Error in OSS notification via BZSt: Background and ToDo’s

In a few days, the deadline for the first OSS return, which must be submitted to the Federal Central Tax Office (BZSt) for the 3rd quarter of 2021 by 31 October 2021 for all cross-border B2C sales (distance sales), will expire. Therefore, tens of thousands of online traders and tax advisors are probably currently preparing and submitting the first OSS return.

However, it is obviously not enough that the first declaration in Germany has to be submitted manually (more information in our blog article on manual OSS declaration). Now there are also errors on the part of the BZSt a few days before the deadline for submitting the OSS declaration.

Thousands of online traders are currently receiving a notice that their OSS report cannot be processed conclusively. At first glance, it seems to be a technical problem in the OSS form.

The OSS error message at a glance

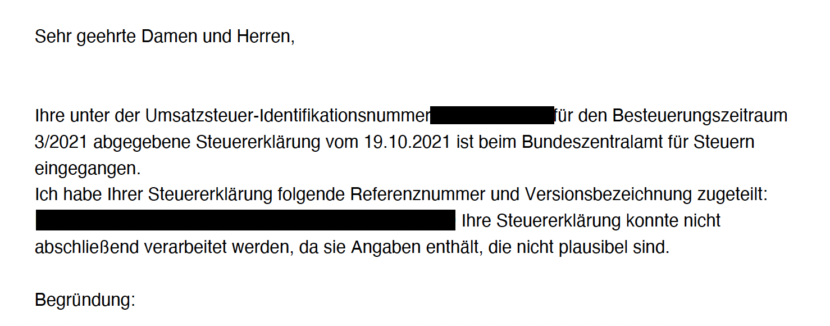

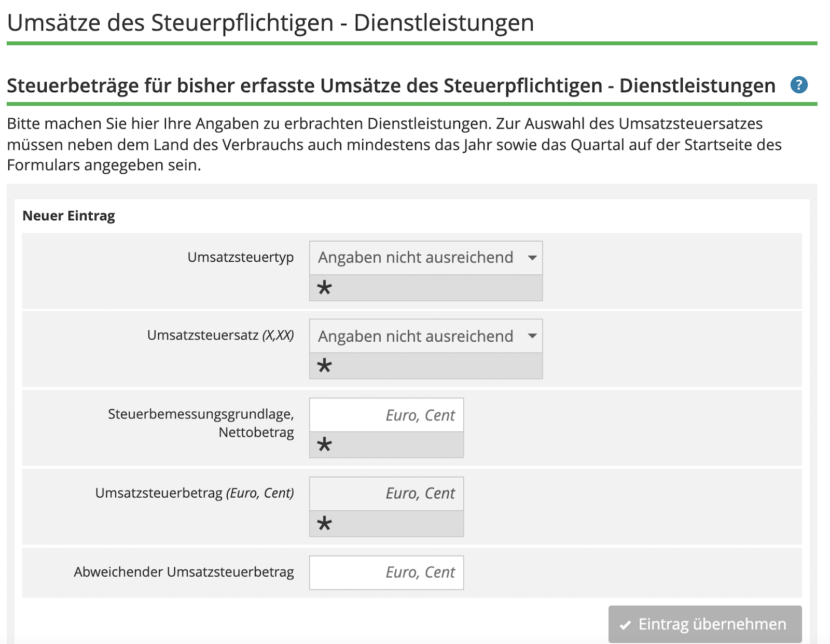

After you have filled in the OSS declaration manually in the BZSt portal “My Bop“, it will be submitted by you. As a rule, you should then receive a confirmation that the OSS declaration was successfully submitted.

However, as already reported on our blog post on OSS registration, there are currently cases where the OSS notification is rejected as “not plausible”. These cases are now becoming more frequent.

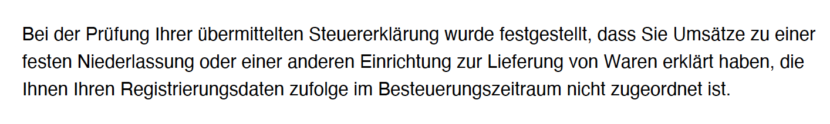

In these cases, you will receive the following letter from the BZSt:

Another question that arises is, in which specific cases does this OSS error code occur on the part of the BZSt?

