Efficiency & compliance for tax consultants and accountants Thanks to automated VAT and preparatory accounting for online merchants.

- Sales, returns, fees, payments and movements – all in one software

- Automated, audit-proof VAT assessment

- DATEV-compatible, GoBD-compliant CSV exports

- VAT registrations & returns in the EU and UK

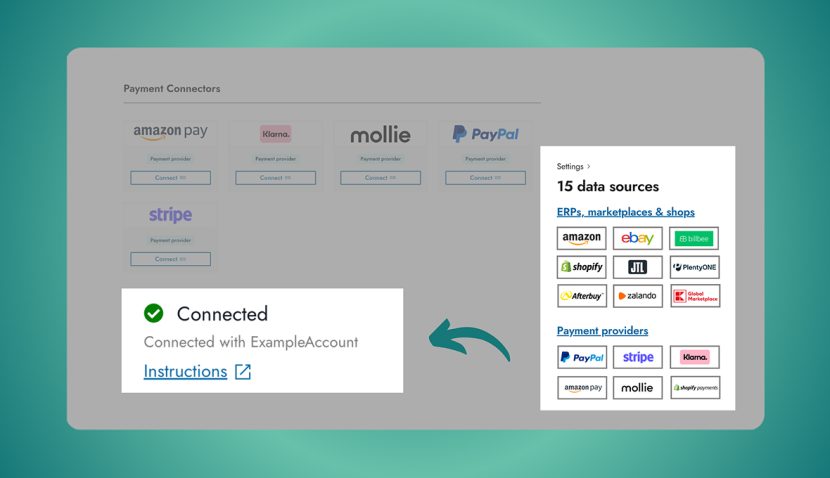

Connectors to over 20 marketplaces, shops, payment, and ERP systems used by your clients seamlessly connect us with e-commerce.

Modern e-commerce.

A challenge for tax firms and accountants.

You have clients who are active as e-commerce merchants and sell their goods in the EU and/or UK?

Then you'll certainly also be sweating over these points on the 10th of each month:

Manual

collection of transaction data

Manual

VAT valuation

Manual

formatting of Excel spreadsheets

Manual

calculation & booking of fees

Manual

matching of sales & payments

High manual effort.

Numerous risks.

Missing documentation

The lack of proper documentation of all transactions can lead to incorrect accounting and a shortfall in VAT compliance.

Mistakes when paying taxes

Failing to correctly collect and evaluate all transactions for VAT purposes increases the risk of paying too much or too little tax.

Time pressure and lack of consultancy

Especially with well-running e-commerce businesses, tax consultants often are very busy – the actual consultancy work is then falling short.

Risk of fines

If your client does not meet their tax obligations both at home and abroad correctly and on time, this will result in late payment penalties and surcharges.

Software for automated VAT and preparatory accounting.

More efficiency

Taxdoo automatically imports all transaction data via connectors, processes it according to a standardised procedure and optionally carries out returns and registrations in the EU and UK. This makes accounting significantly more effective.

More security

Thanks to state-of-the-art technology, combined with expert knowledge, we fully automate VAT evaluations for each transaction and process returns accordingly. For you, this means one thing above all: security.

More transparency

Our intelligent software records each transaction separately on the revenue and payment side, allowing data to be traced and verified in compliance with GoBD, from the source to accounting to tax returns.

Our solution.

Your benefits.

Taxdoo is the perfect support for tax consultants and accountants whose clients operate in e-commerce. Our software simplifies VAT compliance and financial accounting.

Your benefits in detail:

Make decisions based on

transparent data

In the Taxdoo dashboard, you will find all of your client's transaction data in one reliable and organized place – collected fully automatically and precisely evaluated for you. This ensures you always have a clear overview of all bookings and payments from key marketplaces, shops, payment, and ERP systems, knowing exactly which fees are incurred.

