Reverse Charge: When are you going to pay Value Added Tax for Amazon and co.

If you sell your products on Amazon and eBay as an entrepreneur, you may have to charge for the Value Added Tax services of these two major corporations yourself and pay them to your tax office. In principle, this applies to all services provided to you by other entrepreneurs from abroad.

What are the requirements for this?

First of all we would like to point out that Taxdoo is now an official partner of DATEV and can provide you with the most advanced FiBu interface for all online revenues and Amazonfees – see here.

Classic to-DATEV converters cost unnecessary time, money and carry risks – see here.

Reverse Charge: reversal of the tax liability

This Value Added Tax is a very fraudulent type of tax. According to studies by the European Commission, the loss of tax revenue in the EU amounts to almost 160 billion euros annually, of which the state coffers lose around 50 billion euros due to fraudulent activities.

One countermeasure is the so-called reverse charge procedure. Behind this is the following regulation:

If an entrepreneur from abroad provides you with a service, you may in certain cases have to charge Value Added Tax for this service yourself and pay it to your tax office. Your service provider may only settle accounts with you net.

The catalogue of these specific services is regulated in § 13b of the Value Added Tax Act. It is constantly increasing and in the meantime it is hardly comprehensible even for experts and in practice is connected with many open questions.

E-commerce services are largely covered by these specific services. This applies, for example, to:

- fees for the use of electronic marketplaces (e.g. Amazon or eBay),

- Advertising services through Google Adwords or Facebook,

- Services in the field of web design and/or SEO of entrepreneurs from abroad,

- legal advice from foreign lawyers/experts, and

- Other consultancy services provided by foreign entrepreneurs.

(Note: PayPal services are usually banking services, which are largely Value Added Tax exempted in Germany)

This is intended to ensure that entrepreneurs from abroad actually take theirs Value Added Tax in Germany.

In addition, the reverse charge mechanism serves to simplify trade in services in the EU. Foreign entrepreneurs do not necessarily have to register for tax in Germany, as in the above-mentioned cases it is not they themselves but the service recipient who pays the Value Added Tax tax to his tax office.

The background for this is: If entrepreneurs from abroad provide services to you, these services are basically subject to those Value Added Tax in Germany.

Why are these services taxed in Germany?

Since the introduction of a uniform (harmonised) turnover tax law in the EU on 01.01.1993, the member states have agreed that services – which can be supplies of goods or services – should in principle be Value Added Tax subject to VAT where they are consumed (destination principle):

- For deliveries of goods to private individuals in the EU, this principle applies as soon as you exceed certain delivery thresholds.

- In the case of services which one entrepreneur provides to another entrepreneur (B2B), the country of destination principle has been uniformly applied in the EU since 01.01.2010.

This means that a foreign entrepreneur who provides a service to you would basically have to settle with GermanValue Added Tax . In addition, he would have to register for tax in Germany, as he provides services here. Thanks to Reverse Charge, neither of these is necessary.

Settlement of services using the reverse charge method

If services are subject to the reverse charge procedure, your service provider may only invoice you on a net basis. The reason for this is that you have to charge Value Added Tax for this service and pay it to your tax office.

Important: As an e-commerce merchant, you will normally be entitled to deduct this Value Added Tax as input tax in the same Value Added Taxadvance return.

In addition, your service provider is obliged to include the following notice in its invoice:

tax liability of the recipient

What do I have to consider?

In practice, it very often happens that both the recipient and the service provider are not aware that their transactions are subject to the reverse charge procedure. The following two cases in particular then occur:

- Invoice with German Value Added Tax or English or

- Invoice with reported foreign Value Added Tax

What to do if the bill is wrong?

- If the settlement was wrongly made with GermanValue Added Tax, you are still the debtor of the Value Added Tax. You have to calculate this from your net salary and pay it to your tax office. You should only pay your service provider the net fee and ask for a corrected invoice.

- If you have already paid the full gross amount, you can Value Added Tax only get the excess amount refunded by your service provider!

- The same applies in principle if foreign Value Added Taxaccounts were settled incorrectly: You have to pay the German tax from Value Added Tax the net amount to your tax office for this service. You should also ask for a corrected net invoice.

- If you have already paid the foreign Value Added Tax one, you can only reclaim it from your service provider. The so-called

Input tax refund procedures for payments Value Added Tax made abroad do not apply in these cases!

What if I’m a small business owner?

The reverse charge procedure also applies to small businesses, which do not Value Added Tax in principle have to pay tax to the tax office for their own transactions. Since the opposite is repeatedly claimed in practice, we will mention the relevant legal basis here:

§ Section 13b paragraph 8 UStG states that in the context of the reverse charge procedure the small business regulation does not apply!

Therefore, if you are a small business and use the services of a foreign entrepreneur, you must calculate the Value Added Tax net amount and pay it to your tax office. In practice, the following problem often arises, especially for small entrepreneurs who trade onAmazon

Amazon requires entrepreneurs to deposit an Value Added Taxidentification number (UStId No.) in order to know whether you are acting as an entrepreneur and therefore would have to be issued a net invoice. Many small businesses do not have a UStId number (deposited), so that it is Amazon assumed that it is a private person and therefore charges 19 percent GermanValue Added Tax .

