Revival of Amazon FBA to Switzerland

Since 01.01.2019, FBA shipments have no longer been delivered to customers in Switzerland. The reason for this was the new Swiss VAT law, which came into force on that date.

A few weeks ago, amazon.de informed its sales partners about the planned change to the FBA programme:

In the coming weeks we will start offering Switzerland as a destination for our shipments through Amazon export program. Your eligible offers with shipping through Amazon will automatically be made available on our European Amazon stores for customers in Switzerland.

Let us first take a brief look at the new regulations for deliveries to Switzerland, which came into force on 1.1.2019.

(No longer quite so new) Value added tax law in Switzerland

Like many other countries, Switzerland also has exemption limits for the import of goods.

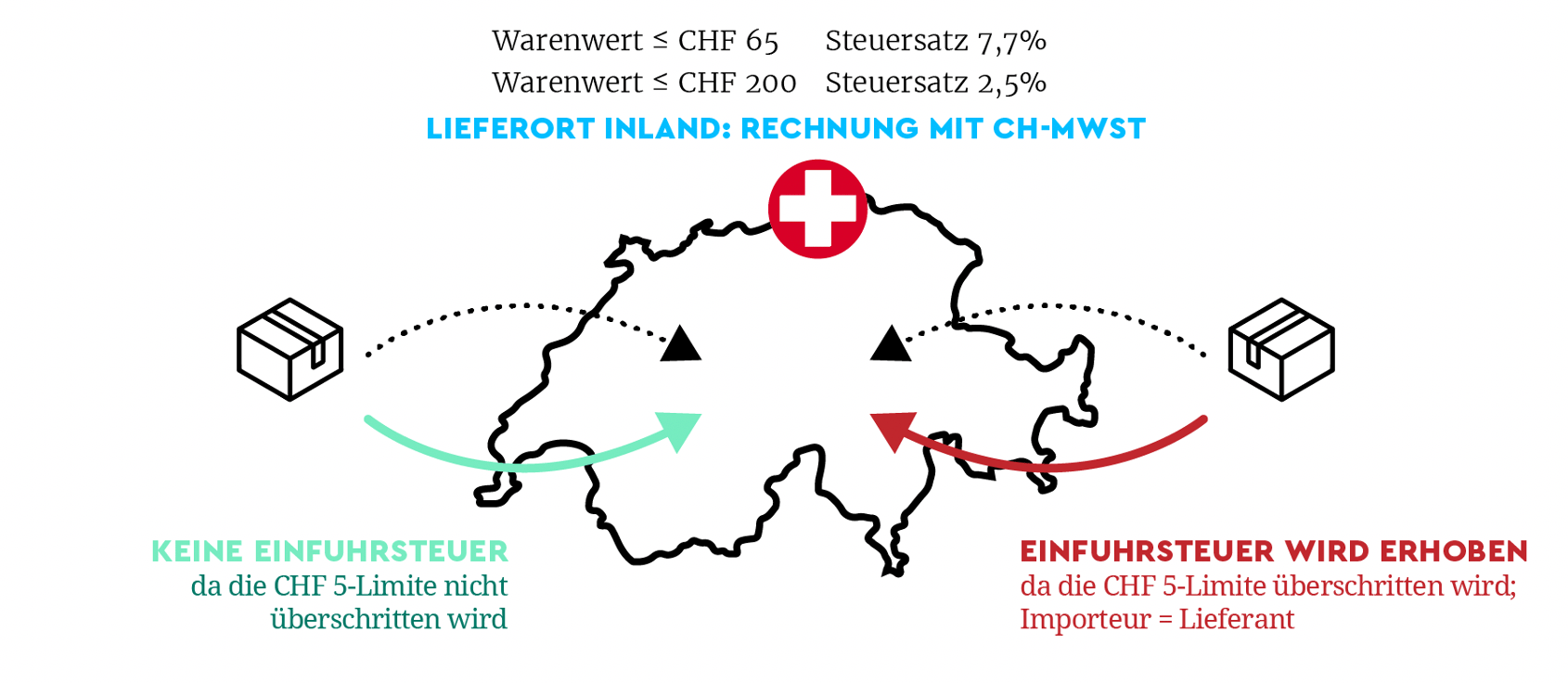

The exemption limits applicable in Switzerland are CHF 65 at a standard tax rate of 7.7 percent or CHF 200 at a reduced tax rate of 2.5 percent (e.g. for food).

These so-called small consignments could be sold completely duty-free – neither duty nor import turnover tax – which led to a considerable competitive disadvantage for companies based in Switzerland.

Since 1.1.2019, traders who send small consignments with a value of more than CHF 100,000 per calendar year to Switzerland must register for tax purposes and pay VAT on these consignments there.

The exact system is described in this blog post.

This new regulation and the susceptibility to fraud in the levying of customs duties and import turnover tax for non-small consignments led Amazon to discontinue shipping to Switzerland about two years ago.

Amazon takes over the handling of customs duties and import turnover tax

According to the information provided, Amazon has now found a solution to deal with the situation under the new Swiss VAT law. A Amazon spokesperson made the following statement to INTERNET WORLD:

We have since worked towards compliance and can now confirm that FBA shipments will be available to Swiss customers in the future. As soon as we make FBA sales to Switzerland possible again, all sales partners not registered for VAT in Switzerland will automatically be able to sell to Swiss customers. Swiss customers will now also be able to see goods from FBA sales partners again.

What must be observed during the process

Amazon will collect the Swiss customs duties and import VAT from the customer and ensure their correct payment to the Swiss tax authorities upon import of the package. For sales partners who do not use FBA, nothing will change and they can continue their business as before.

FBA sellers who generate sales of more than CHF 100,000 per year with small consignments to Switzerland must register for VAT in Switzerland and pay the corresponding VAT.

FBA sellers who do not wish to sell their products in Switzerland must explicitly object to export to the Swiss Confederation at Seller Central.

Online traders who do not use FBA and export to Switzerland themselves must continue to take care of customs duties and import turnover tax themselves.

Assessment of our partner GJS Fiscal on these innovations

This development is certainly promising for smaller traders, as they will be able to sell their articles on the Swiss market again via Amazon . In the medium term, however, it is becoming apparent that traders will have to register in Switzerland via a fiscal representation in any case. On the topic of fiscal representation eCommerce Switzerland, Dr. Roger Gothmann and Gerrit Schröder from GJS Fiscal have published the following blog post and also held a webinar.

Taxdoo is the compliance platform for the digital economy

… and provides the leading online traders in Europe with numerous other compliance services via a unique platform in addition to the handling of ongoing EU-wide Value Added Taxcompliance, Intrastat and financial accounting – Taxdoo is a partner of DATEV.

If you want to know more about how you Value Added Taxcan efficiently and securely map compliance, financial accounting and much more via a platform, then book your individual and free initial consultation with the compliance experts from Taxdoo!

You are also welcome to register for our regular demo webinar in which we will introduce Taxdoo and our compliance services and answer your questions personally.

Weitere Beiträge

Amazon’s Value Added Tax calculation service (VCS) and OSS

Amazon in Sweden, storage, shipping: VAT liability for FBA traders?