Save time and avoid errors

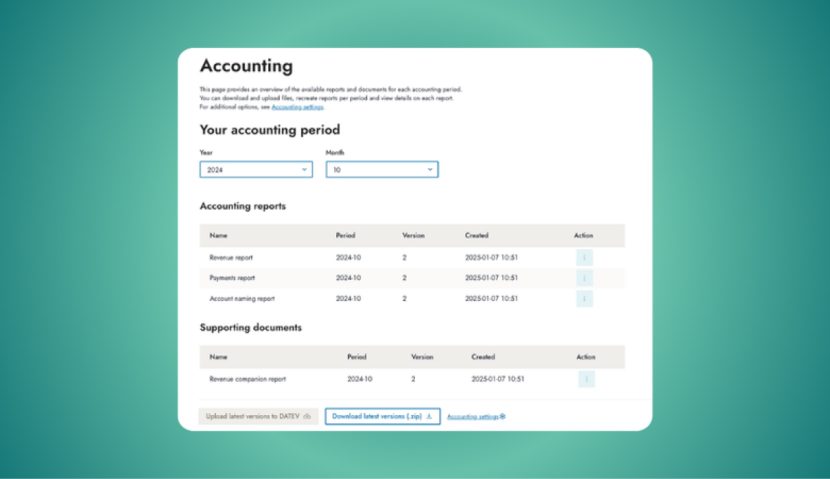

with our DATEV add-on

Thanks to our add-on, you benefit from automated processing of revenues, payments, fees and movements in a DATEV-compatible CSV format, including support for the DATEV OPOS and clearing functions. Payments and sales are automatically matched for you regardless of data volume or turnover and can (optionally) be transferred to DATEV via the "DATEV Buchungsdatenservice" in a legally compliant and data-accurate manner.

Receive fully automated

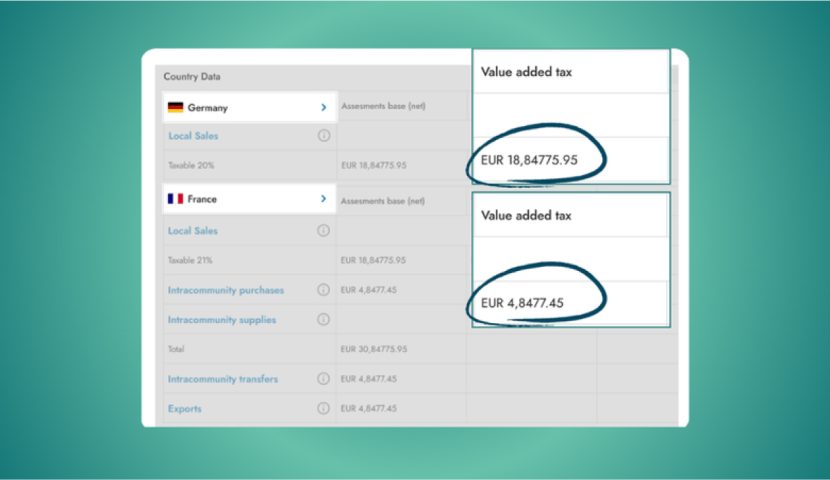

VAT evaluation

Our software, developed by VAT experts, automatically applies the correct VAT rates to your client’s transaction data across the EU and UK – taking into account legal regulations, storage conditions, sales thresholds and special cases or reduced tax rates. You take no legal risk and have time for your clients.

