Taxdoo and Intrastat: all you need to know

Many online merchants have to keep an eye on another important issue in addition to Value Added Taxcompliance: Intrastat.

These are declarations which must be submitted in addition to the Value Added Taxdeclarations and gdrs. concern every trader,

- who sells his products across borders in the EU (B2C and/or B2B) and/or

- participates in Amazonprogrammes such as CEE and Pan EU.

Intrastat – what is it actually?

Intra-Community trade statistics – Intrastat for short – are used to record the mutual and actual movements of goods between the Member States of the EU.

Note: This shows that the issue is closely related to cross-border Value Added Taxcompliance. However, there are also some special features that we will discuss below.

Intrastat declarations must be submitted in the EU country,

from which the goods are physically dispatched, and

in addition to which it is physically received.

This means that both the dispatch and receipt of goods to and from each EU country are recorded. This is therefore referred to as the sending or receiving member state.

Who must submit Intrastat declarations?

You are basically obliged to register – technical term: obliged to provide information – if you

- are registered as an entrepreneur in Germany according to the value added tax law

- concludes a contract with a foreign contractual partner (buyer: B2C and B2B) and

- goods moved between Germany and another EU member state.

As a general rule, all companies liable to VAT that serve the European trade in goods are legally obliged to report their incoming and outgoing goods via Intrastat.

As Intrastat declarations are an additional burden and relatively complex, the intention is to relieve smaller companies of this additional burden.

For this reason there are the so-called notification thresholds.

Intrastat reporting thresholds

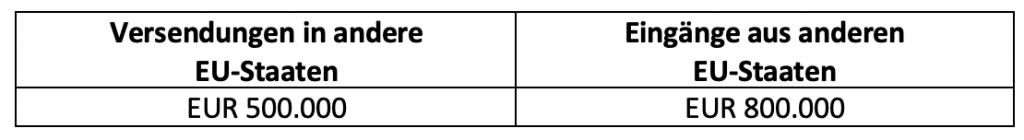

In Germany, for example, you are exempt from the obligation to report if the following thresholds for the respective direction of goods were not exceeded in the previous year:

The reporting threshold differs according to EU country and type of goods. Thus there are always 2 thresholds per country – one for goods issue and one for goods receipt.

The reporting obligation starts automatically from the month of a calendar year in which the threshold value is exceeded for the first time, i.e. for this month the first Intrastat declaration must be submitted in the respective country for the respective traffic direction.

Automatic in this context means that you should not expect to be asked to report to the Federal Statistical Office. For this reason you should keep an eye on the exceeding of the respective reporting thresholds yourself.

The Federal Statistical Office usually finds out about your obligation to report via your tax office, which may pass on the values from your Value Added Taxadvance notifications or declarations for these purposes.

The obligation to submit Intrastat declarations continues until the end of the current calendar year if the threshold was exceeded in the previous year. If these are no longer exceeded in the current year, the obligation to submit declarations for the following year expires.

Failure to comply with the information obligations may result in four to five-digit fines.

When should the notifications be submitted?

Intrastat declarations must in principle be submitted monthly.

The reference period shall be the month in which intra-Community trade took place. Declarations shall be submitted no later than the 10th working day of the following month.

It is your own responsibility to meet the deadlines. You can see them here for 2020/21.

How is a submission possible?

Data transmission to the Federal Statistical Office must always be electronic. An online registration procedure is provided for this purpose, for which registration is required in advance.

The portal offers you the possibility of reporting in XML format via file upload.

For data protection reasons, the transmission of data by e-mail is not permitted!

What has to be reported and at what level?

The basis of assessment for the transactions to be reported is generally the value added tax (VAT) payment (including ancillary services).

Since intra-Community shipments within the framework of Amazon CEE and Pan EU must also be reported, the purchase price or production cost is the assessment basis subject to reporting for these transactions.

Reporting requirements in all EU countries

If you exceed the reporting thresholds in other EU countries, you are regularly required to provide information there as well.

Due to the level of the reporting thresholds, you will always be liable for VAT before you are required to provide information, so you should in principle be registered for VAT in these countries beforehand.

