5 lessons learned from 5 years of Taxdoo

Five years ago today, we founded Taxdoo. What had been planned as an idea for quite some time, we cast into legal form at the notary on that 3rd of May 2016. It doesn’t feel like half a decade because the days and weeks just fly by. What lessons have I learned from founding and five years of Taxdoo? Before I go into the five most important lessons, a brief background on Taxdoo.

The story

In the early 2010s, I had the pleasure of meeting my two co-founders Roger and Christian (and Moritz, our current Vice President Sales) during my Ph.D. at the Chair of Banking and Behavioral Finance at the University of Hamburg. Doctoral colleagues quickly became good friends and I am happy that we have remained so to this day.

Business ideas were also discussed during the regular battles at the foosball table, poker nights, football games or after-work beers, but there was no real start-up fever a good ten years after the bursting of the New Economy bubble. The big start-ups were on the other side of the Atlantic, and the film The Social Network gave us an idea of the pros and cons of founding a company with friends.

The first idea we pursued together was the digitization of menus. We wanted to bring restaurateurs from chalkboards and Word files into the 21st century. Menuload was to become the central place to edit the offer, which would then be automated by our system to end up on the website, optimized for mobile devices and search engines. The product looked good, it worked, it’s just that no one wanted to pay for it. What we simply hadn’t considered: Most restaurants thrive on walk-in customers, and those who are regulars already know what’s on offer. So the willingness to pay was close to zero. At the time, there was no inkling of the delivery boom of the 2020s, which would have made a central location with structured data on restaurant offerings interesting again from a completely different perspective. Nevertheless, we learned a lot about founding, product development and teamwork.

Towards the end of 2014, the topic of Value Added Tax appeared in our discussion for the first time. The trigger was a change in the valuation of digital products. In future, the Value Added Tax was to be levied in the country in which the buyer was based. At the same time, the seller could report all transactions centrally through one place instead of registering in each country (the so-called “mini one-stop-shop”). Together with Roger, whose sales tax background was crucial here, we considered whether we could build a product here. The first prototype for this was already ready: The plan was to create a plugin that shop operators could easily integrate into their shop and automatically calculate the correct Value Added Tax as well as create the invoice. However, this product did not reach market maturity. The reason: our analyses and discussions concluded that the market for digital products outside of large marketplaces such as AppStore or Google Play was not yet large enough for us. That’s why we wanted to first enter the market with physical products instead.

In spring 2015, we were also made aware of EXIST. EXIST is a program of the Federal Ministry of Economics that supports start-ups from science. In addition to a monthly stipend, one also receives material resources and training opportunities. The organisation is carried out by the supervising university or college, which also provides office space. This is an excellent program that can be recommended without reservation. As current or new graduates of the doctoral program, we were eligible to participate and set to work in May 2015 on an idea paper that formed the basis for the application.

This was also the time when we came up with a name. After an initial consideration to name the new company VATload in reference to our first startup, we were able to quickly agree on Taxdoo. “Tax” was going to come up, “do” as a reference to making it as easy as possible to use, the trademark and domain name were still available, and the two consecutive Os were reminiscent of tech trailblazers like Google and Yahoo. The perfect name.

After waiting for about 3 months, we received a rejection in early November 2015. No EXIST for Taxdoo. After the initial shock, it was now a matter of picking ourselves up again as quickly as possible. What now? We wanted the start-up, and we wanted to start looking for alternative investors.

Shortly after the rejection, however, there was a glimmer of hope again: although we had been rejected by the EXIST evaluator, the score we achieved allowed us to make improvements. Nils Neumann from the Technical University of Hamburg-Harburg encouraged us to pursue this path and was instrumental in guiding us through the preparation of the idea paper and the rework. We were given access to the expert opinion and found that there was a problem of understanding. The expert assumed that if we also wanted to sell our solution to traders who sell their goods on Amazon or other marketplaces, we would need access to the checkout process of these marketplaces. This was a misunderstanding that we were able to clear up in the course of the rectification.

At the beginning of February 2016, the longed-for news arrived: EXIST had been approved and we could finally formally get started. The very next day, we moved into our first office at Max-Brauer-Allee 60 in Hamburg, and on May 3, the GmbH was founded. In the last five years we have been able to celebrate huge successes, for which I am, for which we are all infinitely grateful.

