

But let’s start with the most important things first, because the first OSS notification is due by 31 October 2021.

Deadline for submission of the first OSS report

OSS reports must always be submitted by the end of the first month of the reporting period. For the first report, which covers the period from July to September 2021, this is therefore 31 October 2021.

At this point, some of you may ask: 31 October is a Sunday! Then the end of the deadline would have to be postponed to the following working day, i.e. 1 November.

The answer to this is: No! This system applies to many deadlines in tax law – e.g. for the submission of the Value Added Tax advance return in Germany – but explicitly not to the OSS returns. The reason for this is that the OSS data of all Member States end up in a common data pool, so that national peculiarities cannot be taken into account in the deadlines.

You or your clients must therefore have submitted the OSS report by Sunday 31 October 2021 at the latest.

Note the payment deadline: Transfer of the OSS tax amounts for Q3 2021 should be initiated by 28.10.

However, this is only half the battle. In order to meet the deadline, the VAT liability resulting from the OSS declaration must also be received by the Federal Central Tax Office – or the Federal Treasury – by 31 October 2021.

The MeinBop portal for submitting the report is also open on Sundays. However, a transfer you make at the weekend will not be executed until the next working day and often takes another day to reach the recipient. Therefore, you should already have initiated the payment on 28 October.

What are the consequences of missing or forgetting deadlines in tax law?

Forgotten, overlooked, … What are the consequences?

Anyone who misses or forgets to file a tax return is in fact committing tax evasion – at least for the time being, until they have made up the declaration and payment.

The subsequently submitted declaration then has the character of a self-disclosure that exempts you from prosecution. The term “voluntary declaration” makes it clear on what dangerous terrain you are moving from then on.

This is not to be trifled with. If the tax office takes up your case before you or your tax advisor can submit the declaration, in a worst-case scenario the so-called exemption from punishment can be cancelled and you will be charged with tax evasion.

Now, we do not want to hide the fact that the tax offices rarely escalate cases of forgotten deadlines in this way. But it is conceivable.

Repeated failure to comply with the deadline for OSS reports may result in exclusion from the OSS procedure.

Much more important is another sanction measure that the tax authorities have had since 1 July 2021. According to this, any online trader can be excluded from the OSS procedure if he repeatedly misses the deadlines for submitting the OSS declaration.

The risk is that you have to register locally in all EU countries to which you send even a single parcel.

But what is going on now with the current OSS message?

The BZSt messes up the first OSS report! What happens next?

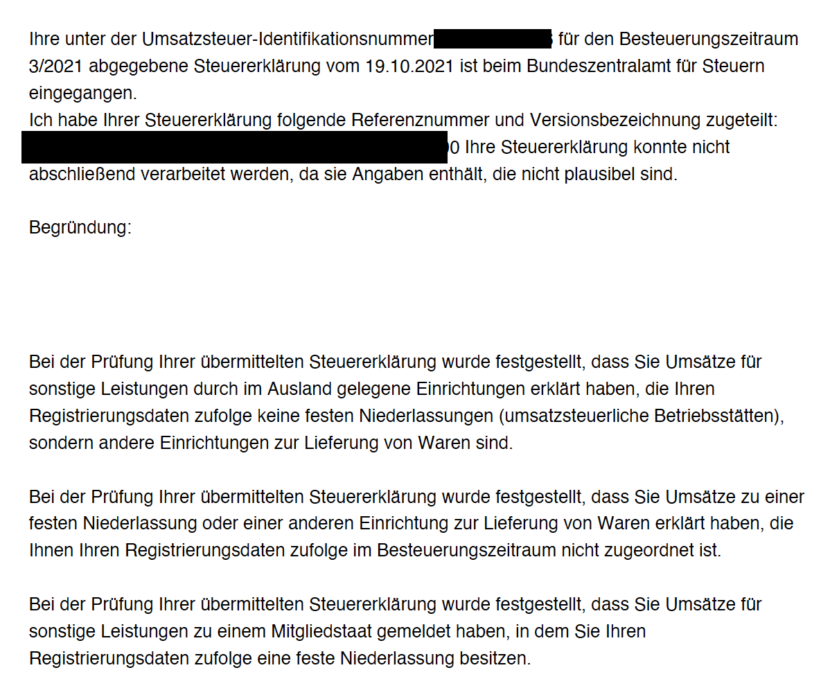

As reported at the beginning, many online traders and tax advisors are currently receiving implausible error messages after submitting their first OSS report.

You can see an example of this in the following screenshot.

Unfortunately, the BZSt does not communicate transparently in these many – probably several tens of thousands – cases. Information is only provided after a telephone enquiry, as far as anyone there can be reached at all.

The current statement from the BZSt on OSS error messages is:

There seem to be errors in the system that lead to these error messages. It is currently not foreseeable whether these will be corrected by 31 October 2021.

In our view, no proper and, if applicable, timely submission of the OSS report has taken place in the context of such an error message.

The question we – and presumably everyone else – is asking is: How can the OSS declaration be submitted on time if the error probably cannot be corrected by the deadline?

Our assessment is as follows.

- Anyone who has submitted a complete OSS return by 31 October 2021 is on the safe side – especially since they have also received a confirmation of receipt with the above-mentioned error message. The fact that the tax authorities cannot work with the data due to an internal error is not a criterion for exceeding the deadline under tax law.

- However, it is important that in addition to submitting the declaration, the VAT debt is also transferred to the federal treasury in due time.

- If the error is corrected by the BZSt at some point, it may well make sense to submit a report again if the BZSt requests this. However, that remains to be seen for the time being.

Please note that our assessment only refers to the specific error message that you see in the screenshot above. There are other error messages, some of which are also justified and require further steps on your part. Therefore, please check very carefully which error message is present in your case.

Today, on 27 October 2021, we received information from the BZSt that the technical error has been identified on their side. Work is now underway to correct the error.

The only question is: What happens next? According to information from the BZSt, the returns affected by the above error message do not have to be submitted again. Once the BZSt has corrected the technical error, your returns will be automatically imported into the BZSt system. You will then also receive a status message in the “My Bop” portal that the declaration has gone through.

Conclusion: Digitisation currently ends where the financial administration begins

The fuss about the levy – or non-levy – of the first OSS notice shows that the tax administration is reaching its limits with the development of such a complex infrastructure as the One-Stop-Shop.

This does not bode well for the further planned Value Added Tax reforms in the coming years. If Germany was already one of the biggest brakemen on the subject of OSS, the current experiences are likely to lead to the further development of our VAT law being almost completely put on ice in the coming years.

Weitere Beiträge

One-Stop-Shop (OSS) EU VAT for E-Commerce

OSS Declaration: Foreign overdue reminders threaten exclusion from the OSS despite timely filings and payments