Opening up the French market with Cdiscount and Taxdoo

Le jour de gloire est arrivé!

Just in time for the national holiday of our neighbours we publish our connection to Cdiscount. ??

What’s Discount?

Cdiscount is the largest marketplace in France after Amazon.fr. The marketplace is operated by Groupe Casino, one of the largest retailers in France. Currently, 63 million products from 12,000 retailers are sold there. The most important categories are electronics, children’s supplies, fashion and furnishings. Cdiscount receives 20 million visitors per month. In addition, Cdiscount also offers its sales staff the use of its own logistics, similar to Amazon the FBA programme, with more than 500,000 square metres available in three warehouses. Cdiscount delivers from its own warehouses to France, Spain, Belgium, Italy and Germany.

The fees start at currently 39.99 € per month plus 15% commission for most products, more information can be found here. You are interested in selling on Cdiscount? On this page you can create an account at Cdiscount and start selling.

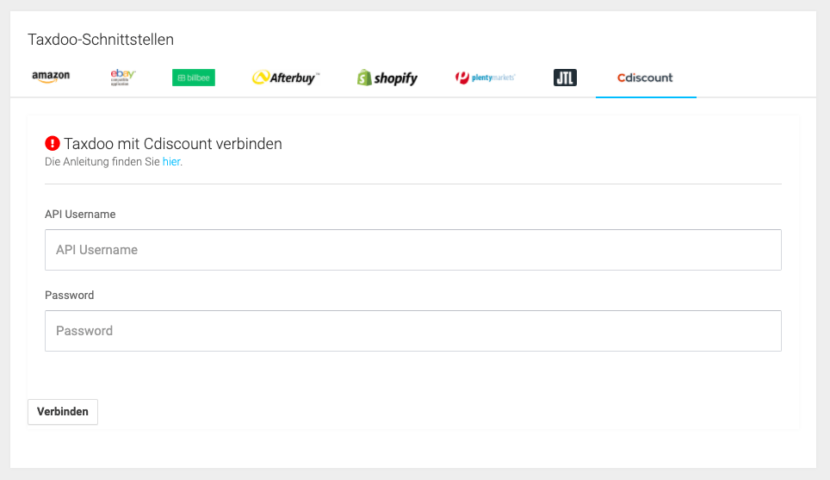

This is how you connect Ciscount to Taxdoo

The connection is very simple. You only have to create a new API user in Cdiscount and deposit the access data at Taxdoo. Done.

Subsequently, we import new transactions directly into Taxdoo every day and add them to your evaluations. If you use the logistics of Cdiscount, we will automatically identify the right warehouse and of course recognize transactions within France. All of course without additional costs.

Do you need a French VAT-Id?

At present (2020), a delivery threshold of EUR 35,000 net applies to France. As soon as you have exceeded this, you are liable for VAT in France for deliveries to France and need an VAT-Id.

The warehouses of Cdiscount are currently all in France. So if you want to use the logistics of Cdiscount, you need a valid French VAT-Id.

The application for a VATID for France currently costs 500 EUR once via Taxdoo, plus 79 EUR per month for the submission of VAT returns. For the order a short e-mail to our support team is sufficient.

How can Taxdoo also support me?

Taxdoo is the compliance platform for the digital economy. For leading online retailers in Europe, we provide ongoing Value Added Taxcompliance, Intrastat and financial accounting (Taxdoo is a partner of DATEV).

If you want to know more about how you Value Added Taxcan efficiently and securely map compliance, financial accounting and much more via a platform, then book your individual and free initial consultation with the compliance experts from Taxdoo!

You are also welcome to register for our regular demo webinar in which we will introduce Taxdoo and our compliance services and answer your questions personally.