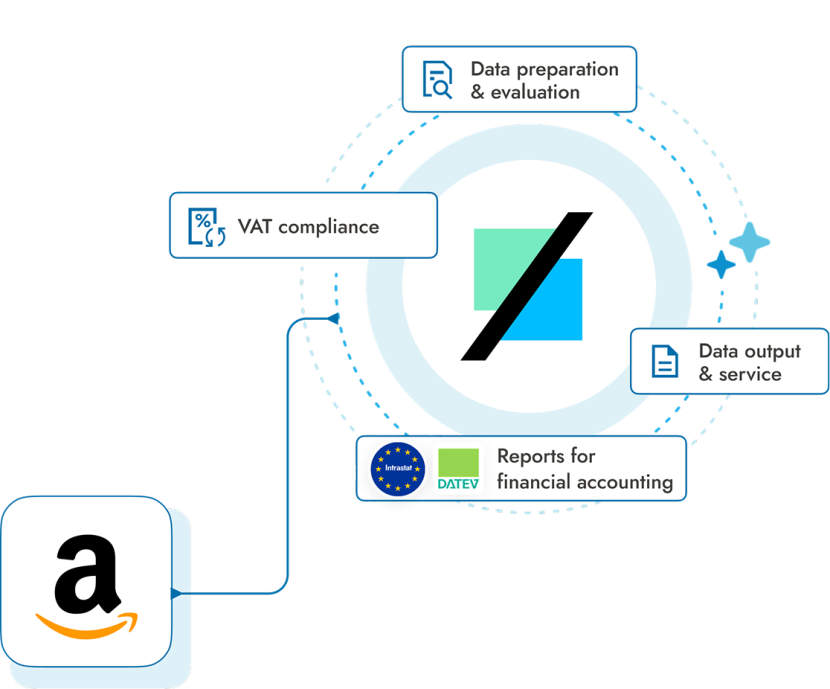

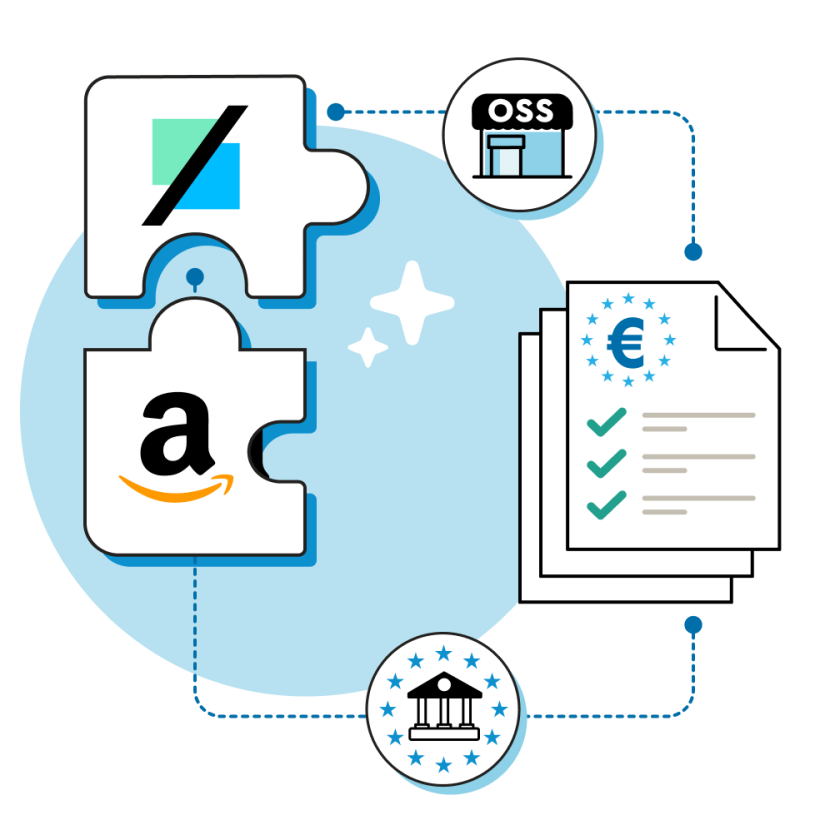

