OSS Declaration: Foreign overdue reminders threaten exclusion from the OSS despite timely filings and payments

Despite numerous obstacles, you have successfully submitted the first OSS report for the Quarter 3/2021.

Neither the missing upload feature nor the cryptic error messages from the BZSt have put you off your guard. Moreover, you transferred the VAT on time so that it could be distributed to the individual member states by October 31, 2021.

After almost two months, however, it seems that the money from the OSS reports has not arrived in many foreign countries, which has led to threatening sanctions on the merchants.

How do you learn about missing payments, and what should you, as a merchant or as a tax advisor, look out for?

Foreign countries will be contacting you regarding your OSS reports: No spam and tough sanctions!

How can you make sure that this message is not spam or phishing? There are several clues that you should pay attention to.

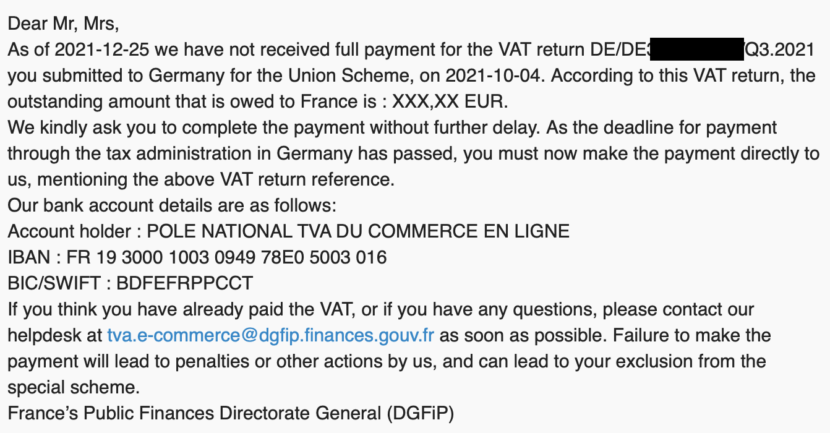

Below you will find one such message as an example. This message comes from France.

- In the redacted field should be your German VAT number (UStID). (Important: Obviously, this alone is not sufficient, as this number appears on your Website’s imprint and/or in your Amazon store and therefore visible to everyone.)

- The amount entered as (XXX,XX) here in line 3 must be identical to your VAT payment in the corresponding country of destination – in this case France – for Q3/2021.

- The second information is not publicly accessible and should therefore, in combination with your VAT ID, ensure that it is not spam or even phishing.

In this email, the French tax authority wrote to a German online merchant on December 25, 2021 that he had not paid his VAT liability from his OSS report for Q3/2021 on time. This should have arrived in France by October 31, 2021.

As a sanction, the online merchant faces the threat of being excluded from the OSS scheme, which is stated as “can lead to your exclusion from the special scheme”. The OSS is referred to as the ‘special scheme’ here. This sanction would mean that this merchant would have to register locally for tax purposes in every EU state in which he makes as little as one cent of sales, as he would no longer be allowed to use the OSS in its entirety – i.e. for all EU states.

What should you do as an affected online merchant or tax advisor, if you have received such a message, but you are sure that you have made the VAT payment on time?

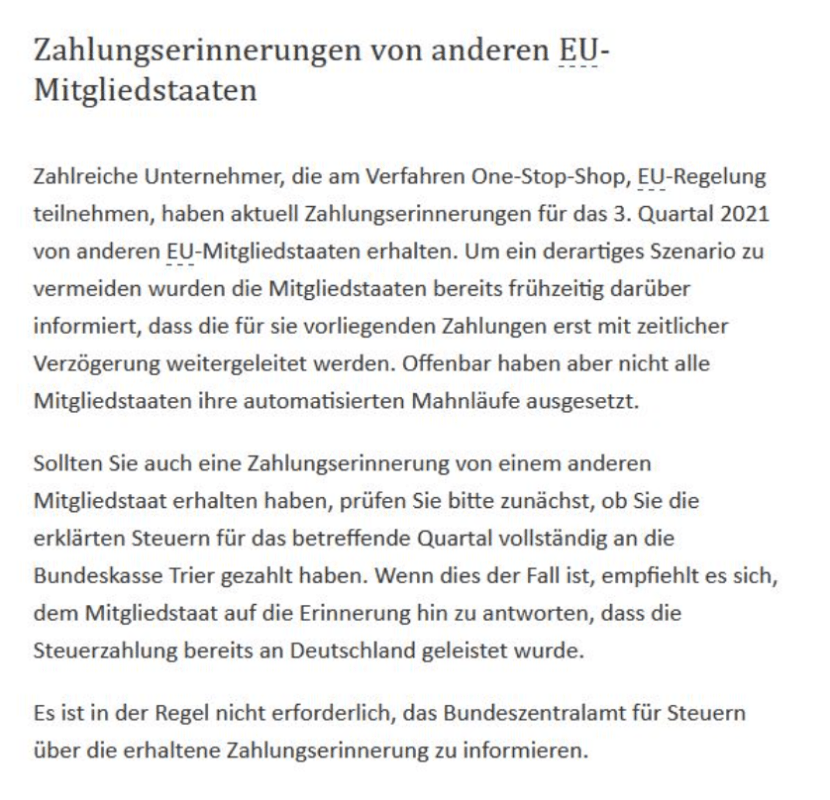

In this case, a statement from the BZSt will help you. This statement specifies three steps.

Statement from the BZSt

The Federal Central Tax Office has heeded our calls and is now proactively starting to inform companies and tax advisors about errors in the OSS system.

To summarize, it means the following:

- Stay calm and do not hastily delete, reply to or ignore the email from tax authorities from foreign countries.

- Check whether you have actually transferred the VAT to the federal treasury on time. For Q3/2021, the payment had to be received by the responsible federal treasury by October 31, 2021.

- If this is the case, reply to the e-mail address mentioned in the message and confirm that you have made the payment on time in Germany.

- As proof, you can attach a screenshot of the bank transfer if necessary.

In conclusion: The OSS-machine still needs to be oiled

What seemed inevitable has become apparent: 27 member states must exchange and cross-check data at the company level as part of the OSS. It was obvious that this would not work smoothly from day 1 – to put it mildly.

Hopefully, all member states are aware of this fact and no one will be unfairly excluded from the OSS system.

Would you like to know how you as a merchant or tax advisor can handle OSS declarations including corrections and all other relevant tax processes for EU-trade in a secure, efficient and automated way?

You can simply book a personal and free consultation with Taxdoo’s VAT and financial accounting experts by clicking on this link.

Weitere Beiträge

One-Stop-Shop (OSS) EU VAT for E-Commerce

OSS declaration deadlines: Submission of OSS declarations late due to BZSt error – What to do?