VAT Fraud & Import One Stop Shop (IOSS)

The biggest VAT reform for online trade has been in force for a short time and it is slowly becoming apparent what is still not running smoothly.

A recent letter from the Federal Ministry of Finance (BMF) dated 10 August 2021, which we discuss below, exposes weaknesses and reveals astonishing figures.

The focus here is on deliveries from third countries to the EU – so-called distance sales with a third-country connection. These were (and probably still are) very susceptible to fraud.

This means that probably only a fraction of the Value Added Tax that should actually be charged is collected.

For this reason, the VAT system for these supplies has also been reorganised as of 1 July 2021 – including the way in which they are declared to the tax authorities.

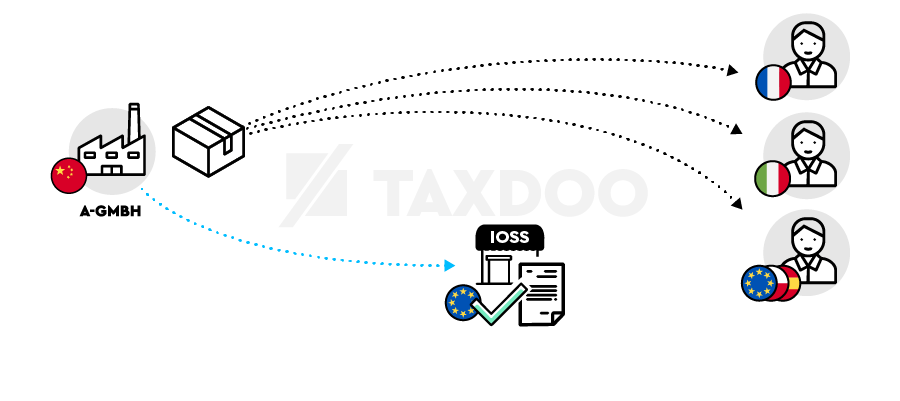

Deliveries from third countries and the IOSS

One driver of the reform was to increase VAT revenue on supplies from third countries, as fraud in this area has been massive in recent years.

A comprehensive explanation of the IOSS can be found in this article. In summary, the following can be said.

- Since 1 July 2021, deliveries from third countries – e.g. the PR China – are always taxable in the country of destination from the first cent.

- There are therefore no longer any exemption limits for VAT purposes. The so-called 22-euro deliveries, which were regularly abused in the past to evade Value Added Tax , have been abolished EU-wide as of 1 July 2021.

- So that traders from third countries – but also traders from the EU with deliveries from third countries in the EU – do not have to register for tax directly in every EU state to which they send only one parcel, the so-called Import One Stop Shop was created.

- The IOSS works as follows: The Value Added Tax for distance sales from third countries with a material value of up to 150 euros can be declared directly and monthly centrally via the IOSS. In addition, these deliveries are exempt from import VAT.

Is the IOSS now a success?

