E-commerce without VAT stress: Automated VAT software You concentrate on your sales, Taxdoo takes care of the VAT.

- Automated evaluation of all transactions – audit-proof and complete

- Timely VAT returns (incl. OSS export) without penalties

- Reduced tax burden thanks to correctly applied tax rates

Our end-to-end e-commerce platform

Free yourself from time-consuming VAT processes

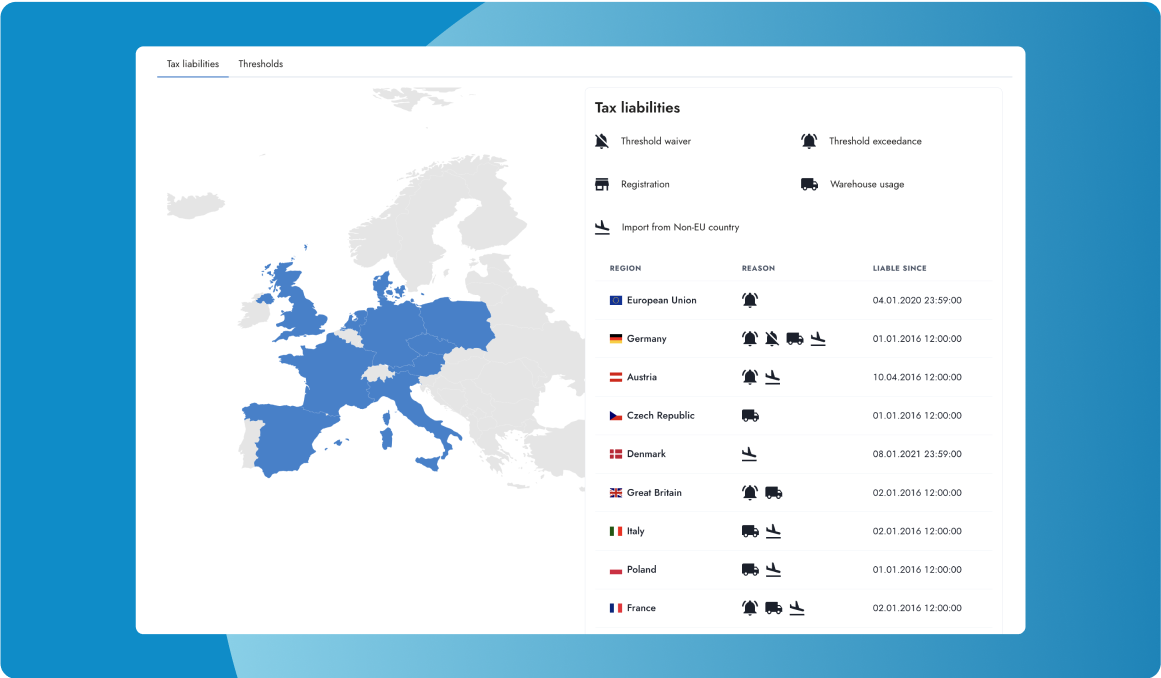