Find discrepancies

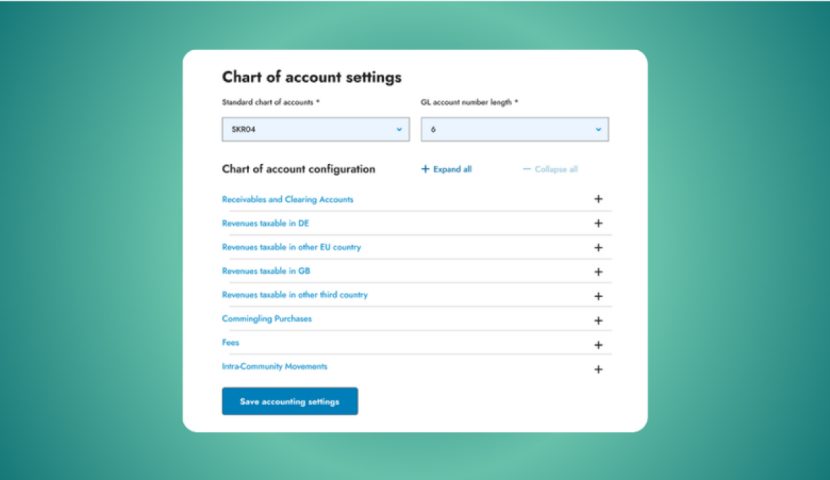

at a glance

The granular and customisable general ledger accounts for debtor and clearing accounts, sorted by source, provide you with an ideal overview and allow you to compare the data. You can also keep an eye on changes at all times. This makes it easy for you to identify discrepancies and balances in your clients' accounting and process them efficiently.

Three simple steps

to efficient accounting with Taxdoo:

Get free consultation

By clicking on “Get free consultation”, you can quickly and easily book a free session with our tax experts, in which we will inform you about the numerous advantages of Taxdoo for tax consultants.

Product presentation with clients

The next step is a meeting between your client, Taxdoo and you, in which we present our product to you in detail, clarify any questions you may have and together find the right price package for your client.

Setting up the Taxdoo account

Once your client has opted for Taxdoo, all you have to do is set up your account and connect all systems via API connectors – supported by our experts. Bye, bye, bureaucracy! Hello, efficiency!

Figures that speak for us:

work with us

in the last 12 months

Sounds interesting?

Get a free consultation now!

Book a non-binding consultation today and discover how you can benefit from these advantages:

- Exclusive support from qualified accounting specialists

- Dashboard for digital and automated mandate processing

- Data preparation including DATEV export for download

- Quality assurance by experienced VAT experts

- Optional: registrations and returns in the EU & UK, incl. OSS

- GoBD compliance & reliability guaranteed

- Documentation of movements

It pays to act fast!

For a short time only, the first client of a newly registered tax firm who books Taxdoo will receive the Professional package and the DATEV export for 2 months free of charge..

"*" indicates required fields

Book a non-binding consultation today and discover how you can benefit from these advantages:

- Exclusive support from qualified accounting specialists

- Dashboard for digital and automated mandate processing

- Data preparation including DATEV export for download

- Quality assurance by experienced VAT experts

- Optional: registrations and returns in the EU & UK, incl. OSS

- GoBD compliance & reliability guaranteed

- Documentation of movements

Further benefits as a Gold and Silver partner

Once you become a partner, you not only benefit from the numerous advantages of the intelligent Taxdoo software. You also have the chance to become a Silver or even Gold Partner and receive further privileges.

Simply talk to us about this in the first non-binding consultation –

and get more information from us!

What other tax consultants say about Taxdoo

“In e-commerce, it's a bit like Asterix and Obelix, a small Gallic village that somehow ticks differently. I think it's cool, but I'm glad that I'm strengthened by partners like Taxdoo.”

Christian Deák

Managing Director • DHW Steuerberatung

"E-commerce is a very intensive industry, especially with regard to VAT. With Taxdoo, you have a reliable partner at your side.”

Marcus Dein

Managing Director • TAXABL Steuerberatungsgesellschaft mbH

"Whenever we have any problems, we always solve them immediately via Taxdoo's support team and promptly receive recommendations for solutions.”

Tanja and Kai Kröger

Partner • GTK Kröger Steuerberater

"At the end of the day, the successful collaboration between us as a tax firm and a software provider like Taxdoo can be broken down into one important component: Data quality, data quality, data quality."

Dirk Wendl

Managing Director • Pandotax

Find out more about Taxdoo –

online or in person!

Popular webinars

Are you interested in topics such as (automated) VAT compliance and efficient financial accounting? Then register today for one - or several - of our most popular webinars and receive all the information you need to ensure the success of your tax firm and your clients.

Upcoming events

Would you like to get to know us and our VAT & financial accounting experts in person? Then come and visit us at one of the numerous e-commerce and tax trade fairs we regularly attend. We look forward to your visit!