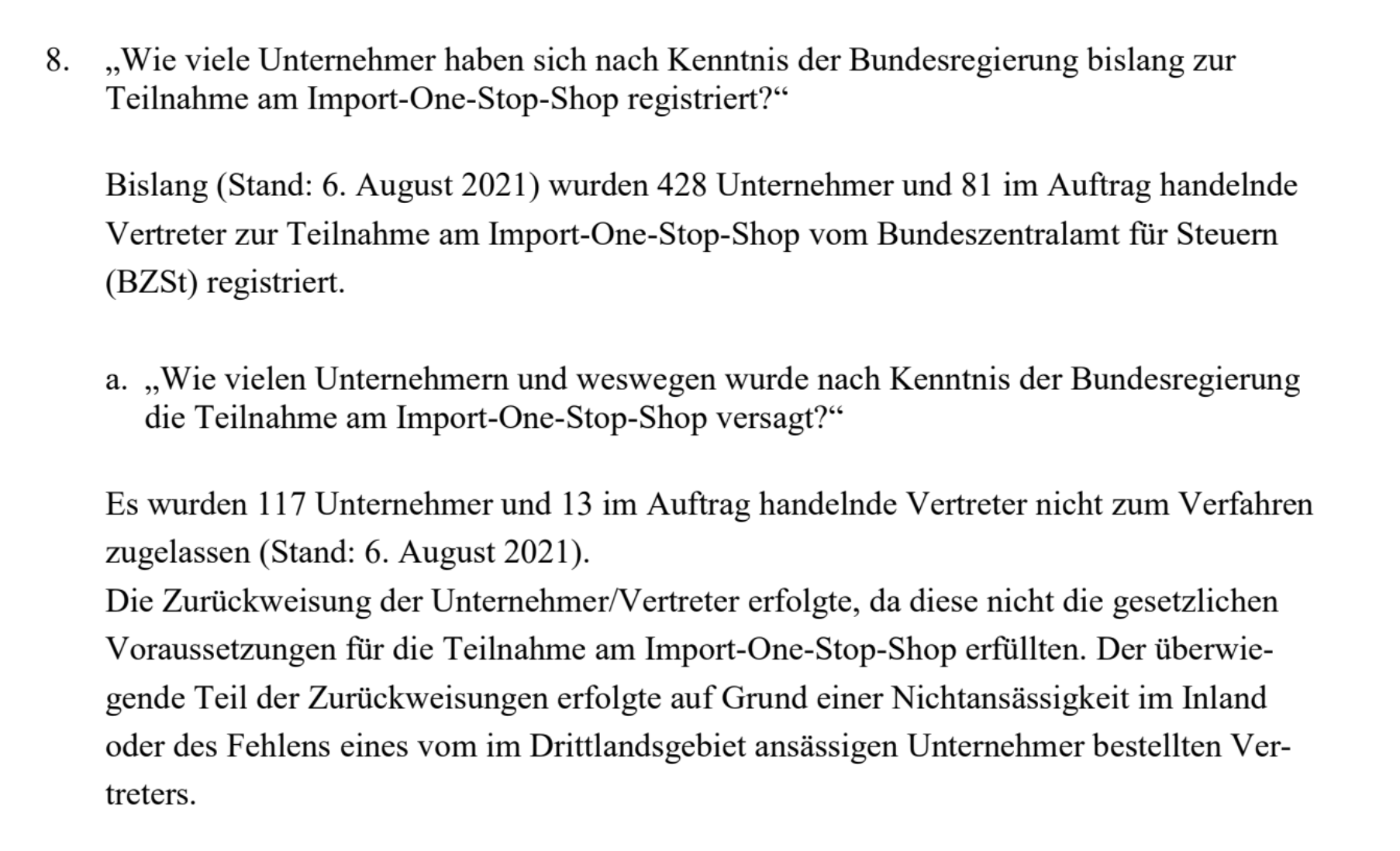

Current BMF figures: IOSS not (yet) a success!

Looking at the current figures (as of 6 August 2021), there were only 428 registered companies.

This figure is shockingly low, as there are tens of thousands of online retailers from the PRC alone who sell their products directly to the EU via webshops such as Shopify.

Interesting: Of the 428 registered companies in Germany, a low double-digit percentage is a Taxdoo customer and based in the EU.

The answer as to why the IOSS has not (yet) reached the masses certainly has a few reasons. But one reason is likely to be at the top of the ranking.