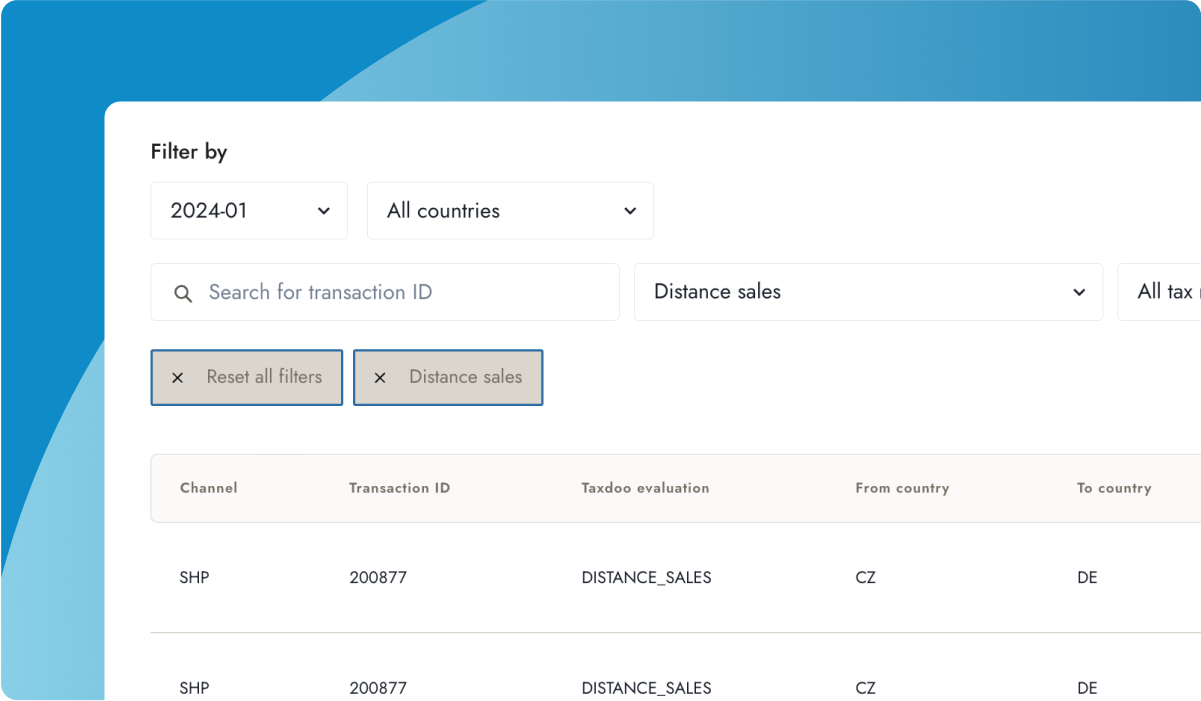

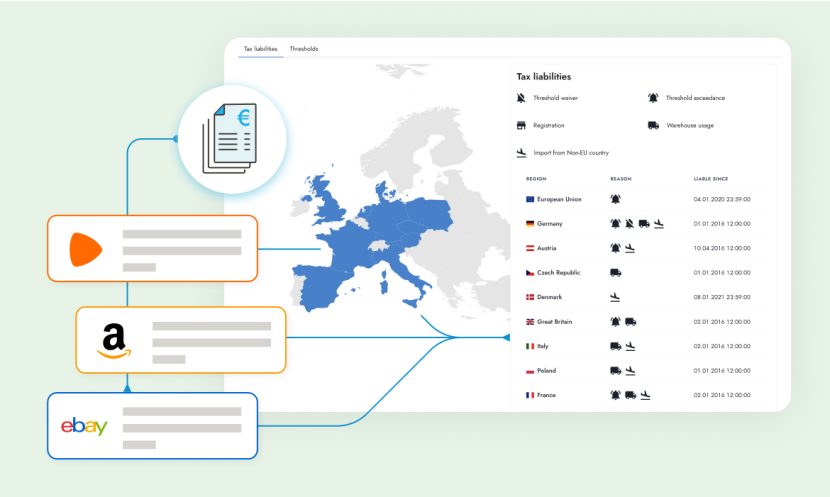

Reliable assessment of EU VAT obligations

Taxdoo's VAT software automatically collects and analyses all your transaction data reliably and also takes special cases into account. Through your personalised dashboard, you and your tax advisor get continuous access to all relevant VAT information, streamlining collaboration effortlessly.

