That has changed: MOSS became OSS

Many of you will remember MOSS (Mini-One-Stop-Shop), which was introduced in 2015. MOSS allowed you to centrally report VAT for sales of digital goods to end customers in other EU countries. Since 2021, the OSS procedure has extended this regulation to include physical goods & products and now offers you the opportunity to easily process all cross-border B2C sales within the EU.

OSS process in application

With the introduction of the OSS procedure, a uniform EU-wide threshold of €10,000 per year (net, totaled across all EU countries) has applied since 01.07.2021. As a result, you as a company may quickly exceed this new turnover threshold. The previously applicable country-specific delivery thresholds of €35,000 or more per country were abolished on July 1, 2021.

If you exceed the annual threshold of €10,000, the place of performance shifts from Germany to the country in which your delivery ends, i.e. your customer's country of residence. This means that you must issue your invoice with the VAT rate of this country.

The turnover that led to the threshold being exceeded is now subject to the VAT rate of the respective destination EU country. This also applies to all intra-Community distance sales in the current year and the following year.

Your options on 1st crossing of the threshold:

- Registration in every EU country: You register in every country to which you deliver and fulfill the tax obligations there.

- Participation in the OSS: You report all relevant sales centrally via the OSS process - easier, faster and more efficient.

Participation in the OSS procedure is voluntary.

Frequent questions about OSS quickly answered

Let us briefly explain the following OSS topics to you in just two minutes:

- Significance of the OSS for VAT

- Validity of the threshold value of 10,000 euros

- Mandatory invoice information for sales tax

- Automatic recognition of distance sales

Amazon as an example of an OSS application

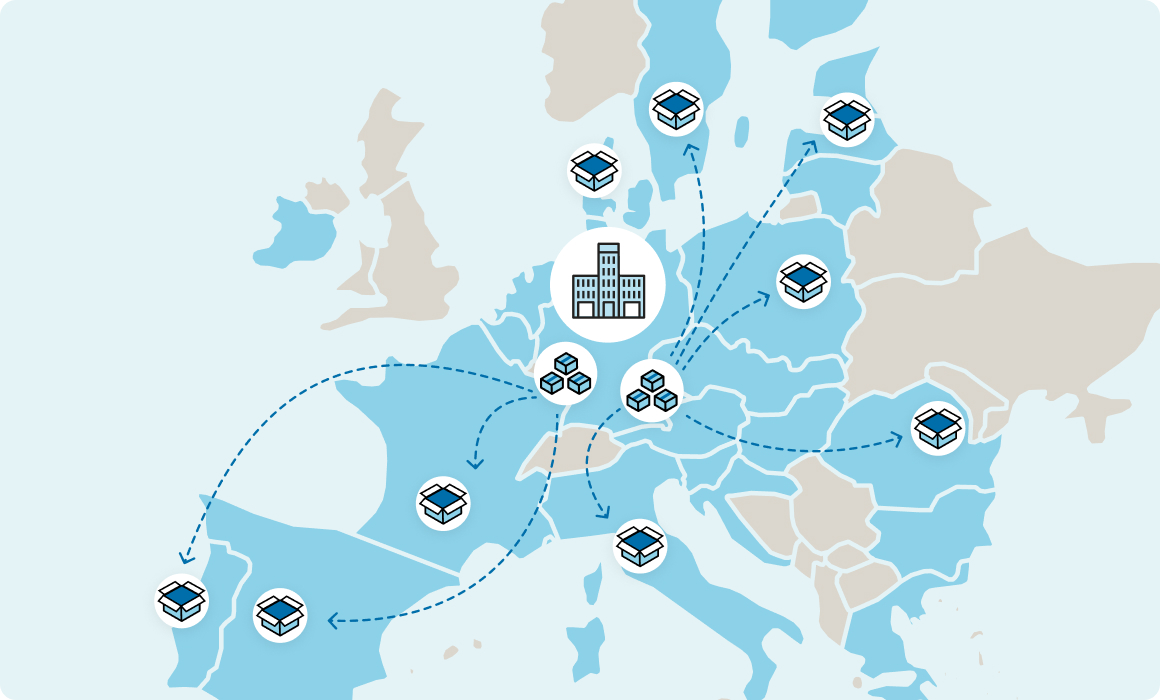

If you use Amazon FBA (Fulfillment by Amazon), you often store your goods in several EU countries. This allows you to take advantage of the fact that the goods reach your customers in other EU countries faster and more cheaply. The OSS procedure simplifies the tax requirements considerably.

Advantages for you as an Amazon merchant:

Instead of having to register for tax in EU countries, a single registration in the OSS is sufficient.

All sales are recorded and processed centrally in a single report.

The BZSt takes over the distribution of VAT amounts to the respective EU countries.

You avoid penalties and errors thanks to centralized reporting and compliance with the correct VAT rates.

Please note: If goods are stored abroad as part of Amazon FBA, you as an online retailer must also register locally in the countries where the warehouses are located.