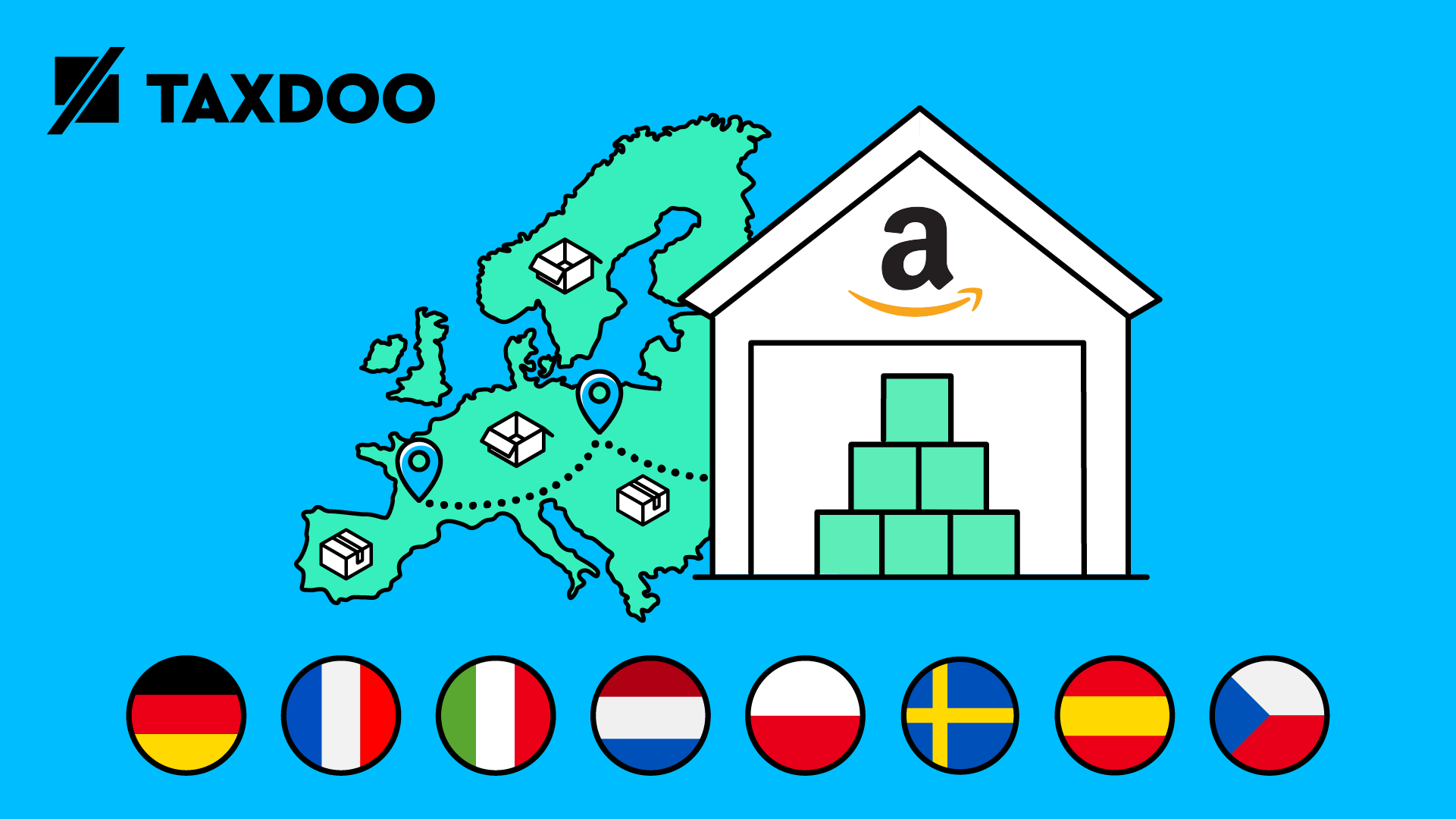

Amazon PAN EU: What should be considered at Value Added Tax?