- Audit-proof and audit-compliant tax reports

- Transparent overview of all tax obligations

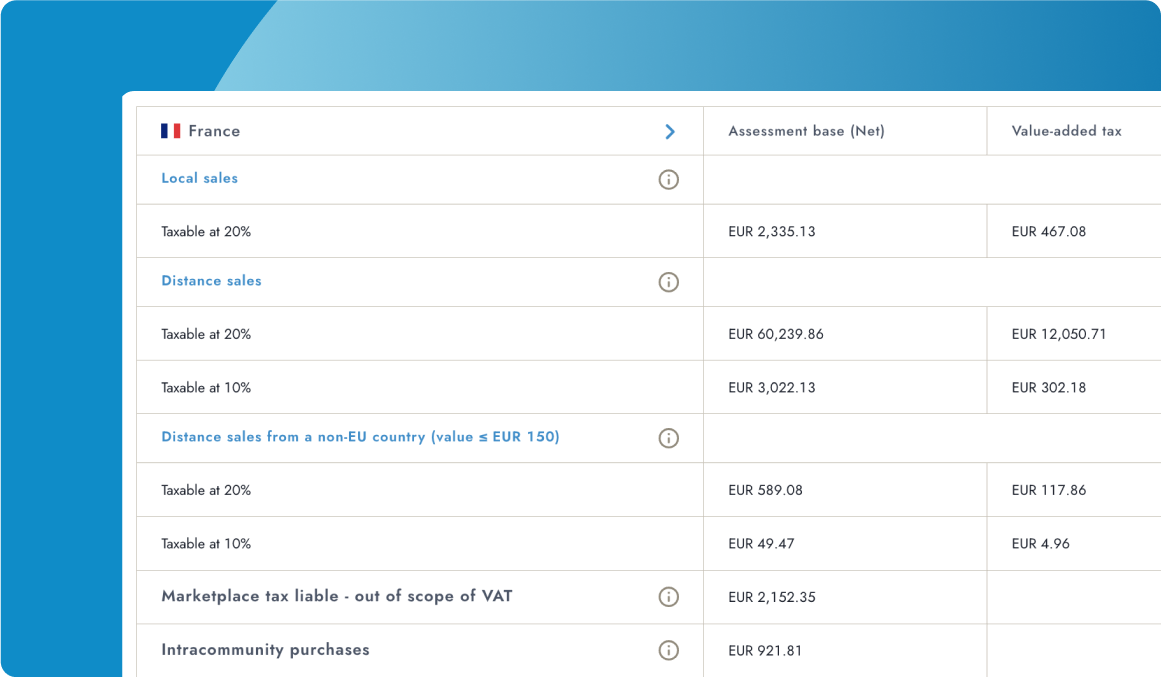

Pay less tax thanks to reduced tax rates

Taxdoo suggests the accurate reduced tax rates for the products you sell. With regular updates and prompt adoption of new regulations, you only pay the required VAT.

