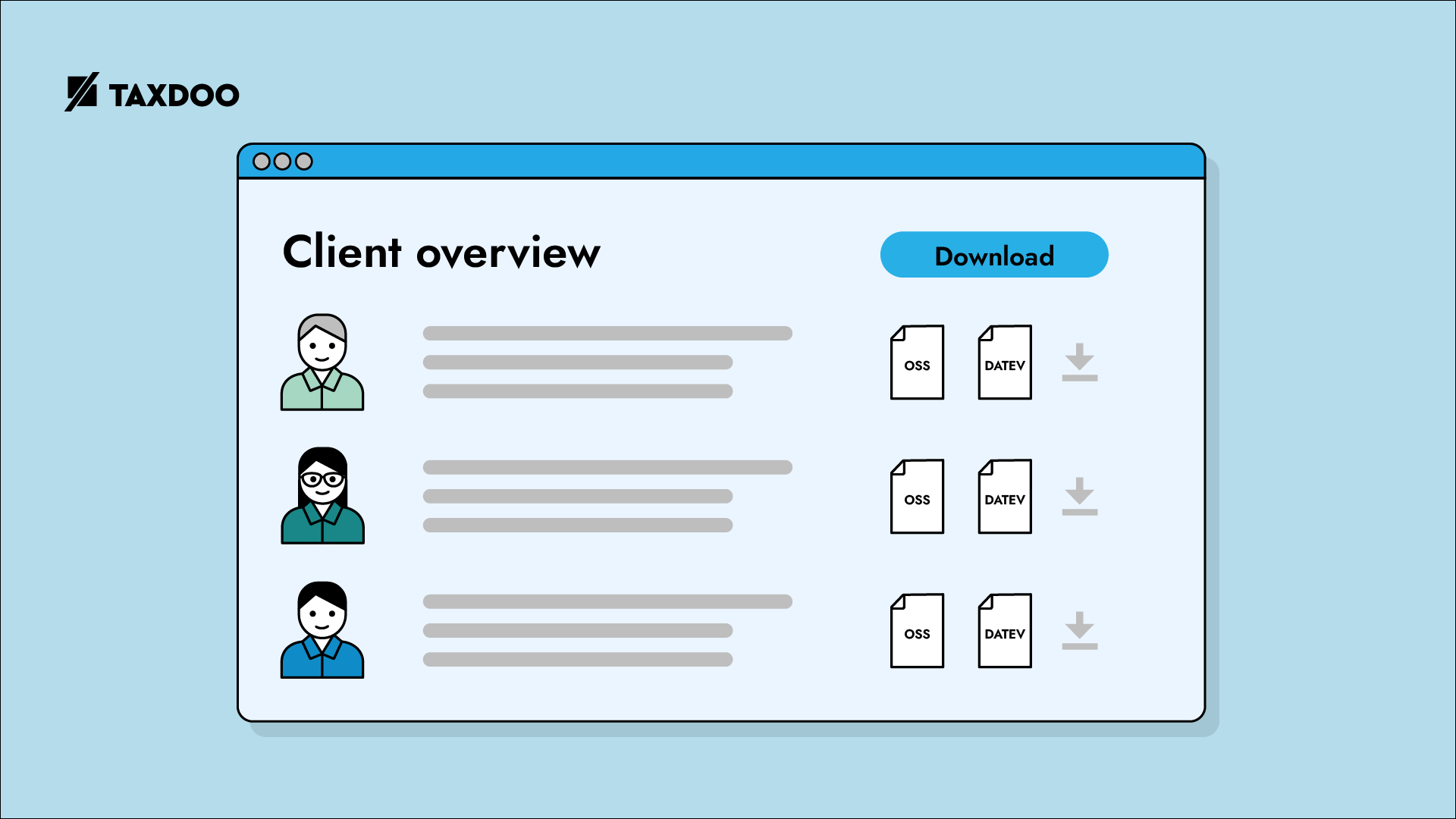

Introducing client overview! Become more efficient when working with multiple clients.

Today we would like to announce our new feature where we focus on helping accountants, tax advisors and, in general, users that manage 2 or more clients through our dashboard.