Problems with OSS reporting occur with data on distance sales from foreign warehouses

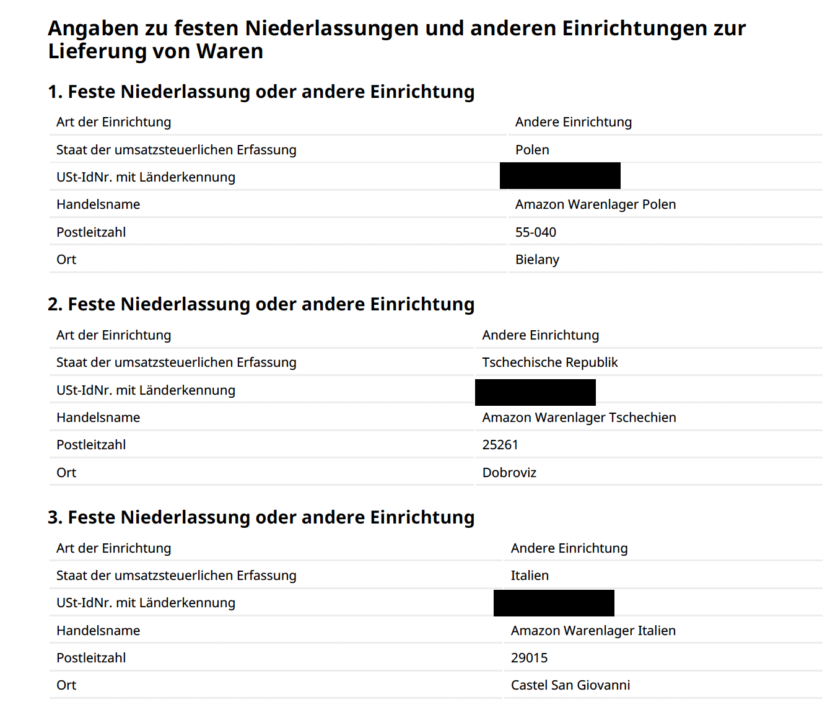

According to current information, such an error message always occurs if you use foreign warehouses, for example within the framework of the Amazon FBA programme, and therefore also make deliveries from other EU countries and have entered the corresponding turnover in the OSS declaration.

We briefly recall the OSS registration notice: Within the scope of the OSS registration, you had to enter Amazon warehouses or fulfilment centres as “other facilities for the delivery of goods”. Even if these warehouses are not explicitly attributable to you, Amazon fulfilment centres or other warehouses must also be entered here according to information from the BZSt. The more surprising are the error messages that appear, but more on that later.

Interim conclusion: If you participate in the Amazon FBA programme, it is likely that you are affected by the above OSS error message.

In the following section, we take a closer look at the individual reasons for the failed OSS message and help you to classify them.

OSS error code #1: Turnover from facilities not attributable to the online trader

A common error message that appears in OSS messages from Amazon FBA merchants is the one below. This indicates that remote sales have been declared that are made from a facility (e.g. Amazon fulfilment centre) that is not attributable to the online retailer.

We have already shown above that, according to information from the BZSt, Amazon warehouses must be recorded as “other facilities” in the OSS registration – even if they are obviously not attributable to the online trader.

When you entered the foreign warehouses of Amazon , you also entered your foreign VAT ID. If your foreign VAT ID is now compared with the address of the warehouse, it is obvious that the warehouse cannot be attributed to you.

However, this is not surprising after the findings of the past months. However, the error message below is all the more surprising. Because based on the structure of cross-border fulfilment structures, it is clear that thousands of online retailers make sales from foreign Amazon warehouses that are not attributable to you.

Obviously, there is a bug in the plausibility checks of the OSS or BZSt at this point.

But that is (unfortunately) not all.

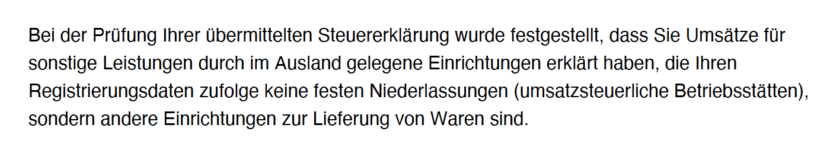

OSS error code #2: Declaration of services from facilities located abroad that are not permanent establishments

This OSS error message relates to the provision of services. Even though many of you do not provide services and only use the OSS procedure to declare distance sales, you now seem to have to deal with the issue of services as part of the error messages.