This is how the OSS works

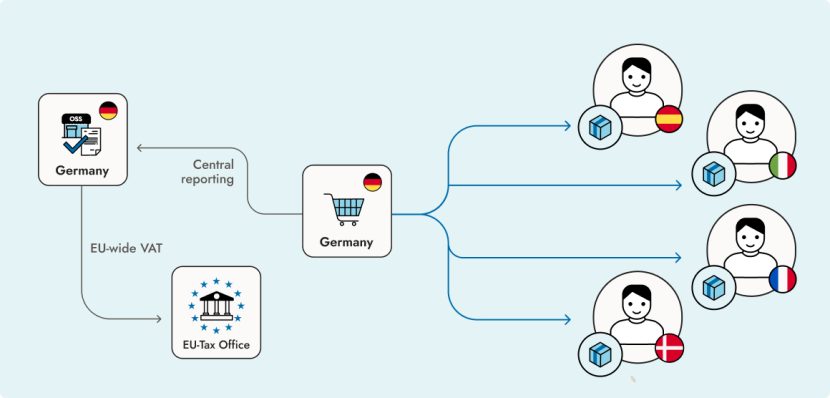

The OSS is a platform that is provided in Germany by the Federal Central Tax Office (BZSt) and is intended as a single point of contact to ensure central VAT compliance in the country of residence.

Online merchants who become liable to pay tax in other EU countries due to their cross-border B2C sales can report their intra-Community distance sales collectively via the OSS and also settle their VAT liability there.

The BZSt distributes the reported sales and the VAT collected to the respective EU states in accordance with the reports. This ensures that you do not have to register for tax in every single EU country and submit VAT returns on an ongoing basis.

Roadmap for your OSS messages

1. Registration: Register in time via the BOP-Elster portal of the BZSt. The OSS procedure can be used from the quarter following your registration.

2. Notifications: To simplify the declaration of your distance sales or services to other EU countries, you must submit your declaration on a quarterly basis. The following deadlines have been set within the OSS procedure:

- Turnover within the 1st quarter up to April 30

- Turnover within the 2nd quarter until July 31

- Turnover within the 3rd quarter until October 31

- Turnover within the 4th quarter until January 31 of the following year

The timely submission of the notification and payment is mandatory as soon as you are registered for the OSS procedure.

3. No turnover: Even if you have not had any relevant sales, you are obliged to submit a reporting.

Benefits of the OSS process

The main benefits of the OSS procedure for e-commerce merchants in the EU are:

You can report and pay your VAT for all cross-border B2C sales within the EU via a single platform. This eliminates the need to register for tax in every EU country you supply to.

By using the OSS procedure, you significantly reduce the administrative burden as you no longer have to submit VAT returns in each individual member state.

Instead of managing multiple tax registrations and declarations in different countries, one centralized, quarterly tax return for the entire EU is sufficient.

As all relevant sales are consolidated in one place, the risk of errors when calculating and reporting VAT is reduced.

Complying with country-specific VAT regulations becomes easier as you can automatically apply the correct VAT rates for each country through the OSS process.

The OSS process gives you a better overview and control over your cross-border sales and tax obligations.

These advantages make the OSS an efficient solution for complying with VAT obligations for intra-Community sales, especially if you deliver to several EU countries.

Limitations and obstacles

Despite the many advantages, the OSS process also has some shortcomings and hurdles for e-commerce merchants:

1. Complexity in determining VAT rates: As you have to pay VAT at the tax rate of the destination EU country, you need to familiarize yourself with the different VAT rates and tax rules in the respective countries. This can lead to increased administrative work.

2. No input tax deduction possible via OSS: In the OSS procedure, you cannot claim input tax for expenses in other EU countries. To get the input tax refunded, you still have to submit separate applications in the respective country, which means additional work.

3. The VAT is only transferred to one location: to the BZSt or to an account at the Federal Treasury. Please note: Direct debit by the BZSt within the framework of the OSS is not possible. You must ensure that you transfer the VAT amounts owed to the Federal Treasury in a timely manner.

4. Increased administrative effort for correct invoicing: You must ensure that your invoices contain the correct VAT rates for the countries to which you deliver. With many different countries and changing regulations, this can be error-prone and time-consuming.

5. Accounting adjustments: Your accounting software or processes may need to be adapted to take into account the correct tax rates and reporting obligations. This may result in additional costs and implementation effort.

6. Complexity of returns and credit notes: When your customers return goods, you also need to ensure that the VAT refund is processed correctly, which makes managing additional tax refunds more difficult.

7. High demands on IT infrastructure: In order to use the OSS process efficiently, a well-functioning IT infrastructure is required that automatically takes various country rules and tax rates into account. Smaller retailers in particular could face technical challenges and costs here.

8. Restriction to B2C sales: The OSS procedure only covers sales to end consumers (B2C). Other procedures must still be used for B2B transactions, which can lead to additional hurdles for mixed business models.

These points make it clear that although the OSS procedure simplifies many processes, in practice it also brings with it new administrative requirements and technical hurdles that need to be well prepared and managed. If there are repeated errors and delays in reporting, there is a risk of exclusion from the OSS procedure in the event of repeated non-compliance.