The most important findings from 5 years of Taxdoo

1. the product must solve an existing problem in an above-average way

Often read, even more often not heeded: The product must solve an actual problem better, and tangibly better. People are inert by nature. To persuade them to change, the improvement must be noticeable compared to the previous solution.

Our first customer was Christian Strohecker from Hamburg, who joined us in late summer 2016. With wellyou.de he successfully sells baby and children’s fashion. As an early user of FBA (Fulfillment by Amazon), he used warehouses from Amazon in Poland and the Czech Republic, and had the sales tax reporting done by the local foreign chambers of commerce. In addition, he had considerable documentation and reconciliation work with an accountant and his own tax advisor. Although we were not able to offer a graphical user interface at the time, Christian quickly realised the potential Taxdoo could have for his workflows. According to his own calculations, he saves over 80% compared to his previous costs thanks to the use of Taxdoo. We are very pleased that Christian continues to be loyal to us and that we are able to support him in selling his products throughout the European Union and the United Kingdom.

2. Delegate early

At the beginning, you do everything yourself as there is usually no money available for additional employees. As soon as the funds are available, however, you should delegate tasks as quickly as possible. Otherwise you are not scalable as a founder and get lost in the minutiae. The step is difficult, but the longer you delay this process, the more difficult it becomes.

Before Taxdoo, I mainly worked alone as a programmer. This has many advantages, but is no longer possible when a complex product has to be built up and further developed. We therefore relied on reinforcement at an early stage. The first employee of Taxdoo was therefore a developer. Patrick was sitting as a student in a Bachelor’s event of the Business Informatics course at the University of Hamburg (coincidentally in a seminar room exactly one floor below our office), when we were allowed to present our Taxdoo project there in April 2016. He took our call on the last slide to apply to us to heart and started as a programmer with us in June 2016. Patrick is not only an outstanding and above-average productive developer, his work also forced me to delegate parts of my own programming work at an early stage. It’s not an easy step to take, especially as a founder, but it’s essential to continue scaling. We are very grateful that Patrick continues to support us, already full time for many years. Patrick is in charge of the heart of Taxdoo, the evaluation of transactions.

Patrick’s first day at work in June 2016

3. Use communication tools wisely

Even if you have been working together in a team for a long time, occasional friction and differences of opinion are nothing out of the ordinary, but completely normal. In order to prevent differing views from developing into a conflict, it is crucial to decide which communication tool to use in which situation.

Shortly before our foundation, I had become aware of Slack, which at that time was beginning to revolutionise corporate communication. Before that, we had largely relied on Skype and email for communication. The advantage of Slack over both forms of communication was, on the one hand, the (in my view still) outstanding search function and, on the other hand, the grouping of the chats into thematically defined channels (such as general, finance, sales, support).

We’ve used Slack from the beginning within Taxdoo and now have over 100 people active in some channels. We discuss and solve customer tickets, celebrate new customers and successes in the team. Therefore, we write almost no emails internally. However, the chat-like nature of Slack also leaves room for misunderstandings and misinterpretations. Slack invites you to be very brief – sometimes too brief, so important context can get lost for others. Also, one’s visibility, being “online” and thus available, can lead others to expect an immediate response. Slack can also be quite distracting. With over 50 channels, there is practically always something new to learn and read. Not always being able to follow everything can quickly lead to the fear of missing something.

The invaluable advantages of Slack (or competitors such as Discord or Teams) are undisputed, but at the same time you should use them very purposefully. As a basic rule: In critical discussions, it is better to quickly use the personal conversation – or the video conference. In case of doubt, this is faster and offers no room for misunderstandings. At Taxdoo, no major problem has ever been solved on Slack or satisfactorily discussed to the end.

Slack offers a lot of room for misunderstanding

4. Get the investor with the best network

After the end of the EXIST funding in March 2017, we started looking for follow-up funding. Although we already had initial sales, they were too low to allow us to make a permanent living, let alone significant investments in the future. Thanks to winning several start-up competitions, we could not complain about a lack of interest. We held numerous talks with business angels about seed financing.

In the end, the only relevant decision criterion is the investor’s network. All other framework conditions are negotiable, but the investor’s network must already be in place before the entry. What introductions (intros) can the investor make to potential customers, strategic partners and candidates for important team positions?