However, since the above error message already contains many technical terms, we will elaborate a little further.

Other services” refers to digital services. You will only have filled this transaction type in the manual OSS declaration if you also provide digital services to private customers in the EU. This includes, for example, the sale of e-books.

However, digital services can basically only be provided by so-called “permanent establishments”.

A fixed establishment is any establishment, other than the seat of the economic activity, which has a sufficient degree of permanence as well as a structure which, in terms of personnel and technical equipment, allows it to provide services.

This definition clarifies that Amazon fulfilment centres are not permanent establishments of yours, as you cannot provide (digital) services to your customers from them. This is also the reason why you have recorded the Amazon warehouses as “other facilities” and not as “permanent establishments” during registration.

According to the error message, the online trader should also have recorded services provided from branches in other EU countries during the manual OSS declaration.

Analogous to distance sales, the BZSt carries out a plausibility check when recording services as to whether permanent establishments in other EU countries have been indicated in the registration. This is the prerequisite for declaring the corresponding turnover.

If this is not the case, the OSS message is not plausible.

However, the above error message also appears for online traders who do not provide services. No services were recorded in the OSS form in the “My Bop” portal either. Only information on cross-border distance sales from Amazon warehouses in other EU countries was provided. Nevertheless, the notification is rejected on this ground.

Obviously, the OSS contains a bug at this point.

Unfortunately, it still does not stop at this point.

OSS Error Code #3: Services in a Member State where there is a “fixed establishment”.

This OSS error message is also related to digital services, which only exist in the imagination of the BZSt. In this case, the online trader is said to have provided a service to an end customer in Germany.

How do we get there?

As part of the registration process, it was stated for online traders based in Germany that they have their registered office in Germany. This means that there is a permanent establishment in Germany.

In the present case, too, no services to end customers in Germany were recorded in the “My Bop” portal. Only sales from foreign Amazon fulfilment centres to German end customers were recorded. These sales must also be declared accordingly via the OSS declaration, as they are cross-border distance sales.

However, the OSS form of the BZSt seems to classify these distance sales as services, even if they were neither provided nor recorded in the OSS form, resulting in an error message.

How can you classify the OSS error messages and what action is required?

In our opinion, there seems to be a technical problem in the OSS form of the BZSt, especially with error messages #2 and #3. Distance sales from other EU countries seem to be incorrectly classified as services, resulting in the error messages explained above.

The background for error message #1 is not obvious at first glance, because it has been obvious since the beginning that Amazon fulfilment centres are not to be assigned to you as online traders. Therefore, this OSS error message from the BZSt is more than questionable.

With regard to the deadline for the first OSS notification, it is extremely disappointing that these error messages are now occurring with thousands of online traders – without timely transparency or information from the BZSt.

The most burning questions you are probably asking yourself now is whether there is a risk for you and what steps you need to take?

Basically, the BZSt has confirmed to you by letter that they have received the declaration, i.e. your OSS declaration.

In these cases, a reference number was even assigned to your declaration. If you have also checked that you have not made any incorrect entries and that you have entered all turnover in the correct sections, then you cannot take any further action for error messages #2 and #3 for the time being, as it is obviously a technical error on the part of the BZSt.

We would recommend that you also transfer the Value Added Tax from your distance sales reported via OSS to the BZSt so that the deadline for payment is met.

We are already trying to contact the BZSt to clarify how to deal with the OSS error messages and what steps you now need to follow so that your declaration is considered to have been successfully submitted.

Update 1: BZSt confirms technical error in OSS form

Update 26.10.2021:

After consultation with the BZSt, there is – as expected – a technical error on the part of the BZSt. Even if all data are entered correctly in the OSS declaration, the declaration is rejected as explained above.

The BZSt must now search internally for errors. We have not received any concrete information as to whether the OSS declarations are nevertheless deemed to have been submitted and whether the deadline for submission has been met. According to the BZSt, there will be an update at the end of calendar week 43 2021.

Of course, we will continue to keep you up to date here on the Taxdoo blog.

Update 2: OSS declarations do not have to be resubmitted to the BZSt after technical errors #2 and #3 have been corrected.