In this case, as a small business owner you must withhold 19 percent Value Added Tax of your net income and pay it to your tax office. Since you have no input tax deduction as a small business, you will be charged twice with German Value Added Tax tax in this case, as you pay this once to Amazon and once to your tax office.

You can do the following in this case:

Let me show you the Federal Central Tax Office a UStId-No. and hand it inAmazon . You should Amazon then ask to correct the bill and get the German Value Added Tax one refunded.

Alternatively, you can get a confirmation from your tax office that you are an entrepreneur. This is the so-called VAT 1 TN form (proof of registration as an entrepreneur).

How do I report reverse charge payments to the tax office?

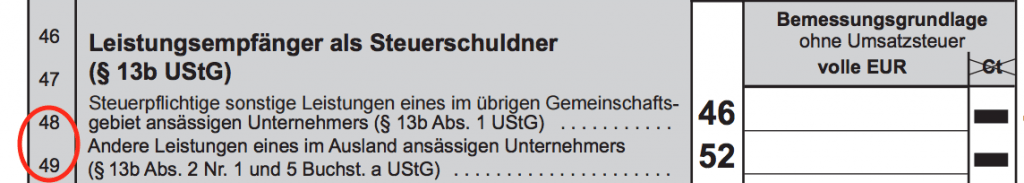

You report the reverseValue Added Tax charge and pay it to your tax office as part of your regular Value Added Taxadvance (or Value Added Taxannual) returns. For most services, line 48 (service providers from outside the EU) and line 49 (service providers from outside the EU) are relevant (click here to open the official form from the Ministry of Finance (page 4 onwards)):

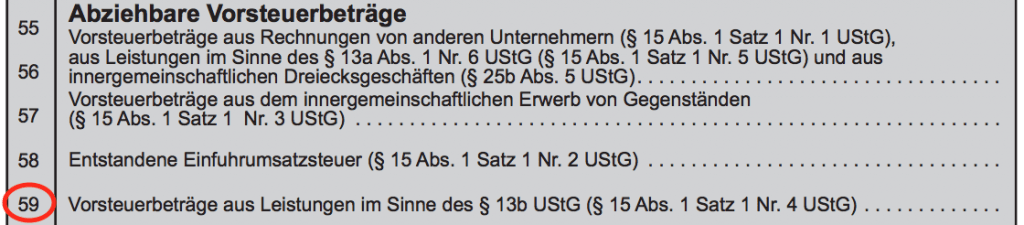

If you are entitled to claim input tax, you can deduct the input tax on these services in line 59 of the same Value Added Taxadvance return (note: small businesses only declare thoseValue Added Tax, but in principle have no input tax deduction):

Reverse charge also for privately purchased services

Finally, we would like to point out a fact that is not known to many entrepreneurs:

If you, as an entrepreneur, use the services of a foreign entrepreneur for your private sector – e.g. advice from a French interior designer – the reverse charge procedure also applies in this case.

This means that in this case the sales tax obligations will also affect your private sphere.

What does the tax office check on?

For the reasons mentioned above, the reverse charge procedure is very error-prone and is often overlooked or not applied. For this reason, this aspect is a focal point within the scope of Value Added Taxspecial audits and tax audits.

If it is established in the course of an audit that you have not paid the tax office Value Added Tax for services provided by foreign entrepreneurs, you will be required to collect the tax subsequently. In addition, this amount is subject to interest – 0.5 per cent for each month of late registration (Note: the interest period does not start immediately but is delayed by 15 months).

If the mistake lies in the fact that the service provider has issued you an invoice with a proven German Value Added Tax name, you often hear the objection that this Value Added Tax has already been paid once and therefore cannot be collected from you again.

Unfortunately, this argument does not work. The legal debtor in this case Value Added Tax is always the beneficiary-also you.

In these cases, you can only try to reclaim the money paid Value Added Tax to your service provider directly from them. As a rule, you will not be able to avoid paying the interest.

Everything reverse charge?

You must note that the marketplaces change their billing methods from time to time.

For example, advertising services provided Amazon for the amazon.de marketplace have not been subject to the reverse charge procedure for some time.

Why?

Amazon has been providing the advertising services for amazon.de for some time through a German subsidiary. As a result, these services are no longer cross-border services and Amazon are now obliged to Value Added Tax invoice advertising services to German online retailers at 19 percent German.

Automate reverse charge and much more with Taxdoo!

Taxdoo can get your sales automatically via the interfaces of Amazon, eBay or your ERP system (e.g. Afterbuy, Billbee, JTL or Plentymarkets) and report them in other EU countries for 79 Euro per month and country.

In addition, all online transactions, including reverse charge services, can be booked automatically via Amazon, within the scope of our DATEV export.

Furthermore, Taxdoo offers:

- automated Tax rates for all products and all EU countries,

- daily updated Delivery thresholds monitor,

- Movements between Amazon-warehouses EU-wide documentation and

- much more, which makes the work easier for you and your accountant.

Simply book a free and non-binding live demo of our automated Value Added Taxonline trading solution.

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

One-Stop-Shop (OSS) EU VAT for E-Commerce