After the end of the EXIST funding in March 2017, we started looking for follow-up funding. Although we already had initial sales, they were too low to enable us to make a sustainable living, let alone make significant investments in the future. We had numerous, exciting conversations with business anglers. But the decisive factor was a presentation at High-Tech Gründerfonds in Bonn. Investment manager Tobias Schulz knew the VAT issue from previous start-up experience in e-commerce and was instrumental in driving HTGF’s entry into Taxdoo. We are pleased that HTFG continues to be a trustworthy partner and investor in Taxdoo.

5. Trust pays off

Particularly in a young company, the majority of newcomers at the beginning will have little experience from previous positions. It is therefore all the more important to treat these team members with respect and trust. Assigning tasks to newcomers that they have never done before is a risk for both sides and not without risk. Of course, this does not always work without mistakes, and it is precisely at this point that a healthy culture of mistakes is indispensable in the company. Mistakes only become a problem if they are concealed or no conclusions are drawn from them.

There are statistics according to which nine out of ten start-ups fail before their first birthday. The fact that we can celebrate five years of Taxdoo is primarily thanks to our team of now almost 100 enthusiastic employees. It is thanks to their motivation, joy and commitment that we are where we are today. Together with our team, we live our values of simplicity, diversity, quality and trust.

Most of our team in April 2021

A champion from Europe

We are extremely grateful to our users for their trust in Taxdoo. Entrusting a young company with a legal topic such as VAT requires an advance of trust, which we want to live up to every day.

Supported by a strong team and outstanding investors, we are confident that a European company can succeed in building a tech company of global significance.

We are just getting started. Our vision is to make trade truly seamless, for businesses of all sizes. E-commerce has made it very easy, especially for small and medium-sized traders, to trade across borders and to use logistics structures that were previously only available to large companies.

Only when regulatory compliance is not an obstacle in the process are the possibilities truly limitless, even for smaller companies. We take care of that so they can focus on their core business to become even more successful.

Before we leave: We are looking for Taxdeerns and Taxdudes to join our team. No matter if in Hamburg or not. Our mission and our values simplicity, diversity, quality and trust are the same everywhere.

Here’s to the next five years! ?