- Reduced VAT payments

- Correct use of tax rates

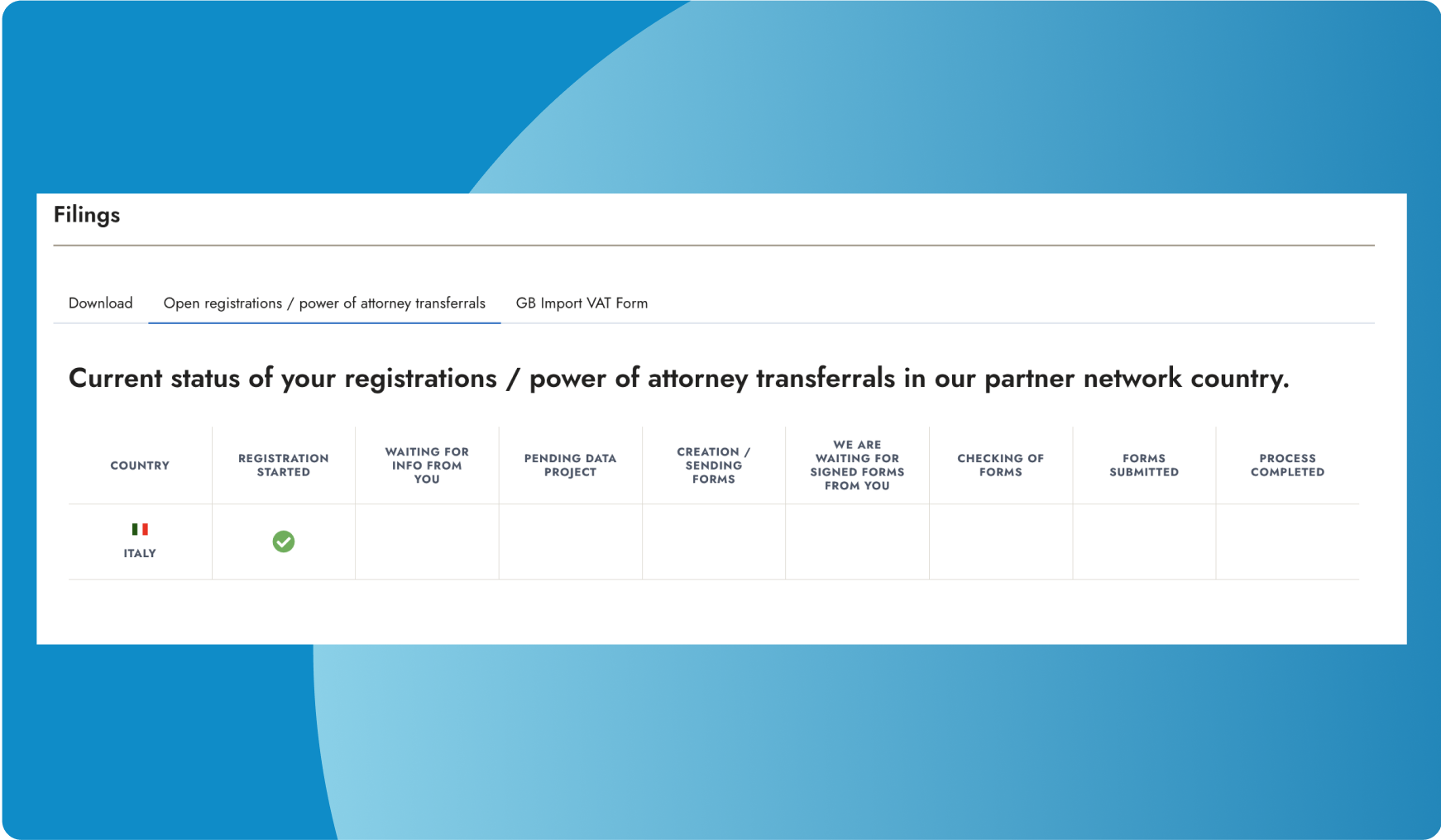

Hassle-free EU-wide VAT registration and filing

Our local network of tax advisors handles VAT registrations and reliable monthly or annual VAT returns for you, including corrections and retrospective returns. This simplifies communication and payment transactions with foreign tax authorities.

- Save time, we take care of communication with foreign authorities

- Timely VAT returns without errors and penalties

Save time with automated One Stop Shop exports

Taxdoo automatically identifies your cross-border B2C sales, preventing duplicate or omitted sales reporting. Any local VAT declarations ineligible for OSS submission are deleted from the report, guaranteeing accurate declaration of all transactions.

