Tax registrations in other EU countries – Common mistakes and solution(s)

If delivery thresholds are exceeded or warehouses (e.g. of Amazon) are used in other EU countries, tax registration in the respective EU country is essential.

Whoever overlooks or deliberately ignores this, must expect criminal tax proceedings – even in Germany.

However, anyone wishing to register for tax in another EU country often faces high bureaucratic hurdles and disproportionately long waiting times.

In the following we will show what this is often due to and how these problems can be solved.

Registration in other EU countries: Common mistakes

As a rule, a tax registration in another EU country should be completed after 8 to 12 weeks, after the responsible tax office has received all the necessary papers and documents.

Frontrunners such as Austria and Great Britain, for example, in some cases even make it within a few working days.

But why do we keep hearing and reading about online merchants who have been waiting for their tax number in some EU countries for over a year?

You will find below some reasons for such delays.

- Documents are lost in the mail or cannot be allocated on site.

- Many EU countries require proof that a tax liability actually exists-for fear that so-called straw men will want to register for tax.

- Even small formal errors can lead to applications not being processed in some EU countries.

- No connection to the tax authorities: Without direct contact to the local tax authorities, the applicant often does not find out why his registration process is stalled.

The solution to these problems is obvious: a process that is automated as far as possible and above all transparent.

We have implemented this.

Registrations in other EU countries at a glance

Taxdoo is the first and only automated one-stop shop for Value Added Taxcompliance in online trading in the EU.

In addition to the submission of all VAT-relevant reports, this also includes tax registrations in the EU.

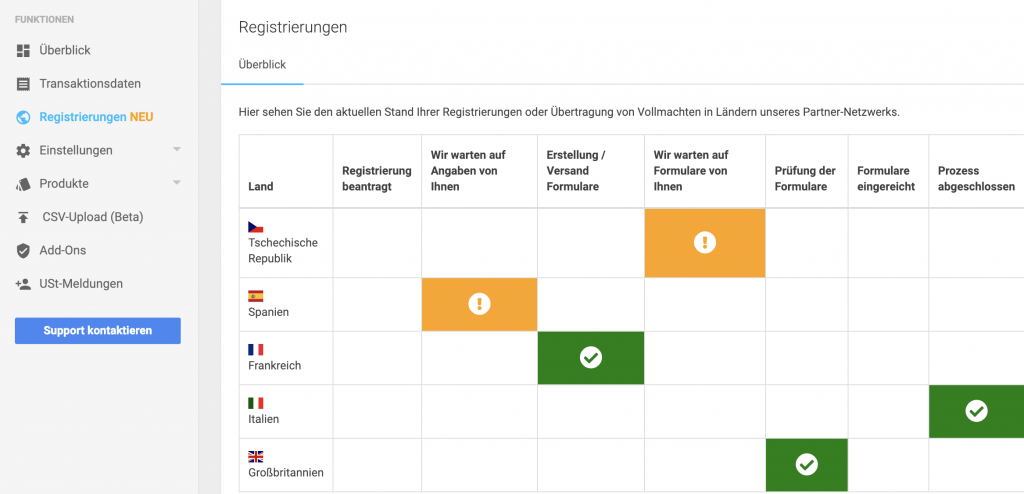

Taxdoo-users, online-dealers and tax advisors see immediately in the dashboard, how the current state of their tax registrations is.

You can follow every single step from the receipt of your application for tax registration in another EU country to the completion of the process.

If information is required from you, our system will automatically send a message to you or your accountant and display it in the dashboard.

Taxoo: Automated Value Added Tax in online trading

Taxdoo automatically obtains data from AmazoneBay and the most common ERP (e.g. Afterbuy, Billbee, plentymarkets or JTL) and shop systems (e.g. Shopify), prepares them for sales tax, transfers them to financial accounting and can also report them abroad.

Automated reporting in other EU countries is possible from 79 euros per month and per country, in addition to a basic price for data preparation.

Simply click here and book a live demo in which we personally explain the advantages of our automated Value Added Taxcompliance to you and/or your tax advisor via screen transmission.