Weitere Beiträge

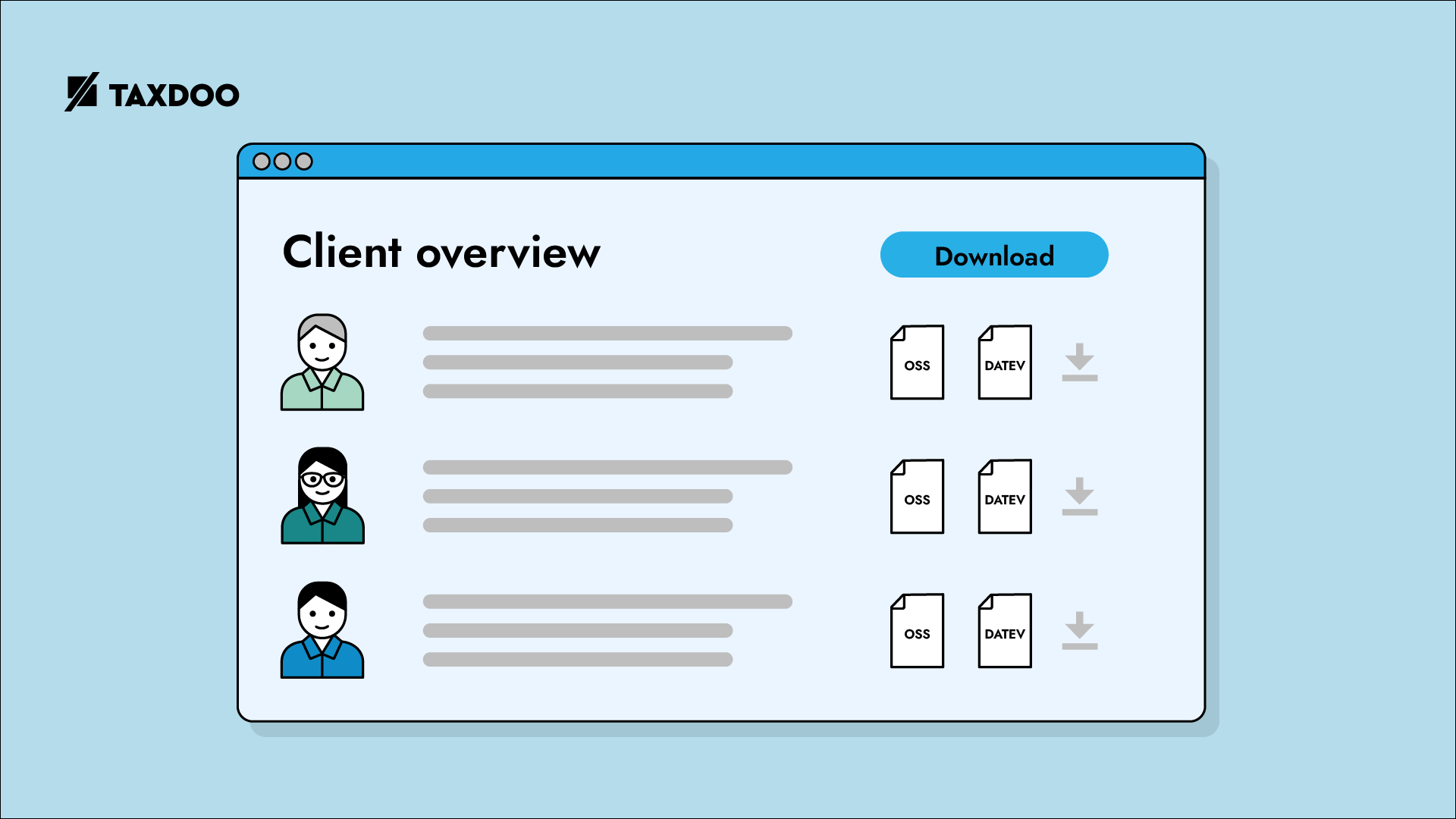

Introducing client overview! Become more efficient when working with multiple clients.

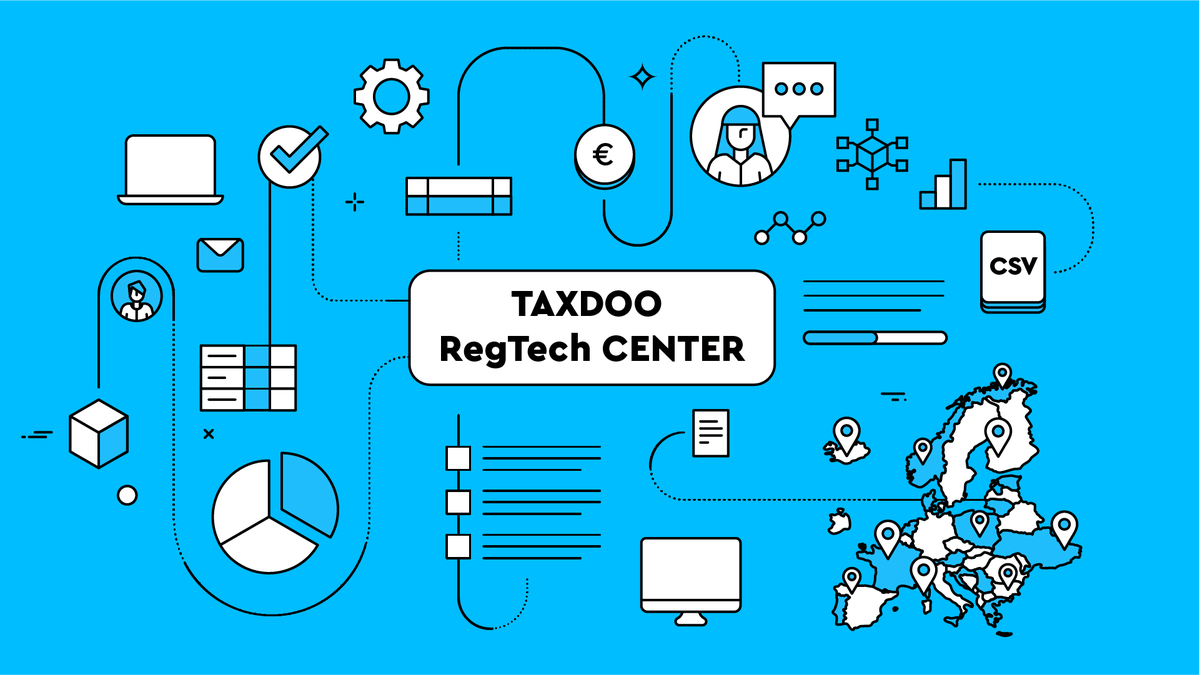

Taxdoo News: Regulatory issues increasingly influencing e-commerce – Taxdoo compliance platform builds RegTech Center