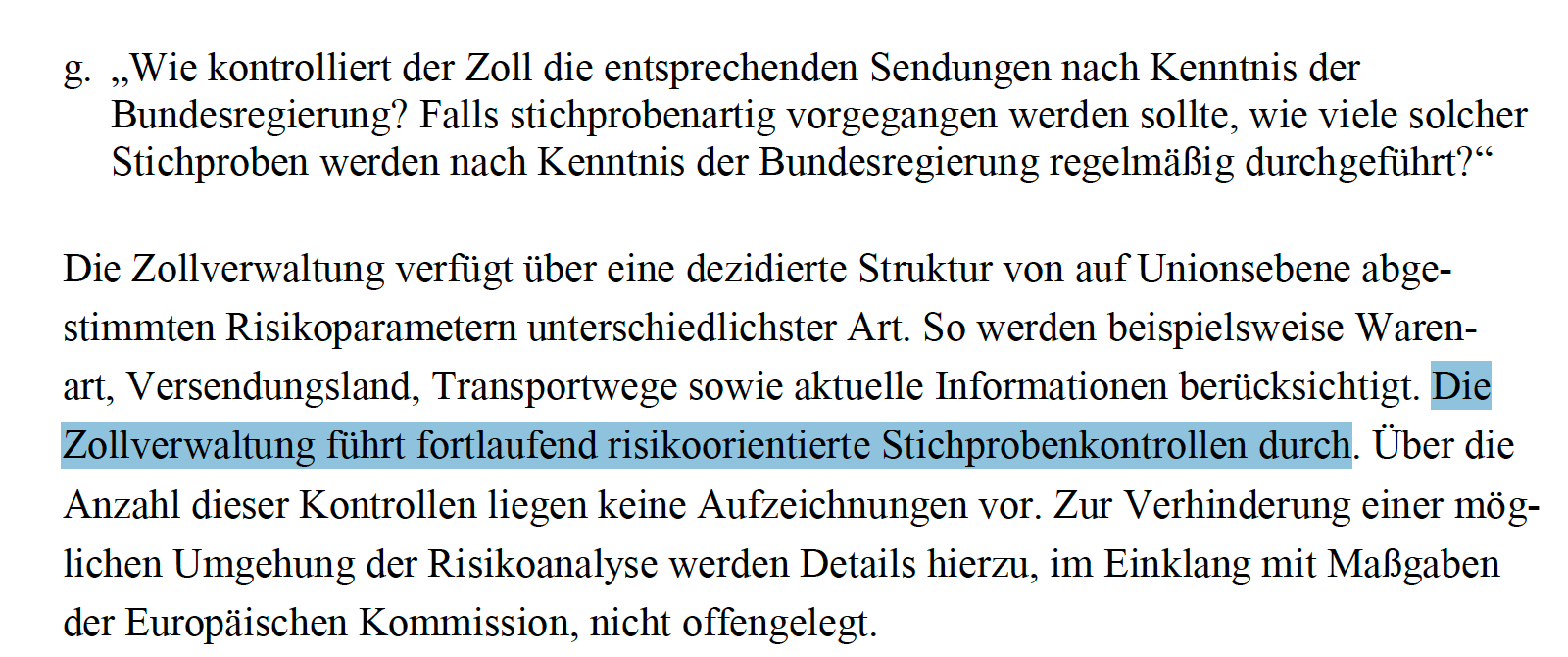

From July 2021 always Value Added Tax! Is every package therefore checked?

… that should be the consequence. Unfortunately, the reality is different.

The low IOSS figures can be easily explained in this context.

Question: Who has an incentive to register for the IOSS?

Answer: The one who wants to discharge (simply and efficiently) his Value Added Tax .

Unfortunately, even since 1 July 2021, there is still no real incentive for dishonest traders from third countries. This is illustrated by the following excerpt from the BMF letter.

Plain language on this passage: Customs has few resources and can only actually check a tiny fraction of the parcels imported from third countries. No matter how sophisticated the structure, no matter how many risk parameters there may be. This disproportion is also no secret.

Conclusion: Incentives are still lacking!

Yes, the tax liability for distance sales from third countries via marketplaces has been incumbent on Amazon & Co. since 1 July 2021.

But in the meantime, there are tens of thousands (probably more) Shopify merchants from the PRC and other third countries who can continue to ship their products VAT-free to the EU because there are insufficient resources on the customs side.

Taxdoo as a scalable platform in the field of accounting and Value Added Tax for Amazon and more – including IOSS interface

You want to learn more about how Taxdoo makes your life as a tax advisor or trader easier?

Then book a personal live demo via this link!

Our experts will explain what we can do and how we can easily connect your or your clients’ setup to our platform.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

One-Stop-Shop (OSS) EU VAT for E-Commerce