- More time and less manual work

- Less risk of missing or duplicate VAT returns

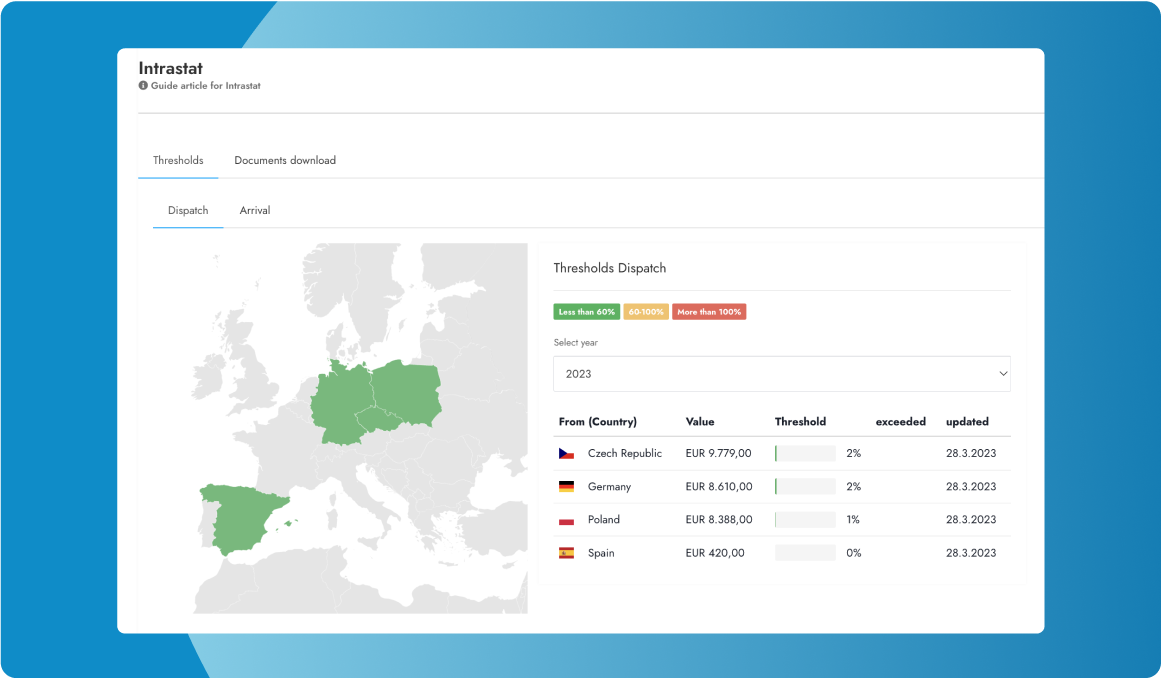

Intrastat declarations – all done!

Taxdoo's VAT software provides a concise overview of all Intrastat reporting obligations and ensures automatic and timely transmission of the reports in the respective countries.