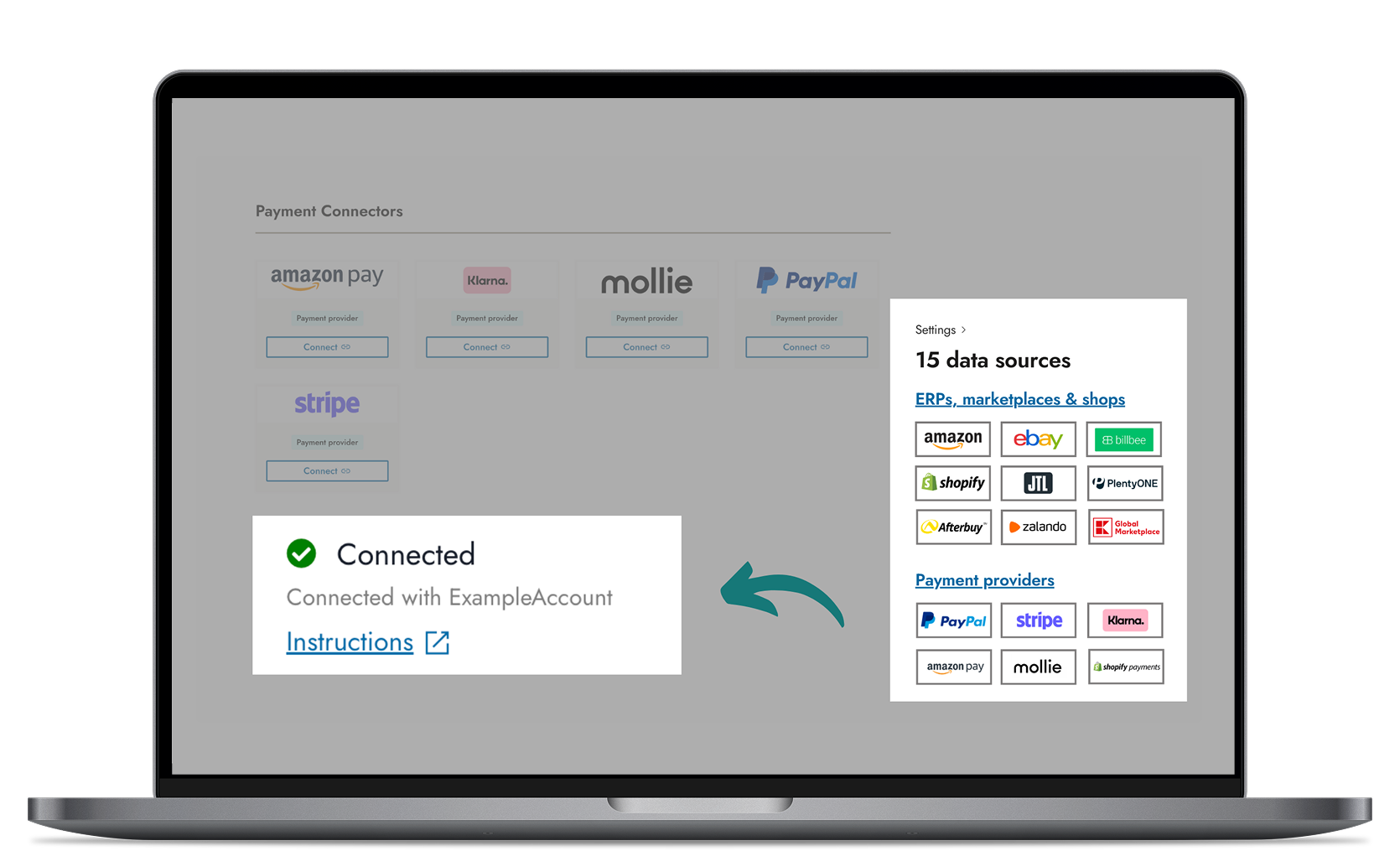

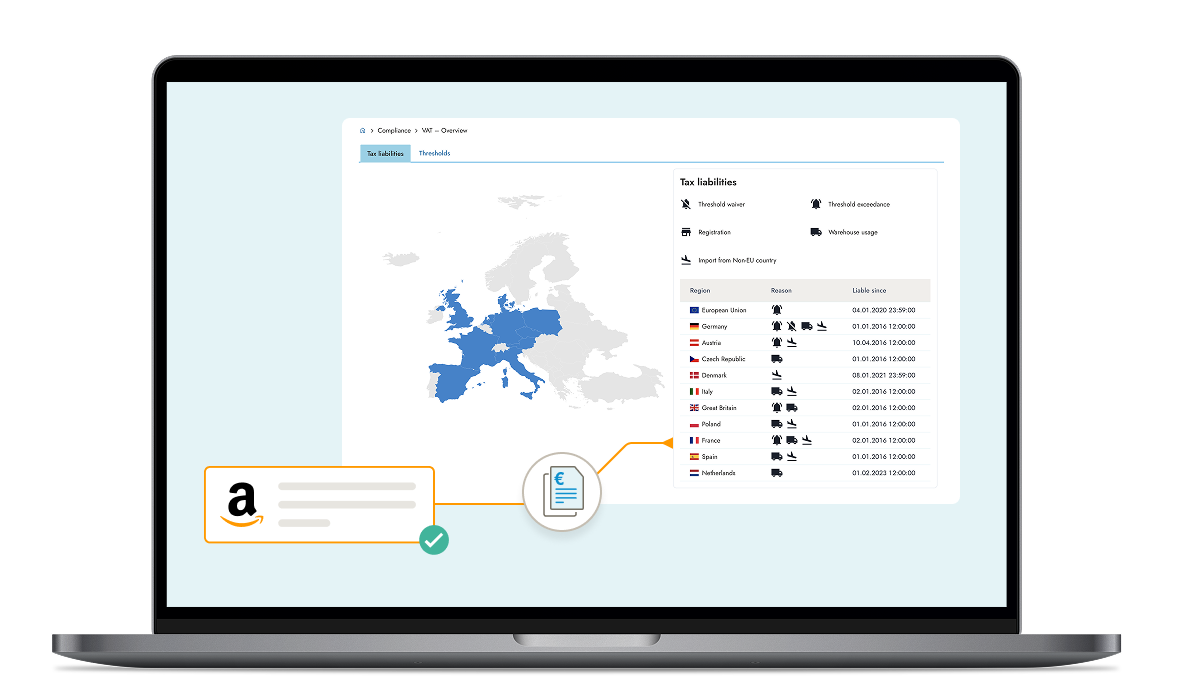

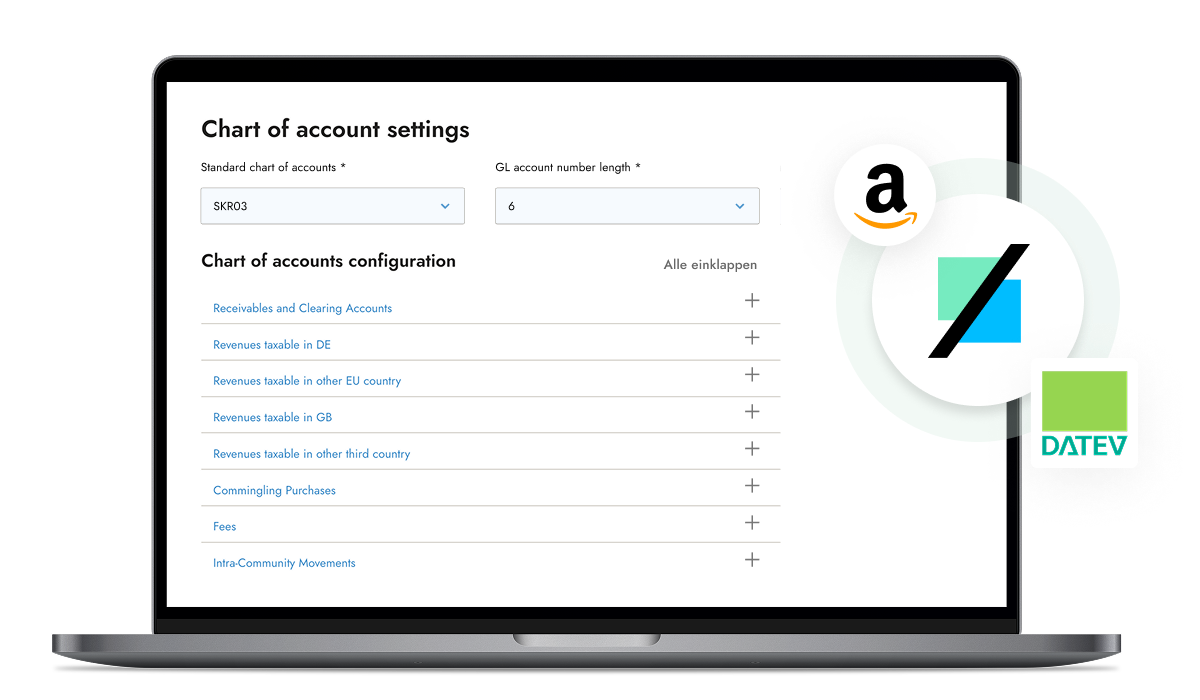

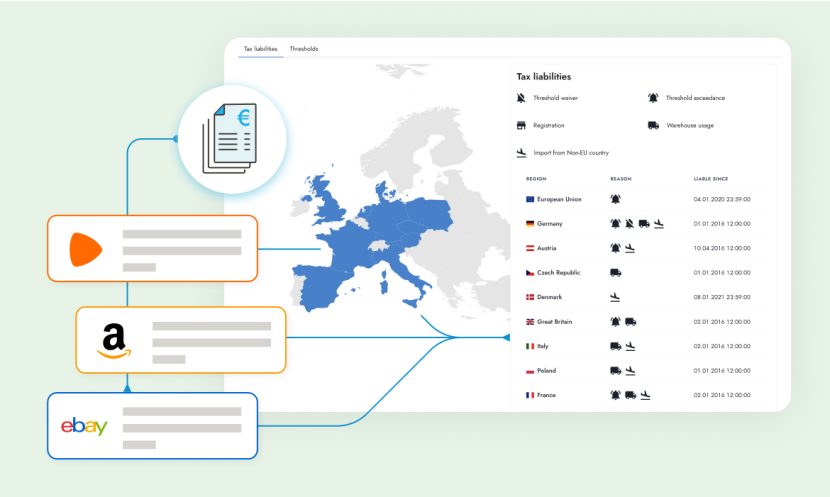

