Post Amazon Commingling Transactions Correctly

The – transaction Value Added Tax Report of Amazon – Data basis for the financial accounting of all Amazon-traders – contains new transaction types for some time now: Commingling_Sells and Commingling_Buys.

Especially for Amazon Pan EU and CEE traders, complex VAT issues are behind this.

We had already reported on this in detail several months ago.

The big challenge now for many traders, accountants and tax advisors is the proper recording and accounting of these transactions.

Bad news first.

No automation of all accounting programs for cross-border commingling transactions

Amazon-Dealers who have their products stored in other EU countries, e.g. within the framework of Pan EU or CEE, do not have standard automated systems – in all available accounting systems (DATEV, Lexware, Addison, …) – available.

Commingling transactions, however, regularly lead to incoming and outgoing services in other EU countries for Amazon Pan EU or CEE traders.

What has to be considered from an accounting perspective?

Commingling transactions briefly explained

The mantra behind commingling transactions is Amazonto deliver to end users as quickly as possible.

For this reason, identical products from different dealers have been exchanged Amazon for many years, if it serves to shorten delivery times.

(Note: This affects traders who have activated the so-called mixed stock. Only in this case may Amazon identical products be exchanged between different traders).

This happens very frequently on the basis of our data and regularly leads to transactions relevant for VAT purposes, which Taxdoo already pointed out more than four years ago.

For a few months now, Amazon these transactions have also been reflected in the data.

But that’s not all it takes. The following must be taken into account for proper accounting.

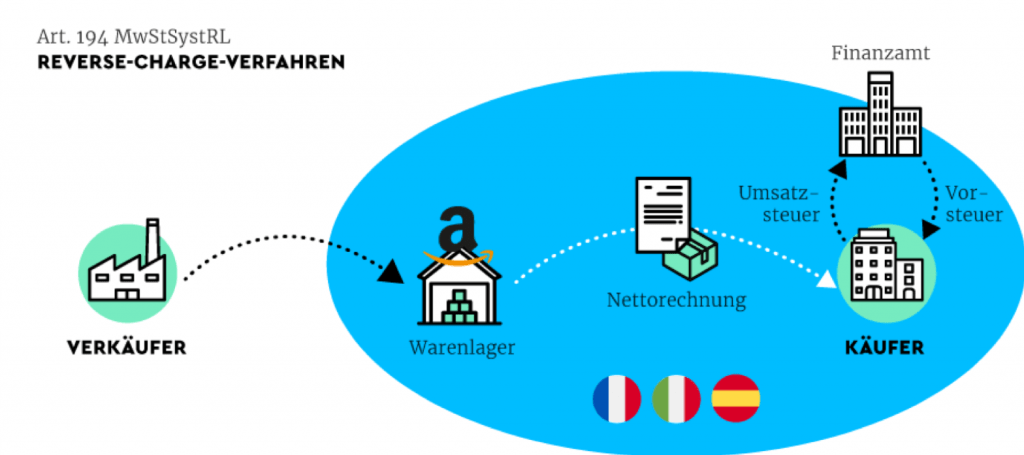

Output power: Art. 194 VAT system or local reverse charge procedure

Commingling_transactions forceAmazon traders to sell their products to other Amazon traders – so-called commingling_sells.

Under certain conditions, these B2B sales are subject to the local reverse charge procedure in some EU countries. In this case, the purchaser must Value Added Tax withhold and pay them to the local tax office.

In a mirror image, the acquirer must recognise a corresponding input power in the context of the commingling transactions.

Input power: Input tax deduction in other EU countries

These input services – commingling_buys – regularly lead to a claim for input tax deduction.

This is also an accounting challenge if this input tax claim arises in another EU country – e.g. in France, Spain, Italy, …. – and you have to pay foreign input tax of 20, 21, 22, … percent and must be entered and represented in the accounts.