- Transparency on Intrastat reporting obligations in the EU

- Correct data evaluation and punctual reporting

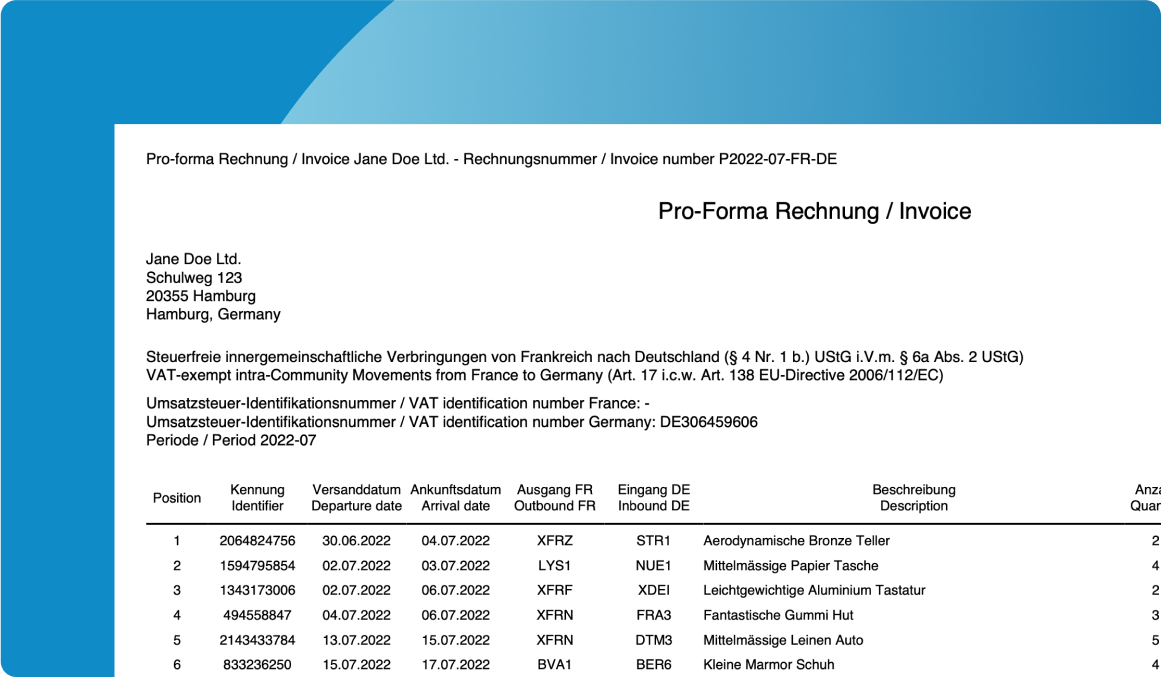

Automated pro forma invoices for tax exemption

Creating pro forma invoices for goods movements within the EU can be tedious and time-consuming. Incorrect issuance carries the risk of penalties and high costs. Taxdoo's e-commerce VAT software eliminates these concerns by automatically generating pro forma invoices, conveniently accessible in your dashboard to serve as proof of tax exemptions.

- Fewer taxes

- Less manual effort thanks to automation

Customer success stories

“It’s a huge time saving, a huge cost reduction. In our small but fast-growing company, we would not be able to operate or exist without the services of Taxdoo.”

Malgorzata Laszuk

PURISH GmbH

“Taxdoo was a game changer for us, as we were finally able to keep track of our VAT and optimise our accounting at the same time.”

Dennis Kraus

Bambelaa International GmbH

Over 3000 leading online MERCHANTS and tax ADVISORS rely on taxdoo

Ready to take the next step?

Would you like to learn more about Taxdoo’s solution or do you need support?

Overview interfaces & systems

Connect Shopify with Ease

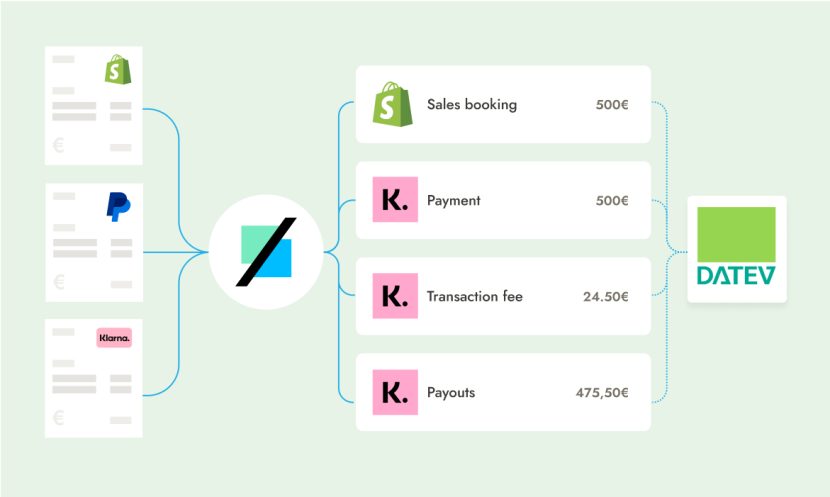

With Taxdoo, you can easily connect multiple Shopify stores. Automated data transfer eliminates the need for manual exports and imports, saving you valuable time. Your sales data is prepared directly for VAT and accounting – including the practical connection to DATEV. This ensures your VAT compliance and keeps your accounting consistently up-to-date.

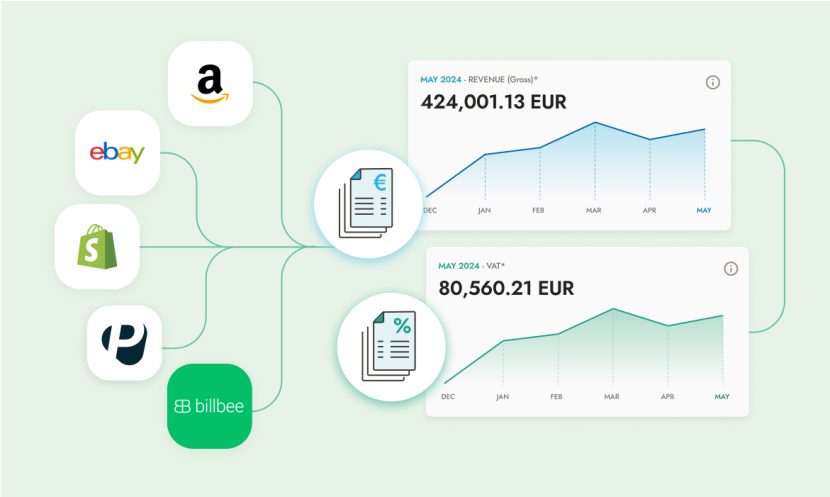

Amazon, eBay and Zalando – marketplaces seamlessly integrated

With our marketplace connectors, you can easily link to platforms such as Amazon, eBay and Zalando to Taxdoo, enabling automatic synchronization of all essential data.