Update 27.10.2021

We have received information from the BZSt today that the technical error on the part of the BZSt has been identified with regard to errors #2 and #3 and that work is already being done to correct the error.

Furthermore, according to information from the BZSt, the returns affected by the above error message in connection with foreign warehouses do not have to be submitted again.

Once the BZSt has corrected the technical error, your reports will automatically be imported into the BZSt system. You will then also receive a status message in the “My Bop” portal that the report has gone through.

Update 3: BZSt itself comments on the existing error messages

Update 28.20.2021

The BZSt has now commented on its own website on the existing error messages in connection with the OSS notification.

In the following, we will explain the essential information that you can find on the BZSt website.

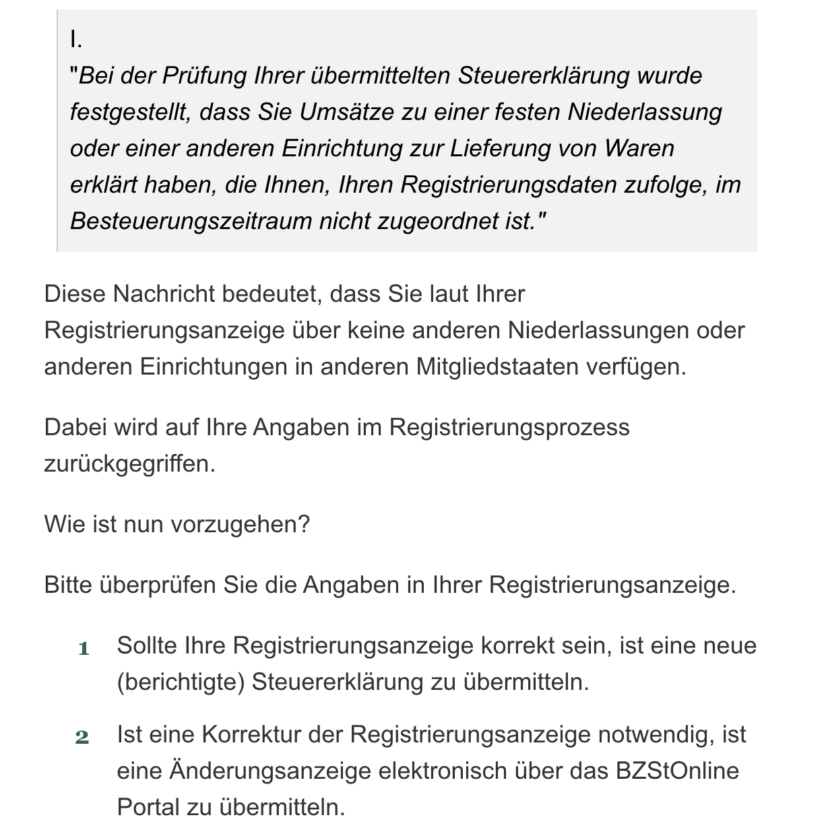

Regarding error message #1, the BZSt makes the following statements:

In many cases, your registration notice will be correct, i.e. you have properly declared all your warehouses used abroad as part of the OSS registration. If this is the case, you should resubmit the tax return according to the BZSt.

For error message #2, which we describe above, the BZSt comments as follows. Under point 1, the BZSt now confirms what we have already told you under update 2.

If you have not recorded any services within the scope of your declaration because you do not provide any services but only supply goods, you do not have to take any further action. In these cases, you can consider the error message as being without object.

Error message #3 is also mentioned on the BZSt page:

Here too, the BZSt confirms our information from Update 2. If you have not entered any services in the form, you do not have to submit your declaration again.

Taxdoo offers solutions – for OSS and more

If you want to know more about how you can efficiently and securely map OSS reports, Value Added Tax obligations, financial accounting and much more via one platform, then use this link to make an appointment for your individual and free initial consultation with the e-commerce and Value Added Tax experts from Taxdoo!

You are also welcome to register for one of our regular OSS webinars, where we will give you even more information about OSS and also present our compliance services, as well as answer your questions personally.

Weitere Beiträge

One-Stop-Shop (OSS) EU VAT for E-Commerce

OSS Declaration: Foreign overdue reminders threaten exclusion from the OSS despite timely filings and payments