Accounting in e-commerce: from a low-margin miscellaneous business to a blueprint for an efficient division of tasks between technology and tax consulting in the AI age

A model is currently being developed in e-commerce that is intended to serve as a blueprint for a key question: How can technology and tax consulting efficiently complement and empower each other in the AI age?

The key question is: How can the symbiosis of individual tax advice, reserved tasks and efficient automation be achieved – thought through from start to finish and for the greatest benefit of the client?

Mantra for years: Accounting will disappear!

Every tax expert has probably heard this truism regularly for over a decade. Little to nothing has happened so far.

Why?

Because “disappearance” was and still is simply too short-sighted. Technology never serves an end in itself, and problems generally never disappear—not even if we ignore them.

At its core, it is always about the question: Where and how can technology be used for a clearly defined goal and benefit?

I am speaking here for my industry – e-commerce – and from the experience of working with over 800 tax firms: this goal and the associated benefits have never been clearly defined. We’re now addressing this.

Accounting: a collection of different activities and processes

If you don’t understand a problem in depth and in its components, you will rarely find a solution to it.

Let’s break down what is generally understood as accounting in e-commerce.

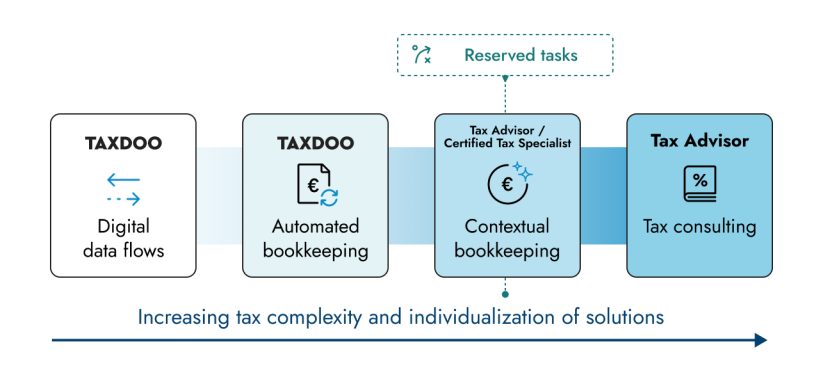

1. Digital data flows: the foundation

Automation begins with interfaces to marketplaces, shops, and payment providers. These ensure clean data flows and form the basis for a key question and the central principle of the GoBD: Is the accounting complete?

2. Automated accounting: currently the greatest automation potential

Standard cases, document reconciliation, technical reconciliations: This is repetitive and algorithm-based work with low perceived value – yet enormous amounts of data. This is precisely where the greatest potential for automation lies. But it’s also precisely where the greatest potential for errors currently lies in practice – with implications for the two following steps.

3. Contextual Accounting: Experts & Machines

Where automation reaches its technical limits and tax context is required, a hybrid approach combining tech and tax, or experts and machines, emerges: with high demands on both. In accounting, we then regularly discuss the clarification of individual issues and the associated tax assessment.

4. Tax advice: proactive, data-based and a premium product

No more accounting – but closely linked to it. At the end of the process is the actual consulting: closing, tax return, strategy. This involves considerable effort, but also the greatest (perceived) benefit for the client – provided the path and the fundamentals are right.

accountDigital + Taxdoo: a platform for automated accounting and enabler for proactive and data-based tax advice

Tax firms today face the challenge of efficiently managing e-commerce mandates – despite growing data volumes and a shortage of skilled workers. The solution: a clear division of labor between machine-based, scalable accounting and contextual tax expertise.

Strategic acquisition for a new infrastructure

In April 2025, Taxdoo acquired 100% of the shares in accountDigital – with a clear goal: to create a platform for tax firms on which both data collection and automated accounting are scaled and standardized using AI.

One product – two tasks: Automation & relief

Tax offices receive automated accounting from us (see step 2 above) as a finished product directly in DATEV. We reliably handle the mechanical booking processes so that you can concentrate on what is the core of their work: contextual accounting (including, where applicable, reserved tasks) and tax advice.

Scaling meets practice: Hundreds of mandates already integrated

The Taxdoo + accountDigital platform already automatically processes the data of hundreds of e-commerce clients. This provides a proven, productive accounting infrastructure that can be seamlessly integrated into the firm’s and DATEV processes.

New clarity: What AI can do – and what only tax experts can do

Our platform enables a clear separation between machine-based and contextual tasks. Transactions and payments are processed and decrypted daily to provide a transparent and timely picture of business transactions.

This database forms the basis for proactive, data-driven tax advice from tax firms.

Resource focus: Skilled workers make the difference

Especially in times of limited capacity, one thing is particularly important: the targeted deployment of specialists in tax offices. Our platform ensures that staff are deployed precisely where they create added value – in tax classification and client consulting.

accountDigital + Taxdoo: the vision and the people behind the platform

For us, the acquisition of accountDigital is far more than a traditional merger. It represents a clear commitment to automation at the highest level and to close collaboration with the law firm community.

With accountDigital we are strengthened by 30 experienced accounting professionals who efficiently onboard clients and continuously review the results of our AI-based processes.

Tax advisor Stefan Gostomzik plays a central role in this. Since the merger, he has focused entirely on the further development of our technology – and is a direct, equal point of contact for tax advisors and all Taxdoo teams.

Product managers with skin in the game

Stefan is a tax advisor who has experienced every challenge one might encounter in e-commerce accounting for years. He is now responsible for our product development in the accounting area and is able to focus on it 24/7. And I can assure you, 24/7 is not a commonplace term.

Stefan’s central wish, which he had previously only addressed to the accountDigital team, is now directed at all tax firms out there: “I’m only satisfied when someone ruins my weekend because they showed me a transaction that our technology can’t yet (correctly) map.“

This founder DNA, to personally vouch for the product at any time and anywhere, was the decisive reason why we chose accountDigital. This Always-Day-1-Spirit we will protect like our greatest treasure, because that is what it is.

But there is also a partnership-based error culture, which for us is the core to create broad acceptance for the platform solution in the market.

What does this mean?

We develop the product together with the users = tax offices.

What’s next? Pilot phase with the first tax offices starting in September

Over 200 tax and e-commerce experts met at the Taxdoo Innovation Summit 2025 in Hamburg to discuss with thought leaders such as Philipp “Pip” Klöckner (Doppelgänger Podcast) and tax consultant Stefan Groß (“Taxpunk”): How is AI changing our work – now and in the coming years?

Taxdoo CEO Dr. Christian Königsheim presented the platform to the general public for the first time. Tax firms were then given the opportunity to register for a pilot phase.

You also want to take part in the pilot phase?

Then register now and actively help us shape the future!

This pilot phase will start in September and we will publicly report on it. Doing this, we want to create trust through transparency from day one.

Because the most important thing that lies before us now cannot be solved with technology.

With optimism and enthusiasm: Transformation begins in the head and ends in the heart

Luisa Stalla, who also participated in the Taxdoo Innovation Summit 2025 as Transformation Manager of the German Tax Consultants Association (DStV), summed it up in a personal conversation: “Every successful transformation begins in the head and must end in the heart.“

That is what we are concerned about and what we are currently working on with absolute focus!