Whether you sell in Germany or across other EU countries, you always have an overview of your tax obligations. With our marketplace connections, you reduce manual effort and ensure that your data is prepared seamlessly for accounting and VAT compliance.

Your goods movements, neatly connected

Get a clear view of sales, intra-community shipments, and returns in Taxdoo with our connector to fulfillment provider Hive. Especially for EU-wide trade, you have all important data automatically integrated into Taxdoo. This simplifies compliance with tax obligations for your accounting team and tax advisor.

Payment providers and Taxdoo – automatic recording and processing

Whether PayPal, Stripe or Klarna – with our connectors, you can automatically import all transactions, fees, refunds and payouts from your e-commerce business. The data is recorded seamlessly and prepared directly for your accounting, giving you a comprehensive overview at all times.

FAQ

More questions? We have got it covered for you! Find a collection of frequently asked questions here.

VAT and financial accounting

VAT registrations and reports be filed via Taxdoo in the following countries: Poland, the Czech Republic, Italy, France, Great Britain, Spain, Austria, Belgium, the Netherlands, Luxembourg, Denmark, Ireland, and Sweden.

Depending on the interfaces you have linked, the first evaluations are available at different points in time. For example, we receive your data from Amazon only once a month for the previous month – always around the beginning of the subsequent month. Interfaces like JTL, eBay, Shopify or others usually make initial data available on the day after the linking. Please note, however, that this depends on the concrete interface settings. You can find the respective import dates in the help articles that we offer for each interface.

Yes, Taxdoo also ensures that products with reduced VAT rates are evaluated correctly. For this, after posting your products, you tell us separately which ones are subject to a reduced VAT rate in one or more countries. However, we generally assume that your products are subject to the standard tax rate in the respective sales countries.

Yes, you have the option in these cases to use our CSV upload. But we recommend that you always use one of our standard interfaces if possible.

Find the ideal plan

Professional

from 49 €

- All add-ons bookable

- All connectors to marketplaces, shop, payment and ERP systems

- Telephone support

- Free VAT registration in the EU and UK(1)

- Local country filing(2)

(1)(2) Find detailed information in our price calculator.

Premium

from 299 €

Everything in Professional, plus:

- Prioritised premium hotline(1)

- Dedicated account manager(2)

- Discounted corrections of VAT returns(3)

- Exclusive onboarding process(4)

- Yearly accounting call(5)

- Individual tech call(6)

- Professional compliance expert calls(7)

(1) Customer support with prioritized telephone treatment.

(2) Personal Customer Success Manager, constant exchange

(3) Discount on corrections: €99 instead of €249 per month.

(4) Personalized onboarding with Customer Success Manager

(5) Exclusive advice on successful annual financial closing

(6) Professional setup of connectors with tech experts

(7) Clearing up region-specific questions with compliance experts

Enterprise

Individual pricing for companies that manage a gross merchandise volume (GMV) of more than 400,000 euros per month.

Get the flexibility to match costs to your company’s specific needs and performance.

Contact us for a customised plan!

What our customer say about us

Talk to an expert!

In a 15-minute initial consultation, we want to get to know your company and our e-commerce professionals will explain to you how:

- Taxdoo significantly reduces your sales tax expenses

- Working with your tax advisor made easier

- The implementation of Taxdoo

- Our customer service will service you long term.

Together we will find the optimal solution for you!

You will soon benefit from audit-proof sales tax assessment, EU-wide reports and automated e-commerce accounting!