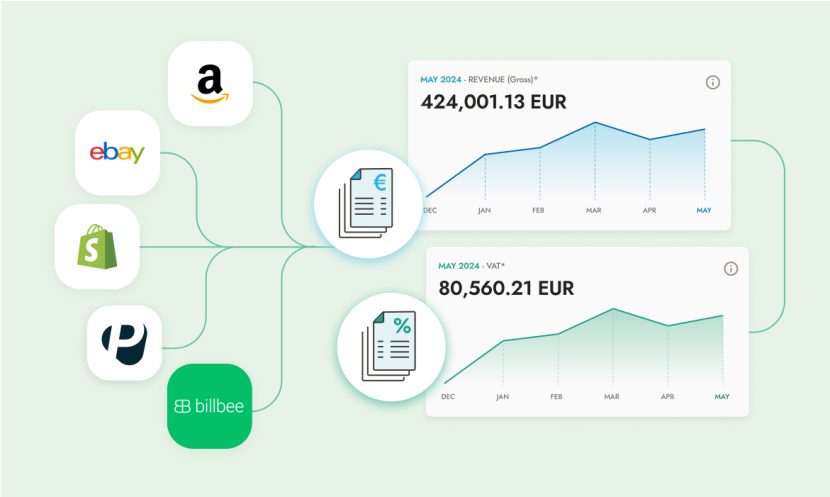

With Amazon PAN-EU, traders of all sizes can open up a market of many hundreds of millions of inhabitants with shipping in the respective EU country at the push of a button. In addition to the advantages of PAN-EU, sellers should also be aware of the various Value Added Tax obligations at home and abroad.