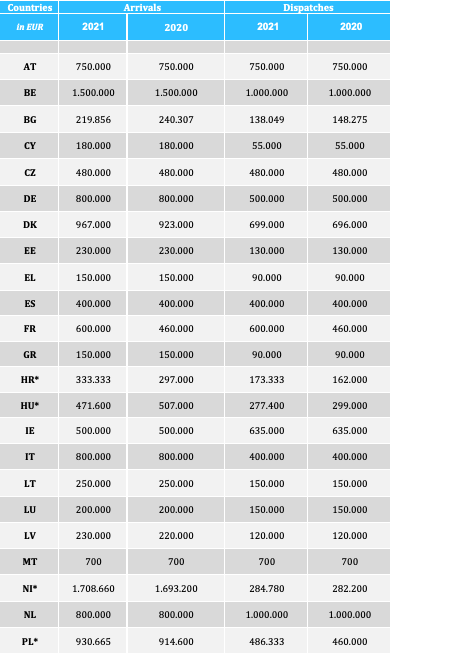

The reporting thresholds for 2020 and 2021 are as follows.

* Exchange rates

…and how can Taxdoo help me with that?

We offer you a one-stop compliance platform so that all processes in cross-border online trading can be automated in a legally compliant manner: Value Added Tax-compliance, financial accounting and Intrastat.

Taxdoo obtains transaction data directly and fully automatically from all relevant marketplaces and ERP systems, which are also included in the calculations of the Intrastat reporting thresholds.

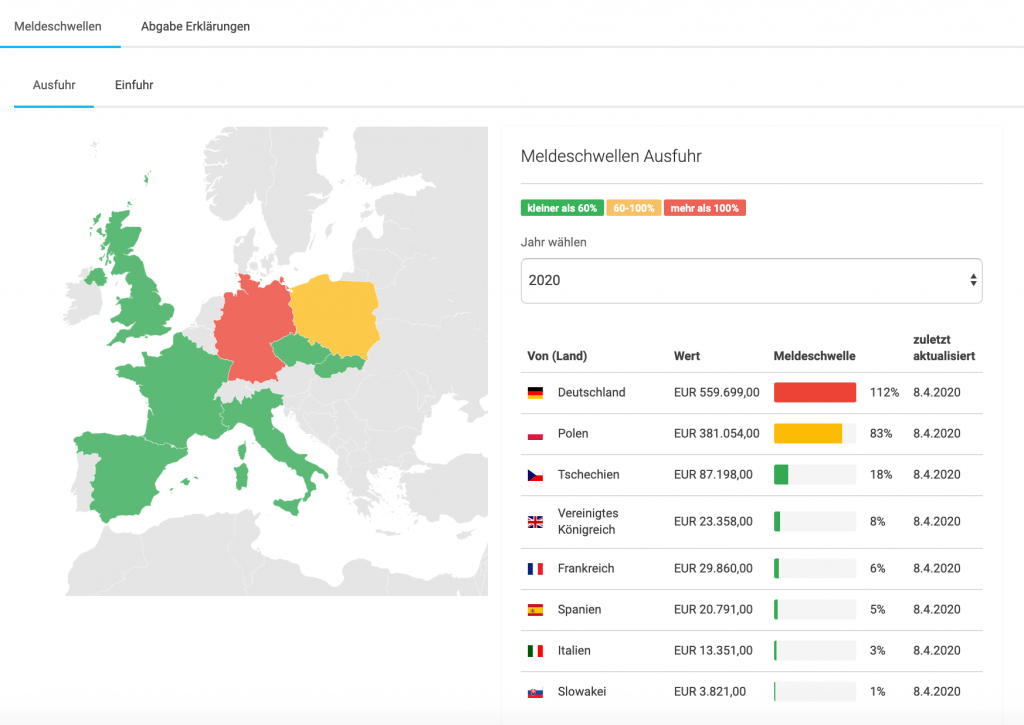

Using an intuitive traffic light system, the reporting thresholds per direction of goods (export as well as import) and the resulting reporting obligations can be monitored on a monthly basis.

Advantage: this function is available to all Taxdoo customers from the moment they book the basic package in the customer dashboard under Intrastat and is updated on the 8th of every month!

Should you become subject to reporting requirements in one of the EU states, we can automatically generate the Intrastat declarations for the respective goods direction for you.

This requires that the product be booked in the Dashboard under Add-Ons for a fee.

Note: Taxdoo provides you with the declarations for Germany in your dashboard under Intrastat > Submit declarations. It is your responsibility to submit the declaration to the Federal Statistical Office in due time. The submission in other EU countries is taken over by our local partners.

You can find further information on booking and submitting the report to the Federal Statistical Office if you are already a Taxdoo customer here.

I’m not a taxi-doo customer yet – what then?

…if you want to learn more about Taxdoo and our solutions, just click here and book your individual and free initial consultation with one of our compliance experts. We are looking forward to meeting you!

Weitere Beiträge

VAT in the Digital Age – The Next VAT Reform for E-Commerce?

Types of transactions for Intrastat declarations from 2022: A New List