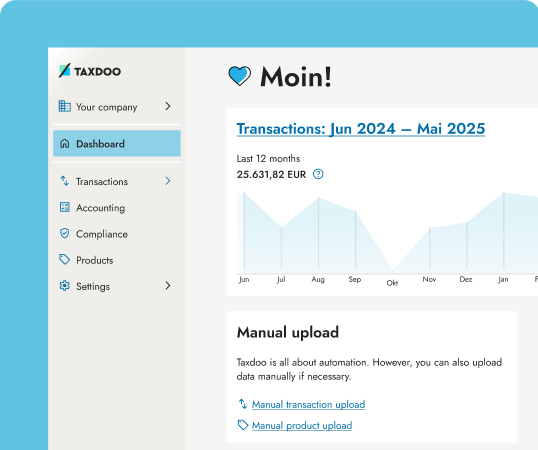

OSS declarations simply completed via Taxdoo

Automated data collection: Taxdoo automatically collects and structures all relevant transaction data for your OSS reports.

Full support with registrations: We take care of all the necessary registrations and notifications for you in the EU countries in which you are active.

Individual consultation: In a free and non-binding initial consultation, our experts will show you how Taxdoo can help you comply with all tax reporting obligations and ensure greater legal certainty.

With Taxdoo, you save time, reduce errors and have the certainty that your tax obligations in the EU will be fulfilled correctly and on time at all times. Our experts will be happy to advise you in a free and non-binding initial consultation.

“The One-Stop-Shop (OSS) procedure offers e-commerce merchants a number of simplifications. It simplifies the processing of cross-border sales and reduces the administrative workload in day-to-day operations. At Taxdoo, we know that time and accuracy are crucial in e-commerce. That's why we support merchants with automated solutions that not only simplify the handling of the OSS process, but also make it nearly error-free. In addition, we actively support online retailers with other challenges that the OSS process cannot yet cover or that can lead to errors. This allows our customers to concentrate on what really matters - growing their business.”

Dr. Roger Gothmann

CEO at Taxdoo and former tax auditor & tax official at the Federal Central Tax Office

OSS and non-EU countries such as Switzerland

As Switzerland is not an EU member state, you cannot use the OSS procedure for your sales to Switzerland. Instead, you must comply with Switzerland's specific tax and customs regulations.

For trade with Switzerland, this means that you will have to complete customs formalities and possibly pay import VAT if goods leave the EU and are imported into Switzerland. You may also be required to register with the Swiss tax authorities if your turnover in Switzerland exceeds a threshold of CHF 100,000 per year. In this case, you must pay VAT directly in Switzerland.

An alternative is for your customers to pay the tax and customs duties on import. However, this can complicate the sales process and potentially lead to delays.

For sales to Switzerland and other non-EU countries, it is important that you inform yourself about the country-specific regulations and ensure that all taxes and customs duties are handled correctly.

Looking to the future of the OSS process & ViDA

The future of the OSS procedure brings exciting innovations that should make cross-border trade even easier for you. The planned EU reform “VAT in the Digital Age (ViDA)” is particularly important here.

What is ViDA and how does it help you in e-commerce?

The ViDA reform (VAT in the Digital Age) was specially developed to further simplify and digitize VAT compliance in e-commerce, especially for trade in physical goods. ViDA brings the following key changes for you as an online merchant:

1. Mandatory electronic invoicing and real-time reporting:

Mandatory electronic invoicing will be introduced for cross-border sales, combined with real-time reporting of transactions. This will make VAT invoicing more efficient and transparent while avoiding manual errors.

2. Harmonization of VAT rules:

ViDA removes the complexity by standardizing the requirements for the taxation of physical goods within the EU. For you, this means clear and uniform handling of VAT regardless of the destination country.

3. Central VAT registration for all EU countries:

Instead of having to register individually in each EU country you deliver to, there will be a central one-time registration. This will allow you to process your sales via a single system and save a considerable amount of administrative work.

ViDA makes it easier for you as an e-commerce trader to trade physical goods across borders by reducing administrative processes and ensuring that you can efficiently comply with VAT regulations throughout the EU.

Increased automation and digitalization of procedures will make it even easier for you to comply with your VAT obligations efficiently in the future. Digital tools can help you to better manage the different tax rates and regulations of the member states. At the same time, compliance monitoring will be improved to ensure that you implement the VAT regulations correctly in all EU countries and can therefore act with legal certainty. The implementation of these measures is planned for 01.07.2028 at the earliest.

Checklist for the OSS procedure

1. Make sure that you can determine tax rates automatically and EU-wide!

2. Register for the OSS!

3. If you participate in the Amazon Pan EU program - or similar programs - then you must identify your distance sales and then report them via the OSS, but all other transactions (B2B transactions, input tax and local sales) must still be reported via local registrations in other EU countries.

4. If point 3 applies to you, regularly ensure that you do not report transactions twice (OSS and local registration) or not at all! This can happen quickly due to the additional complexity.

5. If you do not meet the deadlines for submitting the OSS declaration and paying the OSS tax liability, you may face sanctions, including exclusion from the OSS procedure.