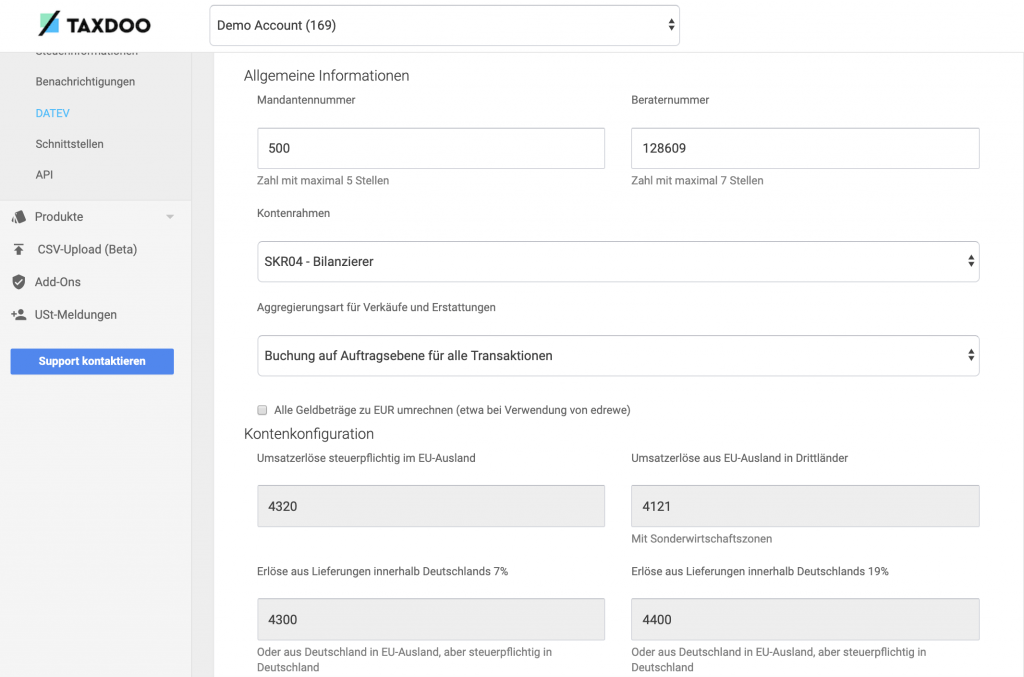

Fully automated booking of all commingling transactions with Taxdoo as official partner of DATEV

Taxdoo is an official partner of DATEV in online trading.

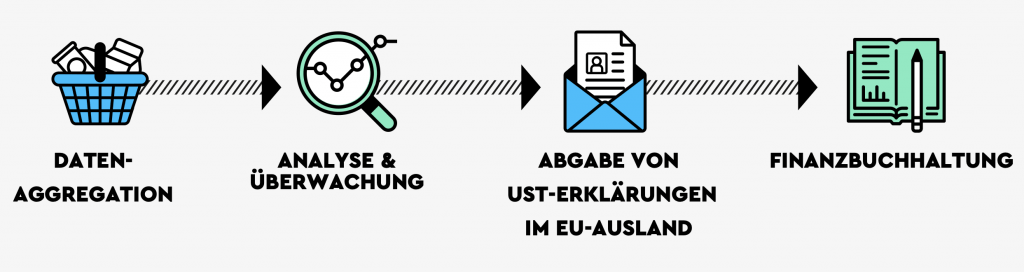

Via our online trade-to-DATEV interface, we can record and evaluate commingling transactions – and of course all other transactions in online trading – fully automatically and transfer them to financial accounting.

We can also offer this process with unlimited retroactive effect.

You want to know more and talk directly to an VAT- and financial accounting expert?

Then use this link to book your individual and free initial consultation!

Taxdoo obtains transaction data directly and automatically from all relevant market places and ERP systems, reports these abroad and transfers them to financial accounting at the push of a button, e.g. via our DATEV interface.

Weitere Beiträge

Amazon’s Value Added Tax calculation service (VCS) and OSS

Amazon in Sweden, storage, shipping: VAT liability for FBA traders?